United States: January – March 2018 Update

One year into the Trump administration, the US antitrust agencies are finally starting to implement their enforcement policies. Most notably, trial began in the US Department of Justice's (DOJ) challenge of the AT&T/Time Warner merger, which is the Antitrust Division's first significant vertical challenge in several decades. Judge Richard J. Leon's opinion in that case could alter the outlook for several other vertical transactions pending before the agencies. While the DOJ was preparing for trial, the Federal Trade Commission (FTC) was preparing for a transition to five new commissioners, who were approved by the Senate in April. It remains unclear whether the new, Republican-led FTC will be more moderate in its enforcement efforts, similar to prior Republican administrations, or will follow in the footsteps of President Trump's DOJ, which has been surprisingly aggressive.

EU: January – March 2018 Update

The European Commission (EC) continued to be quite active in the first quarter of 2018, clearing five mergers. The most significant decision was the approval of a megamerger in the agrochemical sector—Bayer/Monsanto—where the parties submitted a remedy package that totalled over €6 billion. This remedy package included divestitures of research and development assets that addressed the EC's concerns about innovation, similar to the EC's Dow/DuPont clearance last year. In addition to Bayer/Monsanto, two other proposed acquisitions in the chemicals sectors fell through, most notably Celanese/Blackstone, due to excessive divestiture requests required by the Commission.

Snapshot of Events (Legislation/Agency Remarks/Speeches/News, etc.)

United States

- FTC Bench Finally Filling

Out

President Trump nominated Rebecca Kelly Slaughter to fill the final vacancy on the FTC. Slaughter is the current chief counsel to Senator Chuck Schumer. She will serve the remainder of former Chairwoman Edith Ramirez's seven-year term, which ends in September 2022, and she will join Rohit Chopra as the second Democrat on the FTC. Chopra was previously nominated along with Joseph Simons, Noah Phillips and Christine Wilson—all four were unanimously confirmed by a Senate panel in February. - Size of Transaction

Thresholds Updated for Premerger Notification

The 2018 size-of-transaction threshold for reporting proposed mergers under Section 7A of the Clayton Act has been released. The adjusted threshold is $84.4 million, up nearly $4 million from last year. This threshold is revised annually based on changes in the gross national product. - DOJ Announces Modifications

to Consent Decrees to Improve Enforcement

Capabilities

During a speech to the New York State Bar Association, Assistant Attorney General Makan Delrahim noted that three consent decrees filed in December contained "a set of procedural provisions designed to improve their function and enforceability." The most significant change lowers the DOJ's burden of proof for a violation of a consent decree from a clear and convincing evidence standard to a preponderance of the evidence standard. The DOJ will also require defendants to reimburse the DOJ for attorneys' fees and other costs in connection with a successful enforcement effort. - FTC Reaffirms Structural

Relief as Preferred Remedy, Even for Vertical

Mergers

On January 10, Bruce Hoffman, the FTC's Acting Director of the Bureau of Competition, commented on vertical merger enforcement at the FTC. Hoffman noted that many people were surprised by the DOJ's challenge of AT&T/Time Warner, but reiterated that the FTC prefers structural remedies. Hoffman specifically stated that the FTC "start[s] by looking at structural remedies for most vertical mergers." It is only when the structural remedy is at odds with the "efficiencies that motivate the merger" that the FTC considers conduct remedies. - DOJ's Nigro Notes

Divestitures of Stand-Alone Businesses Are Most Effective

Structural Remedies

On February 2, Deputy Assistant Attorney General Barry Nigro clarified that the DOJ not only prefers structural remedies over conduct remedies, but when there is a structural remedy, the DOJ prefers "a clean divestiture of a stand-alone business" rather than an "asset carve-out." According to the DOJ, these divestitures are more likely to create a successful, independent competitor post-closing.

European Union

- Best Practice Guidelines for

Submitting Merger Documents to European Commission Expected in the

Coming Months

Commissioner Margrethe Vestager said on January 25 that best practices guidelines for submitting merger documents will be issued by the EC in the coming months. The decision to publish these guidelines was prompted by the importance documents played in recent EU merger reviews. The EC recognizes that time is short in merger reviews and hopes that these guidelines will help businesses answering the Commission requests more efficiently. - Commissioner Vestager Warns

of Potential Anticompetitive Effects from Common Ownership of

Competitors by Investment Funds

In a series of speeches throughout the first quarter of 2018, Commissioner Vestager noted that the EC is "seeing signs that companies are getting more closely linked." She noted that it is becoming common for large investors to hold significant ownership shares of companies in the same industry. Vestager warned that this type of ownership arrangement could disincentivize competition. The EC is attempting to study these relationships and their potential effect on competition. - AAG Delrahim Highlights

Importance of Cooperation Between DGCOMP and the DOJ in Brussels

Speech

Assistant Attorney General Makan Delrahim, spoke at the College of Europe in Brussels on February 21, addressing various issues concerning the cooperation between the Department of Justice and DG Competition. In particular, the Delrahim underlined the constant and continuous link between the two agencies, which communicate and cooperate at formal and informal levels during merger investigations. He especially voiced the similar shared between them: protecting consumers and competition during an era of rapid technological change.

China

- New Legislation Consolidates

China's Three Competition Agencies into One

China's National People's Congress passed legislation on March 17 that will consolidate the nation's three competition agencies into a new agency called the State Administration for Market Supervision (SAMS). Previously, the Anti-Monopoly Bureau of the Ministry of Commerce (MOFCOM) was responsible for merger control, the Price Supervision/Inspection and Anti-Monopoly Bureau of the National Development and Reform Commission (NDRC) was responsible for bringing enforcement actions for price-related violations of the Anti-Monopoly Law, and the Anti-Monopoly and Anti-Unfair Competition Bureau of the State Administration of Industry and Commerce (SAIC) was responsible for non-price-related violations of the Anti-Monopoly Law.

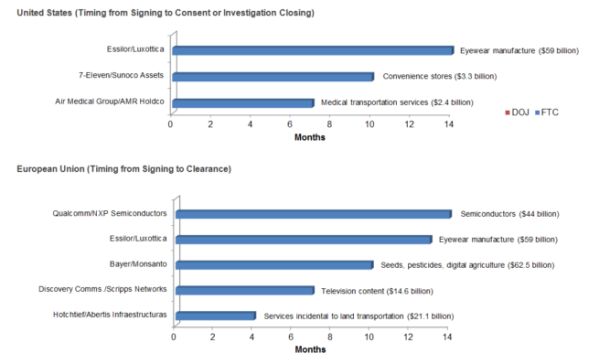

Snapshot of Enforcement Actions

McDermott Will & Emery law clerk Matt Evola also contributed to this blog post.

Antitrust M&A Snapshot - May 7, 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.