The trade war between the United States and China is being fought with goods that you may be importing into the United States. The process is moving fast and furiously, but there's still time for your organization to get involved and petition for business-critical exceptions to the steeply escalating duty rates.

Pursuant to Section 301 of the Trade Act of 1974, the U.S. Trade Representative (USTR) has published three lists of goods that will be subject to additional duties.

- List 1: This list went into effect on July 6, 2018, and targets 818 lines of Chinese imports under the Harmonized Tariff Schedule of the United States (HTSUS). The U.S. is now collecting an additional 25 percent in additional* duties on these goods, which are mainly industrial in nature, including equipment, machinery, machine parts, vehicles and automobiles, batteries, trains and rail parts, transformers, electronics, and more.

- List 2: Another 284 HTSUS subheadings — primarily industrial goods — may be subject to 25 percent in additional* duties in August 2018.

- List 3: By the end of 2018, we could see another 6,031 HTSUS subheadings that will be subject to 10 percent in additional* duties. This list alone is expected to impact $200 billion in goods.

*The duties to be imposed under Section 301 are in addition to any duties that may be imposed pursuant to the classification of the good under the HTSUS or any other trade remedy that may be applicable to the imported good.

Altogether, if duties are imposed against all of the listed items, nearly one in every two items imported from China will be subject to additional duties. The President has threatened to impose duties on the remaining goods imported from China as well.

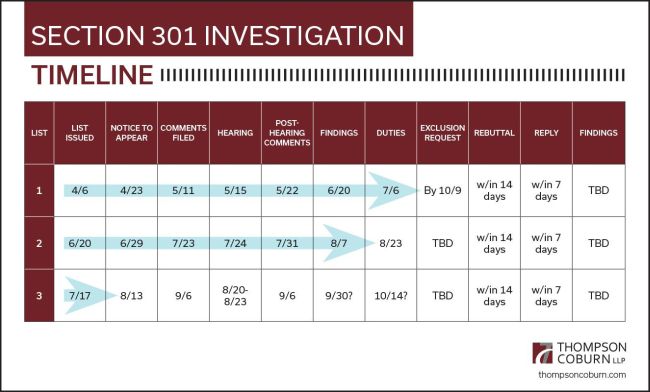

Here's a chart with all the dates we know so far in the rollout of the Section 301 investigation.

How can you get involved?

There are several steps taken by the USTR to determine which Chinese products may be subject to additional duties. Here are three possible ways you can take part in the process and advocate for your organization.

- Comments: It is essential that the government receives a clear message about the impact these duties may have on U.S. businesses. Interested parties are encouraged to file comments on whether additional duties should be imposed on items classified under the proposed HTSUS subheadings.

- Hearings: Interested parties can participate in the hearings scheduled by USTR in an effort to emphasize their interest in this proceeding. Post-hearing submissions may be submitted to respond to questions raised during the hearings.

- Exclusion requests: Should USTR decide to keep your HTSUS subheadings on the list after considering the comments and hearings, USTR will still entertain requests to have specifically identified products excluded from the additional duties. One is not required to file comments or appear at the headings to take advantage of the exclusion process.

What you can do to potentially mitigate the impact of the duties

- Review ACE

data

U.S. Customs and Border Protection maintains an Automated Commercial Environment (ACE), which provides importers with detailed information about the customs entries that have been filed on your behalf. All importers should compare their ACE data with the lists of HTSUS subheadings that may be subject to the Section 301 duties. - Review the

classification

It is a best practice to regularly review the classifications used on imported merchandise. Products may evolve or the law may change, and these changes may impact whether imported items are subject to the Section 301 duties. - File

comments

Without companies filing comments in the 301 proceedings, USTR cannot know the impact of the imposition of these duties. Your unique story provides important input into this process. - Request product

exclusions

The provisions of the HTSUS are broad. Specific exclusion requests may be granted if the importer can demonstrate:

a. Why the goods must be acquired from China.

b. How the imposition of duties would cause severe economic harm to U.S. interests.

c. Why the specific product is not strategically important to China's industrial policies. - Reevaluate product

designs

Goods are dutiable in their condition as imported. Sometimes small changes in product design may change the classification of the item and remove it from the additional duties that have been proposed. - Consider alternative

sourcing

Many companies are looking to shift production from China to other locations in order to avoid the Section 301 duties. - Evaluate opportunities to

recover the duties paid

Customs law allows for the recovery of duties paid on imported merchandise when that or similar merchandise is exported.

Thompson Coburn has developed specific cost-efficient processes to assist in reducing the collateral damage that may be experienced as a result of the trade war's impact on your imported goods. We can also analyze your organization's ACE data compared to the HTSUS subheadings — an evaluation that we may be able to complete at no cost to you.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.