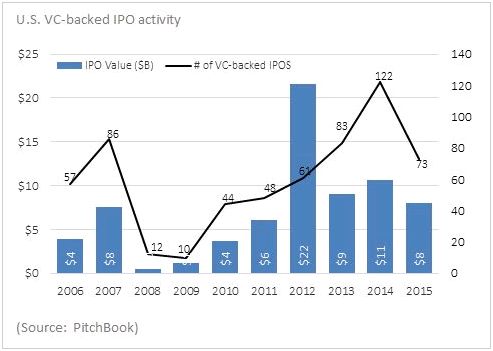

PitchBook's 2015 Annual U.S. Venture Industry Report reported a total of 73 venture capital-backed IPOs were conducted in 2015, the lowest number since 2013. The number of VC-backed IPOs had been climbing since 2009, from 10 IPOs in 2009 to 122 IPOs in 2014. 2015 VC-backed IPOs raised approximately $8 billion, the lowest proceeds collected in three years.

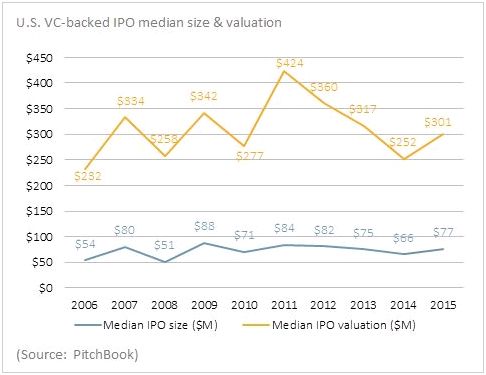

The median IPO size for VC-backed IPOs has remained consistent over the years, fluctuating no more than $11 million since 2009. In 2015, the median IPO size was $77 million. The median valuation of VC-backed IPOs has been declining since 2011, with the median valuation in 2011 reported at $424 million down to $252 million in 2014. In 2015, the median valuation of a VC-backed IPO was $301 million, a number higher than 2014, but still lower than 2011-2013 figures. Due to lower ambitions on IPO valuations, PitchBook reports that compensatory provisions will have to be included more frequently in order for investors to recommit in late stage financing rounds.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved