INTRODUCTION

Using deductible interest payments to reduce U.S. taxable income is often a goal of tax practitioners. These payments are often disbursed to foreign related parties, where the interest income is subject to little or no tax. The U.S. has developed rules that limit the deductibility of these interest payments when the payor is a thinly capitalized corporation and the creditor is a related party that is subject to a reduced tax rate in its country of residence as compared to the U.S. rate. Deductibility is also limited when a person related to the lender makes a "disqualified guarantee" of the debt to an unrelated creditor and no gross basis tax is imposed on the interest.

Example 1: Apple Pie Corporation ("Apple Pie") is incorporated in Florida. It is wholly owned by Papaya Inc. ("Papaya"), a corporation incorporated in a jurisdiction that has a tax treaty with the U.S. and a 0% corporate tax rate. Apple Pie was incorporated with $100 of debt from Papaya and has no other assets. Each month, Apple Pie pays interest to Papaya based on its debt agreement. Apple Pie deducts this interest payment in the U.S., thus lowering its U.S. tax liability.

Absent any regulation or Code section, the interest deduction taken by Apple Pie would reduce any U.S. taxable income. Conversely, the interest payment would not be subject to tax in Papaya's country of residence.

CODE §163(J)

Earnings stripping rules are intended to prevent the erosion of the U.S. tax base of a thinly capitalized corporation by means of excessive deductions for certain interest expense. Proposed regulations were issued in June 1991 (the "Proposed Regulations"). However, the Proposed Regulations have not yet been finalized. To remedy the problem, Congress created Code §163(j).

The earnings stripping provisions under Code §163(j) limit the deductibility of interest payments made to related tax-exempt entities (including related foreign persons). The rules apply to both U.S. companies and foreign companies engaged in a U.S. trade or business1 if the following conditions are met:

1 The company pays or accrues "exempt related-party interest."

2 It has both

a. a debt-to-equity ratio exceeding1.5:1 2 at the close of the tax year and

b. excess interest expense.3

If a company meets all these criteria, it must determine the interest deduction disallowed under Code §163(j).

Disallowed interest expense is carried over to future years and treated as interest paid or accrued in the succeeding taxable year. Thus, falling under the earnings stripping rules does not result in a denial, but rather a deferral, of deductible corporate interest expense.

If either of the criteria under condition 2 is absent (i.e., debt-to-equity ratio not exceeding the1.5:1 threshold or no excess interest expense), there is no earnings stripping limitation on a corporation's ability to deduct related-party interest expense. There are, however, proposed anti-avoidance rules, which provide that arrangements will be disregarded if they have been entered into with a principal purpose of avoiding the earnings stripping rules.4

Form 8926, Disqualified Corporate Interest Expense Disallowed Under Section 163(j) and Related Information, is used by taxpayers to report disallowed interest amounts under the earnings stripping rules. The form was issued by the I.R.S. in December of 2008. The form strictly follows the statute, which differs, in some cases, from the Proposed Regulations. The Proposed Regulations deviate from the Code in setting forth additional adjustments to, inter alia, the adjusted taxable income.

APPLICABILE SCENARIOS

As mentioned in the introduction, there are two distinct scenarios where Code §163(j) will apply: (i) where the payment is made to a related party and (ii) where the payment is made to unrelated party who makes a "disqualified guarantee" to the payor.

Related Person

With regard to the former scenario, a person is "related" if it satisfies any of the definitions within Code §267(b) or Code §707(b)(1).5 Under Code §267, two members of the same controlled group are considered to be related.6

Two corporations are members of a controlled group where

- one entity owns more than 50% of the total voting power of all voting classes or more than 50% of the total value of all shares of each of the corporations, except the common parent corporation is owned by one or more of the other corporations; and

- the common parent corporation owns more than 50% of the total voting power of all the voting classes or more than 50% of the total value of shares of

all classes of stock of at least one of the other corporations, excluding, in computing such voting power or value, stock owned directly by such other corporations. 7

All members of an "Affiliated Group" are treated as one corporation, whether or not the members file a consolidated return.8

Disqualified Guarantee

The second scenario involves a fact pattern where a guarantee is given by a related exempt person or a related foreign person and the interest income is not subject to the standard U.S. withholding tax.9 The definition of "guarantee" can be very broad and includes any arrangement where a person, either directly or indirectly through an entity or otherwise, assures the payment of another person's obligation. The guarantee can be either direct or indirect and include a financial contribution to keep the debtor solvent.

The results of the disqualified guarantee are the same as when a payment is made to a related party.

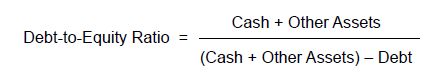

DETERMINING THE DEBT-TO-EQUITY RATIO

For the interest expense limitation to apply, the debt-to-equity ratio must exceed 1.5. This determination is made on the last day of the taxable year. The ratio would be determined as follows:

Example 2: In Year 1, Apple Pie has a loan with its parent, Papaya Inc. ("Papaya"), valued at $600 and wishes to deduct its interest payment to Papaya. Apple Pie also has real property with a fair market value of $300 and $600 cash from the loan. The numerator is $600 and the denominator is $300 (i.e., $300 + $600 - $600). Therefore, the debt-to-equity ratio is 2. Should Apple Pie satisfy the other elements present in Code §163(j), some of its interest deduction may be denied and carried over to the following year.

Example 3: The conditions are the same as in Example 2, but this time, the debt is valued at $300 and the real property is valued at $200. The debt-to-equity ratio is 1.5. The interest deduction is not disallowed under Code §163(j) since the debt-to-equity ratio does not exceed 1.5.

Example 4: The conditions are the same as in Example 3 above, but this time, Papaya guarantees a loan made from an unrelated foreign bank to Apple Pie. This is a "disqualified guarantee" since Papaya and Apple Pie are related, but because the debt-to-equity ratio does not exceed 1.5, any interest deduction by Apple Pie is not disallowed under Code §163(j).

DETERMINING NET INTEREST EXPENSE

Net interest expense is the excess of the amount of interest expense paid or accrued over the interest income.10 It can be represented in the following formula:

Net Interest Expense = Interest Expense Paid/Accrued – Interest Income

Example 5: Apple Pie earns $100 of interest income from its bank account. However, it also has an outstanding loan with another bank and pays $30 of interest on the loan. Its net interest expense is $70 (i.e., $100 of interest income - $30 of interest paid).

DETERMINING ADJUSTED TAXABLE INCOME

Adjusted Taxable Income ("A.T.I.") is computed as follows:

A.T.I =

Taxable Income + Net Interest Expense11 + Net Operating Loss Deduction12 + Deductions for Depreciation, Amortization, or Depletion + DomesticProduction Deduction + Other Adjustments

Since a disallowance only occurs if the net interest expense exceeds 50% of A.T.I., it benefits the taxpayer if the A.T.I. is high, as it will result in a smaller disallowance.

DETERMINING EXCESS INTEREST EXPENSE

As mentioned above, a deduction will be limited to the "excess interest expense" for the tax year. Excess interest expense is the net interest expense over 50% of its adjusted taxable income, plus any "excess limitation" carryforward.13

An excess limitation carryforward from up to three preceding years can be used as an adjustment to A.T.I. for any current tax year.

Example 6: During Year 1, Apple Pie has $200 of A.T.I., including $40 of interest income and 90$ of interest expense, $60 of which is paid or accrued to Papaya and $30 is paid or accrued to unrelated persons. Apple Pie has no excess limitation carryforward and its debt-equity ratio exceeds 1.5. to 1.

Apple Pie's interest expense for Year 1 is $50, the difference between its net interest expense of $50 (i.e., $90 interest expense - $40 interest income) and $100 (i.e., 50% of Apple Pie's $200 of A.T.I.). The payment to Papaya is $60 and is greater than its $50 excess interest expense by $10. Therefore. $10 of the interest deduction is disallowed and carry forwarded to Year 2.

CONCLUSION

Non-U.S. practitioners should be aware of the thin capitalization debt rules when planning for multinational structures. This can be particularly acute when the non-U.S. parent company is taxed in a jurisdiction that has a low to non-existent tax rate for the taxation of interest income and the planner seeks to reduce U.S. taxable income through an interest deduction.

The concern regarding thinly capitalized entities and interest deduction also exists within the B.E.P.S. framework. Action 4 discusses several solutions to the problem, including recharacterizing the interest payment as a dividend and using a carryforward rule that is similar to the one found in U.S. At the same time, Action 4 expands on the number of prohibited transactions by introducing the concept of "interest equivalents." Like the U.S., the B.E.P.S. framework includes the concept of "guarantees in financial arrangements" as an interest equivalent. However, it also includes several other interest equivalents not present in the U.S. tax code, inter alia derivative instruments and Islamic finance transactions.14

Practitioners should also be aware that the I.R.S. Large Business & International ("LB&I") Division has released a step-by-step plan to assist auditors when analyzing interest payments that may implicate Code §163(j).15 When reviewing the interest expense computation, the I.R.S. will review Forms 8926 and 1120, as well as the taxpayer's ledgers, financial statements, and other tax return statements. Practitioners should review the I.R.S. plan with respect to clients making loans involving related parties, so that they may prepare the correct documentation accordingly.

Footnotes

1 Prop. Treas. Reg. §1.163(j)-1(a)(1)(ii).

2 Code §163(j)(2)(A)(ii).

3 Code §163(j)(2)(A)(i).

4 Prop. Treas. Reg. §§1.1.63(j)-1(f), 1.163(j)-3(c)(5), 1.163(j)-6(b)(3). The Proposed Regulations are not consistent in this regard.

5 Code §163(j)(4).

6 Code §267(b)(3),

7 Code §267(f), referencing Code §1563(a)(1) with substitutions.

8 Code §1504(a).

9 Code §163(j)(6)(D)(ii)(I). A controlling interest is direct or indirect ownership of at least 80% of the total voting power and value of all classes of stock of a corporation, or 80% of the profit and capital interests in any other entity. A related person does not include an entity that is 80% controlled by the payor.

10 Code §163(j)(6)(B).

11 Code §172

12 Code §199

13 Code §163(j)(2)(B)(i)-(ii), (j)(6)(B).

14 Stanley C. Ruchelman and Sheryl Shah, "B.E.P.S. Action 4: Limit Base Erosion via Interest Payments and Other Financial Payments," Insights 1 (2015).

15 I.R.S., "LB&I International Practice Service Process Unit – Audit," last updated January 6, 2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.