Investing in a US insurance company presents unique concerns to any investor. This is particularly the case if such an investment would result in the investor becoming a "control" person of an insurance company. Generally, if an investor acquires ten percent or more of the voting securities of an insurance company, either directly or through the acquisition of similar interests in one or more intermediate entities, it will be considered to be acquiring a "controlling" interest in the insurance company. That fact will have two important consequences: (a) the investor will first need to receive approval from the insurance regulatory authority of the state in which the insurance company is domiciled; and (b) following the receipt of such approval, the investor will be subject to that domiciliary state's laws governing insurance holding company systems, which include ongoing reporting and compliance requirements.

Accordingly, prior to taking steps toward an acquisition which would give it a "controlling" interest in an insurance company, a potential investor should determine whether being subject to a highly structured and time-consuming approval process is acceptable, and whether it is willing to be subject to the ongoing compliance requirements of the insurance holding company laws.

Definition of "Control"

In most states, the insurance holding company laws are based on a model "Insurance Holding Company System Regulatory Act" adopted by the National Association of Insurance Commissioners (NAIC). The definition of "control" in the NAIC model act includes a rebuttable presumption that "control" exists if a person owns, directly or indirectly, ten percent or more of an insurance company's voting securities.1

We quote the NAIC model act definition of "control" in full, before commenting on it below:

"Control." The term "control" (including the terms "controlling", "controlled by" and "under common control with") means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting securities, by contract other than a commercial contract for goods or nonmanagement services, or otherwise, unless the power is the result of an official position with or corporate office held by the person. Control shall be presumed to exist if any person, directly or indirectly, owns, controls, holds with the power to vote, or holds proxies representing, ten percent (10%) or more of the voting securities of any other person. This presumption may be rebutted by a showing made in the manner provided by Section 4K [i.e., the disclaimer procedure discussed below] that control does not exist in fact. The commissioner may determine, after furnishing all persons in interest notice and opportunity to be heard and making specific findings of fact to support the determination, that control exists in fact, notwithstanding the absence of a presumption to that effect.

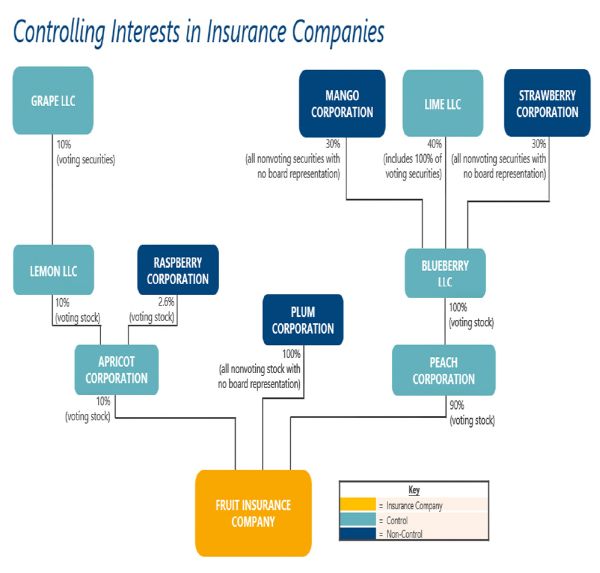

First, the focus of the concept of "control" is on an insurance company's voting securities. Accordingly, the direct or indirect ownership of ten percent or more of an insurance company's nonvoting securities is not sufficient to make the owner a "control" person. In the illustrative diagram below, Plum Corporation, which owns 100 percent of Fruit Insurance Company's nonvoting stock, is not considered to be a control person of Fruit Insurance Company, even though Apricot Corporation, which owns ten percent of Fruit Insurance Company's voting stock, is considered to be a "control" person of the insurance company.

Second, directly or indirectly holding ten percent or more of the voting securities of an insurance company triggers a rebuttable presumption of "control." Accordingly, if an investor were to acquire an ownership interest of ten percent or more of the voting stock of an entity which is itself considered a "control" person of an insurance company, then the investor would also be considered a "control" person of the insurance company through the intermediate entity. In the illustrative diagram below, Lemon LLC, which owns ten percent of the voting stock of Apricot Corporation, which in turn owns ten percent of the voting stock of Fruit Insurance Company, is considered to be a "control" person of Fruit just as Apricot is considered to be a "control" person of Fruit.

Third, if an investor acquires a controlling interest in an intermediate controlling entity of an insurance company, then it would be considered a "control" person of the insurance company through the entities in the preexisting chain of ownership, and furthermore the investor would be considered an ultimate "control" person of the insurance company if the investor was not itself controlled by any other person. In the illustrative diagram below, Grape LLC holds ten percent of the voting securities of Lemon LLC. Grape LLC has an ownership structure in which no single securityholder holds ten percent or more of the voting securities (and each securityholder is independent of the other securityholders). Grape LLC is considered to be an ultimate "control" person of Fruit Insurance Company.

To read the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2019. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.