Project Finance: Structuring for Success

Mini-Summary

This Practice Note considers the meaning of the term "structure" in a project finance transaction and identifies the key issues that may inform the approach to structuring such a transaction. It explains a "plain vanilla" project finance structure and then contrasts that with some of the innovations employed in the Azura Edo IPP project, a conventional power project in Nigeria. This Practice Note was produced by Julian Nichol at Akin Gump Strauss Hauer & Feld, who has experience in the EMEA project finance markets and who advised emerging markets investor Actis on its acquisition of a majority stake in the Azura Edo IPP post financial close.

1. Introduction to project finance structures

This Practice Note (i) considers what is meant by "structure" in the context of a project finance transaction and identifies key issues that inform the approach to structuring a project finance transaction, and (ii) looks closely at the Azura Edo independent power project in Nigeria ("Azura Edo IPP") as a case study to help identify and explain a number of recent and innovative project finance structuring solutions that have been successfully implemented in order to overcome certain identified risks and challenges. This Practice Note is not intended to be a general introduction to project finance and therefore assumes a basic familiarity with its concepts (see Practice Note: Introduction to Project Finance).

This Practice Note does not cover those structures peculiar to the U.S. project finance market, such as tax-equity-driven structures for renewable energy project financings or the differing approach in the United States to structuring reserve-based project loans.

The focus in this Practice Note is on construction financings—that is, new projects being developed from scratch (also known as "greenfield projects"), rather than the sale or purchase of existing operating assets (often referred to as secondary market transactions), which account for a lot of the market activity at the time of writing. The content of this Practice Note could generally be applied to the asset class commonly referred to as "energy and infrastructure" projects, covering projects as diverse as power plants, oil refineries, toll roads and tunnels.

There are also:

- a number of project finance structures used to finance public-private partnerships

- a number of projects structured and financed using Islamic financing principles

- a specific type of resource-linked project financing solution used for financing natural resources projects known as "reserve-based lending."

All of the above are beyond the scope of this Practice Note.

2. What is project finance?

A project financing is essentially a transaction in which the focus is on creating a secure source of revenue from the project in question (which remains to be constructed) to cover operating costs, service debt and deliver a return on investment to sponsors. The reliability of the project's revenue is heavily dependent upon the delicate balance between the project's commercial viability, legal certainty of the risk allocation in the various project documents and the overall "structure" of the project. Project financings typically involve a combination of third-party debt and sponsor equity, usually provided in a ratio of approximately 80/20 or thereabouts. The debt/equity ratio will change according to the lenders' perceived risk profile of the project in question and may also require the sponsors to make "standby" or "contingent" equity available in the event of construction delays or cost overruns, or in response to specific "in-country" risks. Projects in early-stage emerging markets will typically require greater equity commitments as a percentage of overall project costs from the project sponsors.

3. What does "project structure" mean in the context of project finance?

"Project structure" refers to the way in which the participants in a project have been organized in terms of their "risk relationship" and how that "risk relationship" has been reflected in the project and financing agreements for the project in question. In other words, it refers to the project's "architecture," that is, everything from the jurisdiction(s) through which sponsors infuse equity into the project (to take advantage of favorable investment treaty protections), to the jurisdictions in which the project company holds its bank accounts (to safeguard project revenues and provide adequate repayment security for lenders), to the way in which the key commercial arrangements for the project (for example, construction, operation and maintenance, fuel supply and power purchase) have been structured to reduce credit risk or promote performance reliability by those parties and therefore create revenue certainty for the project.

Taking the economic and commercial viability of the project in question as a given, the creation of a successful project structure is possible only once the sponsors and lenders have gained a thorough understanding of the detailed legal, commercial and political risks affecting that project. This is referred to as the project's "risk profile." Such risk profile should cover the relevant project throughout its economic life, from its construction phase through its operating phase (particularly while senior debt remains outstanding).

Every project brings with it its own unique risk profile. However, there is a well-trodden path to follow when building up a project's risk matrix:

- Start with an analysis of country risk (How stable is the country in question, and is there any destabilization risk from neighboring countries?)

- Then, move to macro political risk (How stable is the country's political regime, and is a change in government imminent or historically frequent?) and macro legal risk (How likely is a change in law that could negatively impact the project? Can an adequate security interest be granted to lenders? What is the track record of the courts of the country in question when adjudicating foreign investment disputes? Can a court or arbitral award be properly enforced in-country?)

- Then, once a thorough understanding of macro-country, legal and political risk is obtained, move to the micro level: What are the sector risks facing the particular project? For example, if talking about a power project, is there certainty of fuel supply for the project at the required specification? Can the power be readily exported using the existing transmission network, or is substantial grid reinforcement and/or a new and long transmission line required to be constructed? If the latter, how easy (and expensive) will it be to be obtain the land permits to site the necessary transmission line? Is there any technology risk involved in the proposed design solution?

- In terms of key commercial risks, what is the credit rating or standing of the proposed power purchaser, and is any credit enhancement necessary to ensure that the project revenue stream remains robust? Is there any risk of the contractually agreed tariff being reduced by, for example, removing any subsidy element? (The removal of a subsidy element from a project's offtake tariff has the potential to turn a project into a "stranded asset." The experience of renewable energy sponsors in Spain, Italy and Portugal makes for an interesting case study on this point.) How experienced is the proposed operator of the project when taking into account the specific operating conditions of the project in question? Is there a comprehensive legal and regulatory regime underpinning the sector in question, thereby rendering the parties' obligations in the contracts clearly and easily enforceable? Is there is a regulator for the sector in question, and, if so, what is the regulator's track record of regulating impartially?

The essence of project financing then is the identification of these and other risks and their allocation to the project participants in the optimum way through the project's contractual matrix and structure.

For further information, see Practice Note: Project risk and risk allocation.

4. Specific structures used to overcome identified project risks

It is useful to consider a "plain vanilla" project finance structure before contrasting that with the Azura Edo IPP case study, which involves a number of recent and innovative project finance transaction structures that have been developed to overcome specifically identified risks in that project.

(i) Basic structure of a project finance transaction

A "plain vanilla" project finance structure is summarized in the diagram below:

In essence, the project company SPV is located in the country of the project, and the local and international sponsors infuse equity into that SPV under a shareholders agreement. One or more commercial bank lenders (usually a club of local, regional and international banks) lend money in local and international currencies to the SPV; the offtaker buys the output of the project, usually under a long-term contract at an agreed price and within agreed volume parameters; a series of contracts underpinning the construction (EPC contract) and operation and maintenance (O&M contract) of the project are entered into by the SPV, thereby giving lenders, the offtaker and sponsors certainty that the project will be constructed and operated so as to meet guaranteed performance standards; the SPV's interest in such contracts and the project's insurances will have been assigned to lenders as part of their security package, and the most important of those project contracts (typically EPC, O&M, the offtake and any concession contracts) will be the subject of a direct agreement with the senior lenders via the security trustee.

Taking this as our base, it is now possible to examine how this structure needs to be augmented when dealing with particularly challenging project risks.

(ii) Case study: Azura Edo IPP, Nigeria

The Azura Edo IPP is a high-profile conventional power project that contains a number of innovative and advanced structural support mechanisms.

The project comprises a 459 MW gas-fired, open-cycle power plant, transmission line and pipeline located in Benin City, Edo State, Nigeria. The Azura Edo IPP is Nigeria's first large-scale, project-financed independent power plant, a "first-of-a-kind." In common with other "first-of-a-kind" projects, its structure is innovative and responds to a number of specific challenges facing the project in Nigeria. A full discussion of those challenges is beyond the scope of this Practice Note; however, three key structural features of the project are worth focusing on:

- the equity and debt structure, incorporating commercial and political risk instruments

- the use of a put and call option agreement structure

- credit enhancement techniques used for the offtaker and project company (as gas purchaser).

(A) Equity and Debt Structure

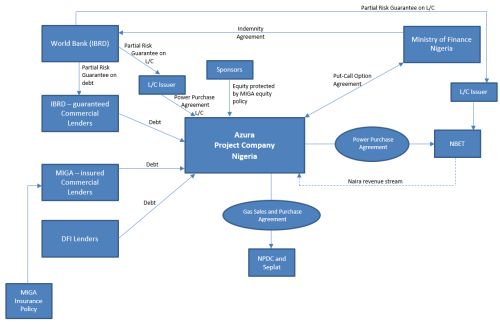

The equity and debt structure in the Azura Edo IPP is summarized in the diagram below1:

The Azura Edo IPP benefits from substantial World Bank support as follows:

- political risk support to encourage lending from the commercial lenders through a MIGA insurance policy; the MIGA insurance policy covers currency transfer/inconvertibility issues (given that the project's revenue stream is in naira, the local currency), asset expropriation, war and civil disturbance, and breach of contract by the Nigerian government

- political risk support through an IBRD partial risk guarantee to encourage lender participation, which covers a breach by the Nigeria Bulk Energy Trader (NBET) of the Power Purchase Agreement (PPA) or a breach by the Government of Nigeria of the Put and Call Option Agreement (PCOA)

- political risk cover to protect the equity provided by the sponsors through a MIGA equity policy

- an IBRD partial risk guarantee supporting the letter of credit issued by a major investment bank on behalf of NBET to cover its payment obligations under the PPA.

This matrix of World Bank support is comprehensive and was required because the project was exposed to substantial political risk, including:

- The PPA signed with NBET was the first such PPA to be signed with an independent power producer (IPP). NBET was, at the time, a new government-owned offtaker with thin capitalization and no demonstrable track record of performance under its PPAs. There were, as is common in many first-of-a-kind IPPs, substantial concerns held by sponsors and lenders over NBET's ability to perform its payment and other obligations under the PPA

- The PPA is in naira, the local currency of Nigeria, which, at the time of signing, was seeing a sharp decline in value against the U.S. dollar, due in part to the then-prevailing low oil price. This led the Government of Nigeria to implement foreign exchange controls to shore up the naira's value. The lenders to the project were able to secure assurances from the Central Bank of Nigeria (CBN) and a series of special dispensations; however, the effectiveness of these depended upon the continued support of the CBN

- The potential for failure to supply gas to the project rests with NBET such that NBET is obliged to continue to pay capacity payments under the PPA in the event of a gas supply failure that is not caused by the project company. Any prolonged failure to supply gas ultimately allows the parties to terminate the PPA, which triggers a payment obligation to the project company from the Ministry of Finance of Nigeria.

(B) Put and Call Option Agreement

The essence of the PCOA is to ensure that the Government of Nigeria stands behind the obligations of NBET in the event of an early termination of the PPA. The PCOA allows the project company to "put" the power plant or the equity interest in it to the Government of Nigeria in almost all instances where the PPA is terminated early. In such circumstances, the Government of Nigeria is obliged to pay a purchase price that, at the very minimum, is enough to cover outstanding debt.

Traditionally, this type of early termination payment obligation has been covered in IPPs by a government guarantee or government support agreement. Therefore, the PCOA represents a new structural innovation for dealing with this risk and is now being used on other projects across the EMEA region.

(C) Innovative Credit Enhancement Techniques

In addition to the innovative PCOA used to backstop NBET's obligations under the PPA, the gas sales and purchase agreement (GSPA) also involved an innovative structure used to "credit-enhance" the project company in respect of its payment obligations under the GSPA.

The GSPA required that the payment obligations of the project company be backed by a letter of credit (L/C) issued by a bank with a required minimum credit rating. The traditional means of structuring to achieve this is for the sponsors and their respective parent companies to procure the L/C without the L/C provider having any recourse to the project company or its assets.

However, in the Azura Edo IPP, the L/C was provided by one of the senior lenders as part of the overall financing package. This required some rethinking of the architecture for project accounts. For example, the project company is required to fund collateral accounts to effectively collateralize the L/C in the event of it being called and to fund L/C collateral reserve accounts to backstop such obligation. This approach represents new thinking to deal with a commonly encountered problem.

(iii) Other potential structuring innovations for a project finance transaction

There are many other innovative approaches to structuring a project that are beyond the scope of this Practice Note. However, that does not mean that they are less important to the wider project finance community or any less innovative. When looking at innovative structuring techniques, consideration may be given to:

- structures used by project lenders to plug a local currency shortfall and to extend local currency tenors offered by local commercial lenders

- the IFC's Scaling Solar Programme in Zambia

- the IFC's approach to financing its Round One solar projects in Jordan

- the treatment of "contingent reserves" in natural resource reserve-based financing transactions

- cash sweeps, margin ratchets, and the tightening or loosening of project covenants in response to specific in-country events or project-related actions occurring or not occurring

- some of the structures used to finance renewable energy YieldCos

- the growing recognition of "green finance" as a suite of financing products in their own right and how these may develop to impact project finance structures in the future.

One thing is for certain: project finance transactions will continue to face risks and challenges, and project structuring techniques will continue to adapt in innovative ways to meet those risks and challenges.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.