Seyfarth Synopsis: As our 2018 Workplace Class Action Report describes, 2017 was quite an interesting year for employers in terms of class certification rulings. Though courts issued many favorable class certification rulings for the plaintiffs' bar this year, new defense approaches and case law precedents resulted in positive outcomes for employers in opposing class certification requests. In today's blog, readers are given a certification breakdown by type of class action, as well as a look into evolving case law and "magnet" jurisdictions that provided obstacles for employers in 2017. Check out the extensive analysis below!

Anecdotally, surveys of corporate counsel confirm that complex workplace litigation – and especially class action and multi-plaintiff lawsuits – remains one of the chief exposures driving corporate legal budgetary expenditures, as well as the type of legal dispute that causes the most concern for companies.

The prime component in that array of risks is now indisputably complex wage & hour litigation.

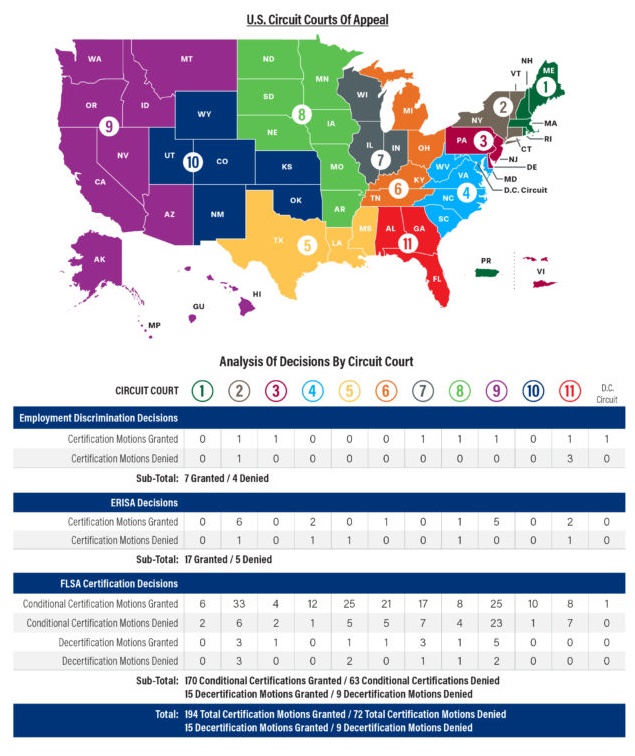

The circuit-by-circuit analysis of 290 class certification decisions in all varieties of workplace class action litigation is detailed in the following map:

Wage & Hour Certification Trends

While plaintiffs continued to achieve robust numbers of initial conditional certification rulings of wage & hour collective actions in 2017, employers also secured significant victories in defeating conditional certification motions and obtaining decertification of § 216(b) collective actions. The percentage of successful motions for decertification brought by employers rose by nearly 18% in 2017. This was the highest success rate over the past decade.

Most significantly, for only the second time in over a decade, and for the second year in a row, wage & hour lawsuit filings in federal courts decreased. That being said, the volume of FLSA lawsuit filings for the preceding four years – during 2014, 2015, 2016, and 2017 – is the greatest in the last several decades.

As a result, an increase in FLSA filings over the past several years had caused the issuance of more FLSA certification rulings than in any other substantive area of complex employment litigation – 257 certification rulings in 2017, as compared to the 224 certification rulings in 2016 and 175 certification rulings in 2015.

The analysis of these rulings – discussed in Chapter v. of this Report – shows that more cases are brought against employers in "plaintiff-friendly" jurisdictions such as the judicial districts within the Second and Ninth Circuits. This trend is shown in the following map:

The statistical underpinnings of this circuit-by-circuit analysis of FLSA certification rulings is telling in several respects.

First, it substantiates that the district courts within the Ninth Circuit and the Second Circuit are the epi-centers of wage & hour class actions and collective actions. More cases were prosecuted and conditionally certified – 48 certification orders in the Ninth Circuit and 39 certification orders in the Second Circuit – in the district courts in those circuits than in any other areas of the country. The district courts in the Fifth, Sixth, and Seventh Circuits were not far behind, with 30, 26, and 24 certification orders respectively in those jurisdictions.

Second, as the burdens of proof reflect under 29 U.S.C. § 216(b), plaintiffs won the overwhelming majority of "first stage" conditional certification motions (170 of 233 rulings, or approximately 73%). However, in terms of "second stage" decertification motions, employers prevailed in a majority of those cases (15 of 24 rulings, or approximately 63% of the time).

The "first stage" conditional certification statistics for plaintiffs at 73% for 2017 are aligned to the numbers in 2016, when plaintiffs won 75% of "first stage" conditional certification motions. However, employers fared much better in 2017 on "second stage" decertification motions. Employers won decertification at a rate of 63%, which was up from 45% in 2016 and 36% in 2015.

The following chart illustrates this trend for 2017:

Third, this reflects that there has been an on-going migration of skilled plaintiffs' class action lawyers into the wage & hour litigation space. Experienced and able plaintiffs' class action counsel typically secure better results. Further, securing initial "first stage" conditional certification – and foisting settlement pressure on an employer – can be done quickly (almost right after the case is filed), with a minimal monetary investment in the case (e.g., no expert is needed, unlike the situation when certification is sought in an employment discrimination class action or an ERISA class action), and without having to conduct significant discovery (per the case law that has developed under 29 U.S.C. § 216(b)).

As a result, to the extent litigation of class actions and collective actions by plaintiffs' lawyers is viewed as an investment of time and money, prosecution of wage & hour lawsuits is a relatively low cost investment, without significant barriers to entry, and with the prospect of immediate returns as compared to other types of workplace class action litigation. Finally, as success in litigation often begets copy-cat filings, that the value of top wage & hour settlements in 2017 topped $525 million – and over $1.2 billion in the last two years – is likely to prompt more litigation in 2018.

Hence, as compared to ERISA and employment discrimination class actions, FLSA litigation is less difficult or protracted for the plaintiffs' bar, and more cost-effective and predictable. In terms of their "rate of return," the plaintiffs' bar can convert their case filings more readily into certification orders, and create the conditions for opportunistic settlements over shorter periods of time. The certification statistics for 2017 confirm these factors.

Employment Discrimination & ERISA Certification Trends

At the same time, the rulings in Wal-Mart and Comcast also fueled more critical thinking and crafting of case theories in employment discrimination and ERISA class action filings in 2017. The Supreme Court's two Rule 23 decisions have had the effect of forcing the plaintiffs' bar to "re-boot" the architecture of their class action theories. At least one result was the decision two years ago in Tyson Foods v. Bouaphakeo, 136 S. Ct. 1036 (2016), in which the Supreme Court accepted the plaintiffs' arguments that, in effect, appeared to soften the requirements previously imposed in Wal-Mart and Comcast for maintaining and proving class claims, at least in wage & hour litigation.

Hence, it is clear that the playbook on Rule 23 strategies is undergoing a continuous process of evolution. Filings of "smaller" employment discrimination class actions have increased due to a strategy whereby state or regional-type classes are asserted more often than the type of nationwide mega-cases that Wal-Mart discouraged. In essence, at least in the employment discrimination area, the plaintiffs' litigation playbook is more akin to a strategy of "aim small to secure certification, and if unsuccessful, then miss small."

In turn, employment-related class certification motions outside of the wage & hour area were a mixed bag or tantamount to a "jump ball" in 2017, as 7 of the 11 were granted and 4 of the 11 were denied.

The following map demonstrates this array of certification rulings in Title VII and ADEA discrimination cases:

In terms of the ERISA class action litigation scene in 2017, the focus continued to rest on precedents of the U.S. Supreme Court as it shaped and refined the scope of potential liability and defenses in ERISA class actions.

The Wal-Mart decision also has changed the ERISA certification playing field by giving employers more grounds to oppose class certification. The decisions in 2017 show that class certification motions have the best chance of denial in the context of ERISA welfare plans, and ERISA defined contribution pension plans, where individualized notions of liability and damages are prevalent.

Nonetheless, plaintiffs were more successful than defendants in litigating certification motions in ERISA class actions, as plaintiffs won 17 of 22 certification rulings in 2017.

A map illustrating these trends is shown below:

Overall Trends

So what conclusions overall can be drawn on class certification trends in 2017?

In the areas of employment discrimination, wage & hour, and ERISA, the plaintiffs' bar is converting their case filings into certification of classes at a high rate. To the extent class certification aids the plaintiffs' bar in monetizing their lawsuit filings and converting them into class action settlements, the conversion rate is robust.

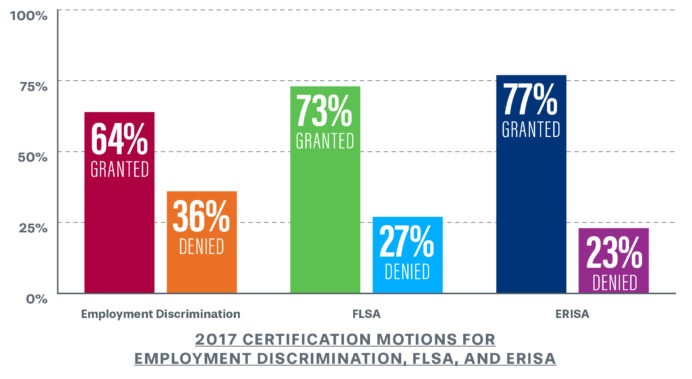

Whereas class certification was somewhat of a coin toss for employment discrimination cases (7 motions granted and 4 motions denied in 2017), class certification is relatively easier in ERISA cases (17 motions granted and 5 motions denied in 2017), but most prevalent in wage & hour litigation (with 170 conditional certification motions granted and 63 motions denied, as well as 15 decertification motions granted and 9 motions denied).

The following bar graph details the win/loss percentages in each of these substantive areas:

- a 64% success rate for certification of employment discrimination class actions (both Title VII and age discrimination cases);

- a 77% success rate for certification of ERISA class actions; and,

- a 73% success rate for conditional certification of wage & hour collective actions.

Obviously, the most certification activity in workplace class action litigation is in the wage & hour space.

The trend over the last three years in the wage & hour space reflects a steady success rate that ranged from a low of 70% to a high of 76% (with 2017 right in the middle at 73%) for the plaintiffs' bar, which is tilted toward plaintiff-friendly "magnet" jurisdictions were the case law favors workers and presents challenges to employers seeking to block certification.

Yet, the key statistic in 2017 for employers was an increase in the odds of successful decertification of wage & hour cases to 63%, as compared to 45% in 2016, 36% in 2015, and 52% in 2014.

The on-going defense of litigation and participation in discovery following conditional certification is often an expensive proposition for employers, and many choose to settle to avoid that scenario. However, for employers that face the costs of discovery and then litigate decertification motions, the pay-off in 2017 was a fracturing of cases at the highest success rate in over a decade – a decertification percentage of 63%.

Comparatively, the trend over the past four years for certification orders is illustrated in the following chart:

While each case is different and no two class actions or collective actions are identical, these statistics paint the all-too familiar picture that employers have experienced over the last several years. The new wrinkle to influence these factors in 2017 was the Supreme Court's ruling in 2016 in Tyson Foods. To the extent it assists plaintiffs in their certification theories, future certification decisions may well trend further upward for workers.

Implications For Employers

For employers, there are multiple lessons to be drawn from these trends in 2017.

First, while the Wal-Mart ruling undoubtedly heightened commonality standards under Rule 23(a)(2) starting in 2011, and the Comcast decision tightened the predominance factors at least for damages under Rule 23(b) in 2013, the plaintiffs' bar has crafted theories and "work arounds" to maintain or increase their chances of successfully securing certification orders. In 2017, their certification numbers were consistent with levels in the last several years.

Second, the defense-minded decisions in Wal-Mart and Comcast have not taken hold in any significant respect in the context of FLSA certification decisions for wage & hour cases. Efforts by the defense bar to use the commonality standards from Wal-Mart and the predominance analysis from Comcast have not impacted the ability of the plaintiffs' bar to secure first-stage conditional certification orders under 29 U.S.C. § 216(b). If anything, the ruling two years ago in Tyson Foods has made certification prospects even easier for plaintiffs in the wage & hour space, insofar as conditional certification motions are concerned.

Third, while monetary relief in a Rule 23(b)(2) context is severely limited, certification is the "holy grail" in class action litigation, and certification of any type of class – even a non-monetary injunctive relief class claim – often drives settlement decisions. This is especially true for employment discrimination and ERISA class actions, as plaintiffs' lawyers can recover awards of attorneys' fees under fee-shifting statutes in an employment litigation context. In this respect, the plaintiffs' bar is nothing if not ingenuous, and targeted certification theories (e.g., issue certification on a limited discrete aspect of a case) are the new norm in federal and state courthouses.

Fourth, during the certification stage, courts are more willing than ever before to assess facts that overlap with both certification and merits issues, and to apply a more practical assessment of the Rule 23(b) requirement of predominance, which focuses on the utility and superiority of a preclusive class-wide trial of common issues. Courts are also more willing to apply a heightened degree of scrutiny to expert opinions offered to establish proof of the Rule 23 requirements.

In sum, notwithstanding these shifts in proof standards and the contours of judicial decision-making, the likelihood of class certification rulings favoring plaintiffs are not only "alive and well" in the post-Wal-Mart and post-Comcast era, but also thriving.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.