Renaissance Capital reported a strong start to the year in its U.S. IPO Market 1Q 2017 Quarterly Review. The first quarter of 2017 saw 25 IPOs, which raised $9.9 billion, a jump from 1Q 2016's 8 IPOs raising less than $1 billion. This was a seven-quarter high for capital raised. Median deal size also rose to $190 million.

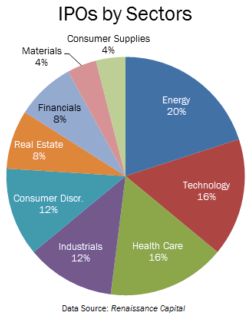

There was an even distribution of IPO activity across various sectors. The energy sector made up 20% of 1Q 2017 IPOs, raising $1.5 billion. The tech sector raised the most capital this quarter, $4.0 billion from its four IPOs. Biotech IPO activity saw its lowest levels since 4Q 2012 with only three IPOs this quarter. The tech sector had the largest U.S. IPO since the Alibaba in 2014 with the Snap IPO raising $3.4 billion.

Private equity-backed IPOs accounted for 12 IPOs, raising $5.1 billion in proceeds. This was the first time in four years that PE-backed IPOs accounted for more capital raised and number of deals than venture capital-backed IPOs. VC-backed IPOs made up 32% of the first quarter's IPOs with eight IPOs, raising $4.1 billion in proceeds.

There were 16 IPO withdrawals and 33 new filings during 1Q 2017. A number of unicorn companies, valued at over $1 billion, were on track for their IPOs but instead opted for M&A exits this quarter.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved