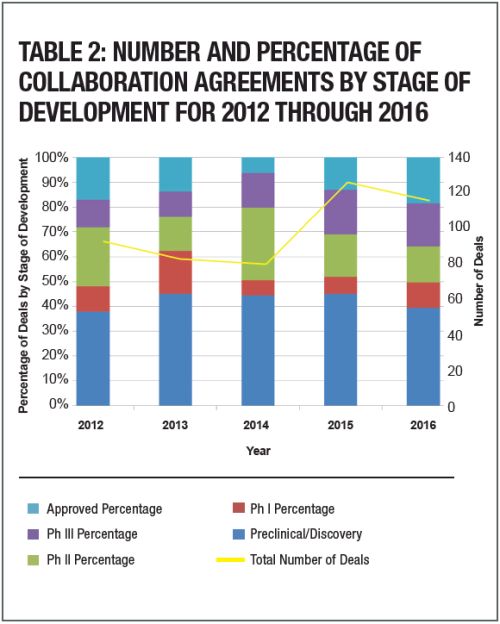

The 2016 BioMeter showed strength at both ends of the drug-development spectrum, with extremely strong results for pre-clinical/discovery transactions and approved product transactions. The average BioMeter value for the entire year across all transactions reporting up-front payments and stage of development was $55.0 million, up from $48.8 million in 2015 and very close to 2014's figure of $58.7 million. There were 114 transactions reporting up-front payments and stage of development in 2016, down from 127 transactions in 2015 but still up dramatically from 79 transactions in 2014, reflecting a healthy amount of deal activity across the industry.

Pre-clinical and discovery stage transactions achieved a record setting BioMeter value of $43.2 million in 2016, compared to $30.5 million in 2015 and $28.1 million in 2014. As in 2015, several mega transactions with BioMeter values exceeding $100 million led the way, including Celgene's $200 million up-front payment to Agios for access to its metabolic immuno-oncology program and its $225 million up-front payment to Jounce for a separate immuno-oncology program, Baxalta's $175 million up-front payment to Symphogen and its $105 million payment to Precision BioSciences in two more immuno-oncology transactions, Genentech's $310 million in payments to BioNTech for mRNA-based cancer vaccines, Novartis' $150 million up-front payment to Xencor for bi-specific immuno-oncology antibodies and other technologies, and Merck's $200 million up-front payment to Moderna for personalized cancer vaccine technology. Excluding these seven transactions, all of which were in "hot" oncology fields, the BioMeter value for pre-clinical and discovery stage transactions was $15.7 million, down slightly from the 2015 value of $16.9 million when mega-transactions were excluded.

2016 BioMeter values also were buoyed to a significant extent by six mega-transactions for approved products that had up-front payments of $100 million or more. The 2016 Biometer value for all approved products was $108 million. AstraZeneca alone received up-front payments greater than $300 million in three transactions ($520 million from Aspen Global for ex-U.S. rights to anesthesia products, $310 million from China Medical for Chinese rights to the cardiovascular drug Plendil, and $550 million from Pfizer for anti-infective products). Excluding only these AstraZeneca transactions more than halves the 2016 BioMeter for approved products to $49.3 million, still much higher than the $17.5 million BioMeter for approved products in 2015.

2016 was mixed for products in clinical trials. The BioMeter value for Phase 1 products was $30.6 million in 2016, compared to $131.5 million in 2015. The 2015 figure was heavily influenced by three mega transactions, without which the 2015 value would have been only $14.4 million. In contrast, 2016 had only one Phase 1 mega-transaction, and, excluding that transaction, the Phase 1 BioMeter value would have been $22 million, a healthy increase over 2015. The 2016 BioMeter for Phase 2 transactions was $46.3 million including three mega transactions and $20.8 million without mega transactions. The value without mega transactions was the same as in 2015, while the total was down from $79.9 in 2015. The Phase 3 BioMeter for all transactions in 2016 was $74.3 million, compared to $56.5 million in 2015. Excluding mega transactions, the Phase 3 BioMeter in 2016 was $16.1 million, compared to $25.8 million in 2015.

2016 saw an up-tick in the percentage of transactions for approved products, representing 18.4% of transactions reporting up-front payment and stage of development. The percentage of Phase 1 transactions also increased to 10.5% in 2016, from 7% in 2015. As in past years, pre- clinical and development stage transactions were most numerous, representing 39.5% of transactions studied.

By indication, cancer, immunologic disorders, and CNS disease accounted for 63% of all transactions reporting up-front payment and stage of development, as well as 82% of mega-transactions reporting up-front payments of $100 million or more. As in 2015, the large indications, rather than rare diseases, make up the majority of licensing transactions and the vast majority of high-value ones.

2016 continued the "tale of two markets" trend of 2015. Hot areas, particularly immuno-oncology, and novel platform technologies are garnering high up-front payments. In other areas, however, the trends are flat or down. Coming during a year in which overall venture investment in biotechnology fell by over $2 billion,1 this data suggests that the bulk of biotechnology companies that are looking to out license programs may find themselves in a buyer's market, with licensees able to exert leverage on deal terms. One silver lining for 2016 has been public capital raising. While the number of biotech IPOs decreased in 2016, the overall amount raised by biotechnology companies remained strong in 2016, down from 2015 levels but still comparable to 2014 levels and higher than previous years.2 In a tightening market, it appears better to be public than private.

Footnotes

1"VC investments and IPOs down, but there's a halftime pep talk," Bioworld" Today, Vol. 28, No. 2, January 4, 2017.

2 "Biopharma logs $37.3B in 2016, with 38 IPOs and Moderna's record private raise," Bioworld" ember 28, 2016.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved