Originally published on October 3, 2008

Keywords: Basel II, Federal Register, Fannie Mae, Freddie Mac, Standardized Approach, capital rules, regulatory, financial services, capital components, equity exposures, credit, corporate, retail exposure, asset, residential mortgage, junior lien, loan, investment

Set forth below is a summary of the key features of the proposed Basel II standardized approach (Standardized Approach) jointly published in the Federal Register on July 29, 2008, by the Office of the Comptroller of the Currency (OCC), the Federal Reserve Board (FRB), the Federal Deposit Insurance Corporation (FDIC) and the Office of Thrift Supervision (OTS) (collectively, the Agencies).1 This summary includes occasional comparisons to other key US regulatory capital regimes, including the existing Basel I "general" risk-based capital requirements, and the Basel IA proposal (Basel 1A), which the Standardized Approach replaces.

General

Under the new approach, a bank2 would be required affirmatively to opt in to use the Standardized Approach, which would have to be adopted in whole and not selectively; otherwise the bank would remain under the existing general risk-based capital rules.3 A bank that wished to use the Standardized Approach would have to notify its primary federal regulator in writing at least 60 days before the beginning of the calendar quarter in which it first used the Standardized Approach.

A non-core bank using the Standardized Approach could opt out of the Standardized Approach and return to using the general risk-based capital rules upon a similar 60-day notice that would include an explanation of its rationale for opting out. However, banks would not be allowed to switch repeatedly between the Standardized Approach and the general risk-based capital rules.

The choice of whether to opt in to the Standardized Approach, or to remain with the general risk-based capital rules, will require a comparison of a bank's capital requirements under both approaches. For most banks, key considerations would include weighing the Standardized Approach's benefits of lower capital requirements for residential mortgage loans, consumer and small business loans against its increased complexity, addition of an explicit operational risk component and higher capital requirements for certain securitization exposures. Absent a significant change to the proposal (including, in particular, elimination or substantial reduction of the proposed operational risk component), we would expect the vast majority of US banks to remain under the existing general risk-based capital regime and the Standardized Approach to be potentially attractive primarily to large non-core banks that could view it as a less complex and therefore more attractive alternative to opting in to the Basel II advanced approach.

Despite the general rule that a non-core bank can choose between the general risk-based capital rules and the Standardized Approach, a bank's primary federal regulator would have the authority to require compliance with the capital guidelines that the regulator found to be most appropriate "in light of the bank's asset size, level of complexity, risk profile, or scope of operations."

In general, if a bank were to opt in to the Standardized Approach, its parent bank (but not thrift) holding company and any other banking subsidiaries of the holding company also would be required to apply the Standardized Approach.

The primary federal regulator would retain authority to modify the capital requirements imposed by the Standardized Approach by:

- Requiring a bank to hold a greater amount of capital than otherwise would be required;

- Requiring a bank to assign a different risk-weight for exposures or deduct those exposures from regulatory capital; or

- Permitting banks, under the "principle of conservatism," and upon prior notice, to make simplifying assumptions in their risk-based capital calculations under the Standardized Approach, provided that the simplification resulted in a higher capital requirement and the amounts involved were not material.

As a result of the recent financial markets crisis, the Agencies are likely to consider changes to the Standardized Approach, including increased capital requirements for complex structured credit products and liquidity facilities.4 More broadly, the scope, timing and content of the various regulatory capital regimes may well be affected by the ongoing crisis, the upcoming election and the prospects for future changes to the financial services regulatory structure.

Capital Components and Calculation

Like Basel IA, the Standardized Approach would maintain the current minimum tier 1 risk-based capital ratio requirement of 4 percent and the total risk-based capital ratio requirement of 8 percent.

However, unlike Basel IA, the Standardized Approach would make certain changes to the components of tier 1 and tier 2 capital, including the following:

- The Standardized Approach would require a bank to deduct from tier 1 capital any after-tax gain-on-sale resulting from a securitization.

- Under the general risk-based capital rules, banks must deduct credit-enhancing interest-only strips (CEIOs) from tier 1 capital to the extent they exceed 25 percent of tier 1 capital. Under the Standardized Approach, a bank would have to deduct from tier 1 capital any CEIOs to the extent they represented after-tax gain-on-sale and would be required to deduct any other CEIOs from tier 1 and tier 2 capital equally (i.e., 50 percent from tier 1 and 50 percent from tier 2, assuming sufficient tier 2 capital).

- Currently, commercial banks (and bank holding companies) generally must deduct from tier 1 capital a portion of non-financial equity investments, while savings associations generally must deduct the entire amount from total capital. The Standardized Approach would replace these deductions from capital with new risk-weights for "equity exposures" as described below.

- The Standardized Approach would require certain "unsettled transactions" to be deducted from capital.5

Risk-weight categories would be expanded from the existing five (0, 20, 50, 100 and 200) to a total of 16, through the addition of 10, 35, 75, 150, 300, 350, 400, 600, 625, 937.5 and 1250 percent categories.6

Under the Standardized Approach, a bank's total risk-weighted assets would be the sum of its total risk-weighted assets for (i) general credit risk, (ii) unsettled transactions, (iii) securitization exposures, (iv) equity exposures and (v) operational risk.

Expanded Use of External and Inferred Ratings

Under the general risk-based capital rules, a bank can only use external ratings issued by a nationally recognized statistical ratings organization (NRSRO) to assign risk-weights to (i) recourse obligations, (ii) direct credit substitutes, (iii) non-credit enhancing interest-only residuals and (iv) asset- and mortgage-backed securities. In addition, inferred ratings are only permitted within a securitization structure.

The Standardized Approach would expand the use of both external and inferred ratings to determine risk-weight categories to include exposures to (i) sovereigns, such as US Treasury securities; (ii) public sector entities (PSEs), such as state or local government obligations; (iii) depository institutions (including foreign banks); and (iv) corporations and other business entities (including bank and thrift holding companies, securities firms, and government-sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac and the Federal Home Loan Banks).

If an external rating for an exposure to a sovereign, PSE or corporate entity were not available, a bank would be required to infer a rating based on the issuer rating, or based on another externally rated exposure, of that same obligor.7

For both external and inferred ratings, if an exposure had only one rating, that rating would be used, while if it had multiple ratings, the lowest rating would be used.8

General Credit Risk-Weight Categories

Under the Standardized Approach, general credit exposures would be grouped into eight exposure categories: (i) sovereign entities, (ii) supranational entities and multilateral development banks (MDBs),9 (iii) depository institutions, (iv) PSEs, (v) corporate exposures, (vi) regulatory retail exposures, (vii) residential mortgage exposures and (viii) pre-sold construction loans and statutory multifamily mortgages.10 The risk-weights assigned to the first five categories would be based on external or inferred credit ratings. The risk-weights for retail, residential mortgage and construction and multifamily mortgage exposures risk-weights would be determined under different rules discussed below.

Sovereigns, Depository Institutions and PSE Exposures

The Standardized Approach would eliminate the distinction made in the general risk-based capital rules between OECD and non-OECD countries for the purpose of determining risk-weights for sovereigns, PSEs and depository institutions. It also would eliminate the distinctions in treatment between general obligation and revenue bonds in the case of PSEs.

In general, the risk-weight assigned to sovereigns and PSEs would be determined by their external or inferred credit rating.11 Exposures to a depository institution would receive a risk-weight one category higher than the risk-weight assigned to the institution's home country. The resulting risk-weight categories would be as follows:

Corporate and Retail Exposures

Under the Standardized Approach, banks would choose between two options for risk-weighting corporate obligations. Regardless of the option chosen, a bank would be required to apply it consistently to all corporate exposures.

Under the first option, a bank would risk-weight all corporate exposures at 100 percent without regard to external ratings. This is the same approach used under the general risk-based rules.

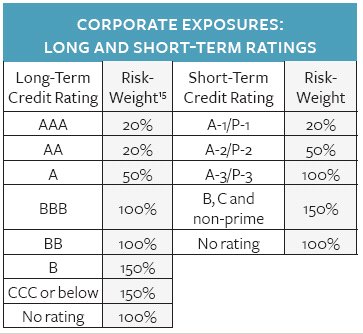

Under the second option, a bank would assign risk-weights based on external or inferred ratings, as set forth in the following chart:14

Credit exposures to government-sponsored enterprises (e.g., Fannie Mae and Freddie Mac)16 would be treated as corporate credit exposures and risk-weighted based on external credit ratings.17

The general risk-based capital rules generally assign a risk-weight of 100 percent to non-mortgage retail exposures such as credit card loans, automobile loans and small business loans. The Standardized Approach would reduce that risk-weight to 75 percent for those retail exposures that meet these criteria: (i) the bank's aggregate exposure to a single obligor does not exceed $1 million, (ii) the exposure is well-diversified and (iii) the exposure does not fall within any of the non-retail exposure categories covered by the rules (i.e., sovereign/PSE/depository institution exposures, securitization exposures, residential mortgage exposures, equity exposures or debt securities). Any retail exposure that does not meet the first two criteria and does not fall within another non-retail exposure category would be treated as a corporate exposure.

OTHER ASSETS

Most loans that are 90 days or more past due or are in nonaccrual status would be assigned 150 percent risk-weights, except for past due residential mortgage exposures, which would be assigned risk-weights based on their loan-to-value ratios (LTVs), as described below. Under the general risk-based capital rules, the risk-weight of a loan generally does not change if the loan is past due, with the exception of some residential mortgage loans.

Consistent with the general risk-based capital rules, a bank would assign a zero percent risk- weight to cash, and a 20 percent risk-weight to cash items in the process of collection.

Any other asset not specifically assigned a different risk-weight would be placed in the 100 percent category.

Residential Mortgages

Under the general risk-based capital rules, residential mortgage loans are assigned to either a 50 percent risk-weight if they meet the definition of a "qualifying mortgage loan," or a 100 percent risk-weight if they do not.

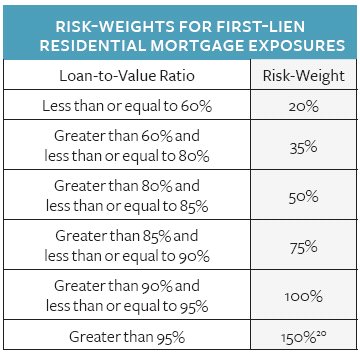

The Standardized Approach would apply a more complicated risk-weighting process that follows the Basel IA approach of assigning risk-weights based on LTV, and differentiating between first-lien and junior-lien loans.18

To qualify for the general LTV-based risk-weights, a first-lien residential mortgage loan would have to be: (i) secured by property that is owner-occupied or rented, (ii) "prudently underwritten,"19 (iii) not 90 days or more past due and (iv) not in nonaccrual status. First-lien residential mortgages that did not meet these criteria would be assigned a 100 percent risk-weight if the LTV were less than or equal to 90 percent, and a 150 percent risk-weight if the LTV were above 90 percent. For those first-lien residential mortgages that did meet these criteria, the following table sets forth the proposed risk-weights:

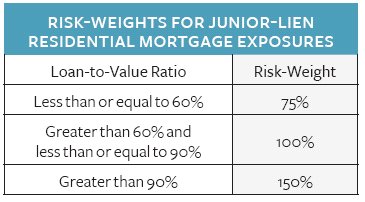

To qualify for the general LTV-based risk-weights, a junior-lien residential mortgage could not be 90 days or more past due or in nonaccrual status. Junior-lien residential mortgage exposures that were 90 days or more past due or in nonaccrual would be risk-weighted at 150 percent. Other junior-lien residential mortgages would be risk-weighted based on the following table:

The Standardized Approach would require a bank to hold capital for both the funded and unfunded portions of both first- and junior-lien residential mortgage loans. The funded portion would be the outstanding principal on the loan, while the unfunded portion would include the potential exposure from a negative amortization feature or the unadvanced portion of a home equity line of credit (HELOC).21

- To calculate the risk-weighted amount of a mortgage's funded portion, a bank would simply multiply the principal amount by the correct LTV-based risk-weight.

- For loans with unfunded portions, the bank would multiply the notional amount of the exposure (the maximum contractual commitment above the funded portion) by the relevant credit conversion factor (CCF).22 This amount would then be added to the funded portion for purposes of calculating the LTV that would determine the relevant risk-weight. This risk-weight would then be applied to the credit-converted unfunded amount.

The following rules would apply to the calculation of LTVs:

- The value of the property (the denominator of the LTV ratio) would be the lesser of the purchase price (in the case of a purchase money mortgage loan), or the estimate of the property's value at origination (or, at the bank's option, at the time the loan is restructured).23

- The loan amount (the numerator of the LTV ratio) would have to

be calculated separately for the funded and unfunded portions of

both first- and junior-liens.

- For first-lien mortgages, the funded loan amount would be the principal amount of the exposure. For a junior- lien, the funded loan amount would be the principal amount of exposure plus the maximum contractual amounts of all senior exposures secured by the same property. Specifically, these senior positions would include unfunded commitments, such as any negative amortization features or unfunded portions of HELOCs.

- The loan amount of the unfunded portion of any residential

mortgage exposure would be the loan amount of the funded portion of

the exposure plus the unfunded portion of the maximum contractual

amount of the commitment.

- Banks could use PMI to reduce the loan amount of a residential mortgage exposure by up to the amount covered by the PMI. This reduction could only be taken if: (i) the PMI is loan-level and not pool-level, (ii) the PMI issuer is not an affiliate of the bank and (iii) the PMI issuer has a long-term debt or claims-paying rating within the top three investment grade rating categories.

- second, simpler method of LTV calculation for loans with unfunded commitments. Under this approach, rather than calculating separate risk-weighted amounts for the funded and unfunded portions, banks would combine a loan's funded and unfunded amounts before calculating its LTV ratio and would then determine only a single risk-weight.24

As with Basel 1A, residential construction loans to individuals for the construction of their own homes would be subject to the LTV-based risk-weights, if the loan was primarily secured by the residential property.25

Off-Balance Sheet Items and OTC Derivatives

The Standardized Approach's treatment of off-balance sheet items would be similar to that of the general risk-based capital rules. The off-balance sheet exposure would be converted to an on-balance sheet credit equivalent by applying a CCF. Most CCFs would remain the same as in the general risk-based capital rules, but the CCFs for certain exposures would be higher under the Standardized Approach:

- As noted above, the CCF for short-term, not unconditionally cancelable commitments would increase from zero percent to 20 percent (an increase from the 10 percent proposed in Basel IA).

- The CCF for certain asset-backed commercial paper (ABCP) liquidity facilities would increase from 10 percent to 20 percent.

- The CCF for certain off-balance sheet securities lending and borrowing transactions would increase from zero percent to 100 percent.

The Standardized Approach's rules for determining the exposure amount for single OTC derivative contracts would be similar to those under the general risk-based capital rules, but unlike the general rules, the risk-weight of the counter-party would be based on external credit ratings, rather than OECD status. The Standardized Approach also would eliminate the 50 percent ceiling on the risk-weight assigned to the credit equivalent amount of the OTC derivative exposure.

In addition, the Standardized Approach would establish specific criteria for recognition of master netting agreements, including standards for legal opinions that would be more flexible than the standards currently imposed under the general risk-based capital rules.

General Credit Risk Mitigation: Collateral and Guaranties

Compared to the general risk-based capital rules (which generally recognize only cash, securities issued or guaranteed by the United States (or its agencies), other OECD countries or the US GSEs), the Standardized Approach would recognize several additional types of primarily financial collateral that could be used to mitigate credit risk, including: (i) gold bullion, (ii) long-term debt instruments of any issuer rated one category below investment grade or higher, (iii) short-term debt instruments of any issuer with a rating of at least investment grade, (iv) publicly traded equity securities, (v) convertible bonds that are publicly traded, (vii) money market and daily price-quoted mutual fund shares and (vi) conforming residential mortgage loans.

A bank would be able to recognize the risk-mitigating effects of qualifying collateral using any one of three methods (provided the same method is used for all similar exposures): the simple approach, the collateral haircut approach or the simple value at risk (VaR) method.

- The simple approach would substitute the risk-weight of the collateral for the risk-weight of the exposure covered by that collateral. Subject to a few exceptions, the risk-weight of the collateral could not be below 20 percent (50 percent in the case of conforming mortgage loans).

- The collateral haircut and simple VaR methods would be identical to those contained in the advanced Basel II approach, and would be available only for repurchase agreement-style transactions, margin loans and certain other types of transactions.

In addition to eligible guarantors (including, e.g., sellers of protection under credit derivatives) recognized under the general risk-based capital rules (i.e., central governments, US GSEs, and depository institutions and qualifying securities firms in OECD countries), the Standardized Approach would expand the list of eligible guarantors to include bank and (to the extent not significantly engaged in commercial activities) thrift holding companies and any other entity (other than a securitization special purpose entity) that has, outstanding at the time of the guarantee, externally-rated unsecured long-term debt securities without credit enhancement.26

In order for a guarantee from an eligible guarantor to be recognized under the Standardized Approach, it would have to meet certain operational requirements with respect to form, scope, terms and enforceability.27

The Standardized Approach would allow a bank to recognize the credit risk mitigation benefits of eligible guarantees and credit derivatives by substituting the guarantor's risk-weight for that of the underlying obligation. The risk mitigation benefits would be reduced to account for maturity and currency mismatches and a lack of restructuring coverage.

Unsettled Transactions

The Standardized Approach would introduce new, higher risk-weights for most unsettled and failed securities, foreign exchange and commodities transactions.28 If a delivery-versus-payment (DvP) or a payment-versus-payment (PvP) transaction did not settle within five business days of the "normal settlement period," the bank would have to hold risk-based capital against the transaction.29 To determine the risk-weighted asset amount, the positive current exposure of the transaction would be subject to risk-weighting based on the number of days that had passed since the contractual settlement date:

For other transactions (i.e., other than DvP or PvP transactions), if the bank did not receive its deliverable by the fifth business day after the contractual due date, the current market value of the deliverables owed to the bank would be deducted 50 percent from tier 1 capital and 50 percent from tier 2 capital.

Securitization Exposures30

The Standardized Approach's treatment of securitizations would generally be consistent with the general risk-based capital rules.31

The securitization framework would apply to "exposures that involve the tranching of the credit risk of one or more underlying financial exposures," and the Standardized Approach contains specific definitions of "securitization exposures," as well as of "traditional" and "synthetic" securitizations, and guidance containing specific types of transactions that would be covered and excluded.

In general, if a securitization exposure has an external or inferred rating, a ratings-based approach (RBA), similar to that used for general credit risk-weighting, would be used to determine the risk-based capital requirement for the exposure. If the exposure did not qualify for the RBA approach, but was either a first priority securitization exposure or an eligible ABCP liquidity facility, the bank would look through to the underlying assets to determine the appropriate risk-weight.32 Credit enhancements provided to ABCP programs would also be risk-weighted based on the highest risk-weight of any of the underlying exposures, but not less than 100 percent and only if the enhancement is in a second loss position or better and has at least an investment grade credit risk.33 A securitization exposure that did not qualify for any of these approaches would be deducted from regulatory capital.

An originating bank would be required to use the RBA approach if its retained exposure had at least two external ratings or an inferred rating based on at least two external ratings. An investing bank would have to use the RBA if the exposure had one or more external or inferred ratings. As with the general credit risk-weights, the lowest external or inferred rating would be used. The proposed RBA risk-weights for both long- and short-term exposures are as follows:

Both long- and short-term risk-weights for securitization exposures under the Standardized Approach would be virtually identical to those under general risk-based capital rules, except for exposures rated BB (or its equivalent), which are assigned a 200 percent risk-weight under the general risk-based rules.

Under the Standardized Approach, in order for an originating bank in a traditional securitization to exclude securitized assets from the risk-based capital requirements, the securitization would have to satisfy the following operational requirements: (i) the transfer of securitized assets would have to be considered a sale under US generally accepted accounting principles (GAAP),34 (ii) the bank would have to have transferred the credit risk associated with the securitized assets to third parties and (iii) any clean-up calls associated with the securitization would have to meet certain separate criteria.35

The Standardized Approach would continue the existing general risk-based capital approach that allows banks to exclude assets of asset-backed commercial paper conduits from their financial statements.

Equity Exposures

As noted above, the general risk-based capital rules require that banks and savings associations deduct certain equity securities from tier 1 capital. Under the Standardized Approach, these securities would no longer be deducted, but would be subject to risk-weighting.

The Standardized Approach would distinguish between equity exposures that are exposures to investment funds and exposures that are not. The risk-weights of non-investment fund equity exposures would be calculated using the simple risk-weight approach (SRWA). The SRWA is summarized in this table:

Equity exposures to investment funds would be calculated using one of four methods. Two of these, the "simple modified look-through approach" and the "alternative modified look-through approach," would be similar to the approaches under the current general risk-based capital rules.36 The Standardized Approach would introduce two new methods, the full look-through approach and the money market fund approach.

- Under the full look-through approach, a bank would calculate the risk-weighted asset amount for each of the exposures held by the investment fund, as if the exposures were held directly by the bank.

- The money-market fund approach would only be available to banks that have an equity exposure to money market funds that have an external rating in the highest investment-grade category. Banks would be able to apply a 7 percent risk-weight to all such exposures.

Operational Risk

Unlike the general risk-based capital rules, the Standardized Approach would include a specific charge for operational risk. The operational risk charge would cover the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events.

The Standardized Approach would apply a basic indicator approach (BIA) to calculate operational risk. Under that approach, a bank would add to its risk-based assets an amount which equals 15 percent of a bank's positive annual gross income over the three previous years, multiplied by 12.5. Years in which a bank's annual gross income was negative or zero would be excluded from the calculation.

The Agencies seek comment on whether to permit Standardized Approach banks to use the Basel II advanced approach's "advanced measurement approach" for calculating operational risk.

Inclusion of an operational risk component is likely to be one of the most controversial features of the Standardized Approach.

Public Disclosure

Unlike the current risk-based capital rules, the Standardized Approach would require banks to disclose publicly certain financial information. This requirement would generally only apply to the top-tier legal entity within a banking organization (typically, a bank holding company). In addition, each banking organization would be required to adopt a formal disclosure policy that outlines the basic procedures for making those disclosures.37 The Standardized Approach would give banks flexibility in how to format the public disclosures, which could be incorporated into existing reports or produced separately.

- There would be two types of public disclosures: quantitative disclosures, which would be made quarterly, and qualitative disclosures, which would be made annually. The disclosures would focus on financial information concerning capital structure, capital adequacy, credit risks, securitizations, operational risk and certain other risks. These public disclosures would be available for at least three years, although banking organizations would have flexibility in how these reports were formatted and stored.

However, each bank subject to the Standardized Approach, not just the top-tier entity, would, on a quarterly basis, have to separately disclose publicly its total and tier 1 capital ratios and their components (i.e. tier 1 capital , tier 2 capital, total qualifying capital and total-risk-weighted assets).

Foonotes

1. 73 Fed. Reg. 43982. Comments on the proposed Standardized Approach are due by October 27, 2008.

2. For purposes of this analysis, unless the context clearly indicates otherwise, the term "bank" is used to refer generally to US commercial banks, savings associations and bank holding companies, all of which are subject to US regulatory capital requirements.

3. Generally, "core banks" that are required to use the Basel II advanced approaches (72 Fed. Reg. 69288 (December 7, 2007)) would not be permitted to opt in to the Standardized Approach, unless they were exempted in writing from the advanced approaches by their primary federal regulator.

4. See, e.g., the April 16, 2008 press release of the Basel Committee on Banking Supervision, available at: http://www.bis.org/press/p080416.htm .

5. As explained in more detail below, for certain failed transactions, the current market value of the deliverables owed to the bank would have to be deducted 50 percent from tier 1 capital and 50 percent from tier 2 capital.

6. The 1250 percent category is the equivalent of a "gross-up" which is sometimes used in the general risk-based capital rules. Several of these new weight categories would be used only in limited circumstances. For example, the 625 and 937.5 percent categories would only be used for certain unsettled or failed transactions.

7. Unrated exposures would receive inferred ratings based on the issuer's general credit rating if the unrated exposure ranked at least pari passu with the issuer's general creditors in the event of insolvency. An unrated exposure would receive an inferred rating based on the credit rating of a specific issuance of the same obligor if, among other things, the unrated exposure ranked at least pari passu with, and had a maturity less than or equal to that of, the rated exposure.

8. This is slightly different from the existing general risk-based capital rules, which allow banks to use the second-lowest rating for exposures with three or more ratings.

9. In general, most supranational entities and MDBs receive a zero percent risk-weight.

10. The Standardized Approach would not change the risk-weight treatment of pre-sold construction loans and multifamily mortgage loans. As required by statute, most of these loans would be assigned a 50 percent risk-weight. Pre-sold construction loans for residences where the purchase contract is cancelled would be assigned a 100 percent risk-weight.

11. A PSE could not receive a risk-weight lower than that of its sovereign.

12. The tables in this memorandum use S&P credit rating categories for purposes of illustration, but the Standardized Approach would allow use of rating categories from any other NRSRO.

13. These risk-weights would be used for long-term exposures only. The Agencies request comment on whether to allow the use of short-term ratings for risk-weighting short-term exposures to PSEs.

14. However, as with PSEs, corporate exposures could not be assigned a lower risk-weight than that given to the country of incorporation.

15. Compared to Basel IA, the Standardized Approach's proposed ratings-based risk-weights for corporate exposures are slightly higher on the low end of the investment grade ratings, but slightly lower for the below-investment grade ratings.

16. Following the Treasury Department's September 9, 2008 actions pursuant to The Housing and Economic Recovery Act of 2008, Pub.L. 110-289 (July 30, 2008) placing Fannie Mae and Freddie Mac into conservatorship and providing explicit financial support, the senior unsecured long-term and short-term debt of both GSEs remain rated AAA and A-1, respectively. Therefore, the Standardized Approach would assign a 20 percent risk-weight to these obligations, the same as currently assigned under the general risk-based capital rules. The Agencies request comment on whether risk-weights for GSEs should instead be based on financial strength ratings, which do not contain NRSRO assessments of the extent to which GSEs are implicitly backed by the US government. However, in light of the September 9 actions, this issue would now appear largely academic in the case of Fannie Mae and Freddie Mac, although it could still be relevant for other GSEs, including the Federal Home Loan Banks.

17. Exposures to securities firms and depository institution holding companies also would be treated as corporate (rather than depository institution) exposures.

18. The Standardized Approach would retain the Basel 1A risk-weights and categories for residential mortgage loans, which, compared with the existing general risk-based standards, provide for lower risk-weights for loans with LTVs of 80 percent or less, and higher risk-weights for loans with LTVs above 95 percent. Taking into account proposed changes to the treatment of securitizations, opting into the Standardized Approach could change the evaluation of whether and how to swap residential mortgage loans into mortgage-backed securities for purposes of reducing risk-based capital requirements.

19. Although the Standardized Approach does not contain a specific definition of "prudently underwritten," existing regulations generally require consideration of all relevant credit factors, including LTV, the capacity of the borrower (or the income from the underlying property) to adequately service the debt, the value of the mortgaged property, the overall creditworthiness of the borrower, the level of equity invested in the property, any secondary sources of repayment and any additional collateral. See, e.g. 12 C.F.R. Part 34, Subpart D (OCC Regulations). Loans with LTVs over 90 percent generally do not qualify as being "prudently underwritten." The guidelines for determining whether a loan is "prudently underwritten" may evolve as additional regulatory guidelines, such as the recently proposed amendments to the FRB's Regulation Z (73 Fed. Reg. 1672 (Jan. 9, 2008)), are implemented.

20. Because residential mortgage loans with LTVs over 90 percent (after giving effect to any private mortgage insurance (PMI)) generally must already be placed in the 100 (rather than 50) percent risk-weight under the general risk-based capital rules, the practical impact of the Standardized Approach on high-LTV loans would be to increase the capital requirements for loans with LTVs above 95 percent.

21. Unlike Basel IA and the current risk-based capital rules, the Standardized Approach would require banks to maintain capital against unfunded portions of all HELOCs, regardless of whether those credit lines were "unconditionally cancelable."

22. The Standardized Approach would retain most of the CCFs from the general risk-based capital rules. However, the Standardized Approach would impose a 20 percent CCF for short-term commitments, an increase from the general risk-based rules which generally assign short-term commitments a zero percent CCF, and higher than the Basel 1A proposal which would have increased the short-term CCF to 10 percent.

23. The estimate of the property's value would be based on an appraisal or evaluation of the property in conformance with the Agencies' appraisal regulations and related guidance. The Standardized Approach's proposed requirement to value a loan's funded and unfunded amounts at origination or a refinancing differs from the Basel 1A approach that would have allowed banks to adjust a positively amortizing loan's LTV quarterly, and required quarterly updating for a negatively amortizing loan.

24. For residential mortgage loans without an unfunded portion, the two methods for calculating LTV would result in the same risk-weighted asset amount. The alternative LTV ratio calculation would make calculating risk-weighted assets for loans with unfunded portions less complex.

25. The Standardized Approach would continue the approach under the general risk-based capital rules (and Basel 1A) of risk-weighting most loans to commercial home builders at 100 percent, except for certain "qualifying residential construction loans" secured by pre-sold properties, which would continue to qualify for a special statutory 50 percent risk-weight.

26. Smaller banks likely would not benefit much from this proposed expansion of eligible guarantors since relatively few of their loans are likely to be guaranteed by entities with rated debt.

27. The guarantee would have to: (i) be written, (ii) be either unconditional or a contingent obligation of the US government, (iii) cover all or a pro rata portion of all contractual payments of the obligor, (iv) give the beneficiary a direct claim against the guarantor, (v) not be unilaterally cancelable by the guarantor, (vi) be legally enforceable against the guarantor, (vii) require payment in the event of a default without requiring legal action, (viii) not increase the cost of credit protection in response to a deterioration in the credit of the reference exposure and (ix) generally not be provided by an affiliate of the bank. Credit derivatives would be subject to certain additional requirements.

28. These new capital requirements would not apply to the following types of transactions: (i) those accepted by a "qualifying central counterparty," (ii) repo-style transactions, (iii) one-way cash payments on OTC derivative contracts, and (iv) transactions with a contractual settlement period longer than normal, generally five business days.

29. DvP transactions are securities or commodities transactions where the buyer is only obligated to make payment if the seller makes delivery of the securities or commodities, and vice versa. PvP transactions are foreign exchange transactions where each counterparty is only obligated to transfer currencies if the other counterparty has also done so.

30. For a more thorough analysis of the Standardized Approach's treatment of securitizations, please see our firm's August 2008 white paper on the topic, entitled "Proposed Rules for US Implementation of the Basel II Standardized Approach: A Summary of the Rules Applicable to Securitization Exposures," available at http://www.mayerbrown.com/publications/article.asp?id=5373&nid=6 .

31. However, unlike the general risk-based capital standards, the Standardized Approach would incorporate an additional capital requirement to address the risk of early amortization in securitizations of revolving credit facilities, such as credit card and HELOC loans.

32. In doing so, it would apply the weighted average underlying risk-weight for first priority exposures and the highest underlying risk-weight for eligible ABCP liquidity facilities.

33. The credit risk would be determined by an internal risk assessment, similar to those currently made for these exposures under the general risk-based capital rules.

34. Recognizing pending initiatives to change US GAAP with respect to sales treatment, the Agencies note that they would "reassess, and possibly revise, the operational standards" in the event changes were made to the existing accounting rules.

35. Additional operational requirements would apply to synthetic securitizations.

36. Under the "simple modified look-through approach," the bank would set the risk-weighted asset amount of the exposure equal to the adjusted carrying value of the exposure multiplied by the highest risk-weight that would apply to any exposure the fund is permitted to hold under its prospectus, or similar agreement. Under the "alternative modified look-through approach," a bank would assign a risk-weighted asset value on a pro rata basis to the risk-weight categories that would be assigned to the fund's assets based on the fund's prospectus or similar documents. Unlike the simple modified approach, the alternative approach allows different valuations for different classes of fund assets.

37. These requirements would be imposed on all banking organizations that adopt the Standardized Approach, regardless of whether they were publicly traded or otherwise subject to SEC disclosure requirements.

Mayer Brown is a global legal services organization comprising legal practices that are separate entities ("Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; and JSM, a Hong Kong partnership, and its associated entities in Asia. The Mayer Brown Practices are known as Mayer Brown JSM in Asia.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

Copyright 2008. Mayer Brown LLP, Mayer Brown International LLP, and/or JSM. All rights reserved.