The Internal Revenue Service (IRS) has announced the amended 2018 cost-of-living adjustments for transportation programs and retirement and health and welfare plans. Once again, the cost-of-living index did not change significantly this year. This means there were few changes to the IRS 2018 limitatons as compared to 2017. The one significant change is to the FICA taxable wage base, which changes are based on the average wage index.

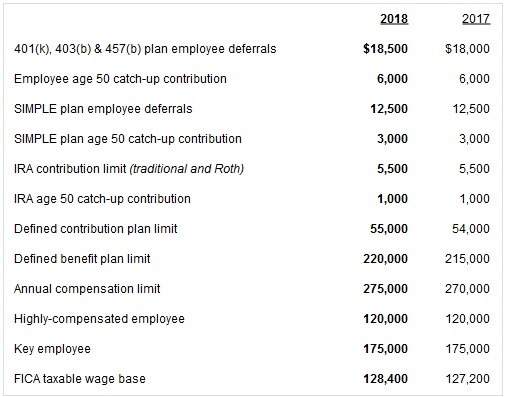

Retirement Plan Limits

Notable 2018 annual retirement plan limitations, as compared to 2017, are as follows:

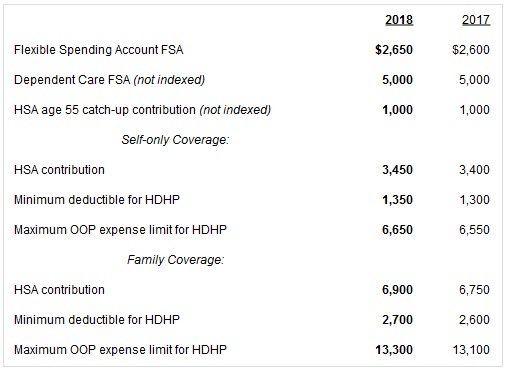

Health and Welfare Plan Limits

The 2018 annual limitations, as compared to 2017, are as follows:

HSA = Health Savings Account

HDHP = High Deductible Health Plan

OOP = Out-Of-Pocket

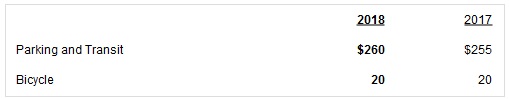

Qualified Transportation Fringe Benefits

The 2018 monthly qualified transportation fringe benefit limitations, as compared to 2017, are as follows:

Plan sponsors should update payroll and plan administration systems for the 2018 cost-of-living adjustments and should incorporate the new limits in relevant employee and participant communications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.