The Liquidity Coverage Ratio (the "LCR" or the "rule") adopted by the Office of the Comptroller of the Currency (the "OCC"), the Board of Governors of the Federal Reserve System (the "Board") and the Federal Deposit Insurance Corporation (the "FDIC) (collectively, the "agencies") requires covered institutions to maintain a stock of high-quality liquid assets ("HQLAs") sufficient to satisfy their projected net cash outflows over a 30-day period as computed under the rule.

Over time, covered institutions will find that modifications to the structure and terms of their assets and liabilities, coupled with educated choices about which HQLAs they hold to cover the gap between calculated outflows and inflows, can both improve their ability to withstand liquidity pressures and minimize any adverse effects on revenues that may result from holding the necessary level of HQLAs. The following analysis of the LCR is designed to help covered institutions achieve compliance with the rules and to help them start the process of making that compliance more efficient.

I. LCR COVERAGE AND TIMING

There are two forms of the LCR. There is a version for large, internationally active banking organizations with $250 billion or more in total consolidated assets or $10 billion or more in on-balance sheet foreign exposure, and for consolidated depository institution subsidiaries of these companies with $10 billion or more in total consolidated assets. There is also a modified LCR (the "Modified LCR") that is somewhat less stringent. The Modified LCR applies to bank holding companies and savings and loan holding companies without significant insurance or commercial operations that have $50 billion or more in total consolidated assets.

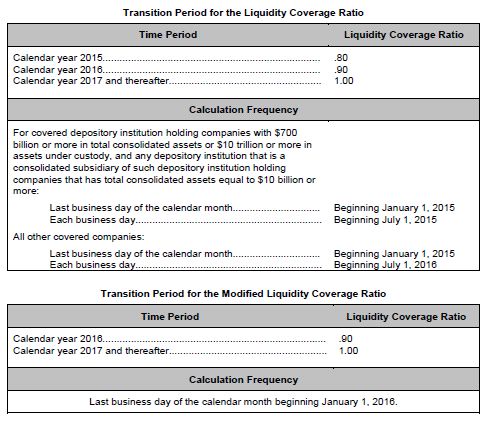

The effective dates and calculation requirements for covered companies differ based on the size of the institution. The following tables lay out the relevant requirements:

II. THE LIQUIDITY COVERAGE RATIO

Conceptually, the LCR is relatively simple and can be expressed by the following formula: HQLAs/Total Net Cash Outflow Amount ≥ 1. In other words, an institution must calculate its total net cash outflows over a 30-day measurement period, and if the result of that calculation is a number greater than zero, the institution must hold a commensurate amount of HQLAs that can be liquidated to meet the assumed outflows. The equation requires unpacking to fully appreciate the complexity involved in its calculation.

First, the LCR must be calculated and maintained on a daily basis, except for those institutions subject to the Modified LCR, which need only calculate the LCR on the last day of each calendar month.

Under the rule, HQLAs are subdivided into three classes: Level 1, Level 2A and Level 2B assets. Level 1 assets receive 100% credit. Level 2A assets receive 85% credit and Level 2B assets receive 50% credit. Level 2 assets are capped at 40% of total HQLAs and Level 2B assets are capped at 15% of total HQLAs. The LCR also requires that HQLAs be "eligible," such that they can be easily liquidated, from an operational standpoint, within the 30-day measurement period. In addition, HQLAs are subject to an adjustment that "unwinds" specific types of secured transactions that mature within 30 days of the calculation date.

A covered company's total net cash outflow amount is derived by adding up total cash outflows over a 30-day period, subtracting total cash inflows over the same period and then applying a maturity mismatch add-on. Total cash inflows under the rule are subject to a 25% haircut, so that even if a covered company's total cash inflows matched its total cash outflows, it would still need to maintain a cushion of HQLAs. In order to calculate the amount of its cash inflows and outflows, a covered institution must determine the maturity and type of each of its transactions. The rule provides a prescribed set of maturity assumptions. Outflow and inflow rates can be assigned once the maturity and the type of each transaction are determined under the rule. The maturity assumptions generally presume that all contingencies, such as the exercise of a put or call option, are realized to the disadvantage of covered institutions (i.e., maturities for outflows will be shortened and maturities for inflows will be extended). The result of these various maturity assumptions, transaction classifications and corresponding outflow and inflow rates is a complex matrix of fund flows that will ultimately shape institutions' preferences for certain types of transactions based on the effect of those transactions on the LCR calculation.

III. HIGH-QUALITY LIQUID ASSETS

HQLAs are divided into three tiers based on the agencies' perception of the ease with which various assets can be sold, while maintaining a minimum level of price integrity, during a time of market stress. The agencies also endeavor to ensure that covered institutions have the practical and operational ability to convert their HQLAs into cash in time to meet projected liquidity demands.

To view the full article please click here.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved