Housing activity was robust for most of 2018, but certain headwinds create uncertainty for the future.

Despite a strong job market and demand from maturing millennials, existing home sales, which make up about 90% of all home sales, fell 3.1% due to high home prices, rising mortgage rates and low supply of available homes, especially at the entry level.

Both housing starts and building permits were up modestly in 2018; however, housing starts fell to a more than two-year low in December 2018 due to rising labor and materials costs, shortage of land, and weakening housing demand.

Multifamily starts were up 5.6% while single-family starts were up 2.8% in 2018, marking a reversal from 2017, when single-family starts outpaced multifamily starts.

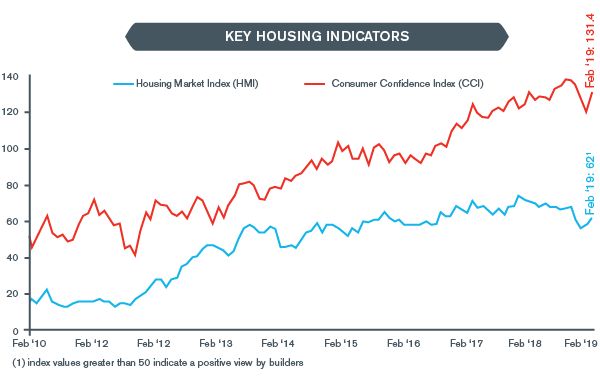

Remodeling activity remains strong, despite weakness in sales due to the upward trajectory of home prices, as well as strong consumer confidence and a robust economy with steady job and wage growth.

Strong demand and low inventory levels drove home prices higher in all markets in 2018, but the 20-city index increased at its slowest pace since 2014, indicating that prices are beginning to level off.

The stock performance of all subsectors of the industry have underperformed the S&P 500 Index over the past 12 months, reflecting investor concerns about the near-term future of the industry.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.