This morning the Federal Reserve Board ("FRB") published in the Federal Register a proposed rule setting forth an entirely new regulatory scheme for companies that provide remittance transfers, including banks.1 Remittance transfers are electronic transfers of money from U.S. consumers to recipients in foreign countries. The FRB's proposal would (1) require that specific disclosures be given to each "sender" of a remittance transfer showing how much money will be received by the recipient of the transfer in local currency; (2) enable senders to dispute errors for up to 180 days following a remittance transfer; and (3) impose vicarious liability on remittance transfer providers for the acts or omissions of their agents. Comments on the proposal are due July 22, 2011.

BACKGROUND

Section 1073 of the Dodd-Frank Act added a new section 919 to the Electronic Fund Transfer Act ("EFTA") to require certain disclosures and to impose new error resolution provisions with respect to remittance transfers.2 These provisions are to be implemented by rules proposed initially by the FRB, but rulemaking authority will transfer to the Consumer Financial Protection Bureau ("CFPB") on the Designated Transfer Date – July 21, 2011 – which is the date that administration of the EFTA formally transfers from the FRB to the CFPB. See Dodd-Frank Act § 1084 (amending EFTA by "striking 'Board' each place that term appears and inserting 'Bureau'"). As a practical matter, this means that the FRB has begun the rulemaking process, but the rules will eventually be completed by the CFPB.

REQUIRED DISCLOSURES

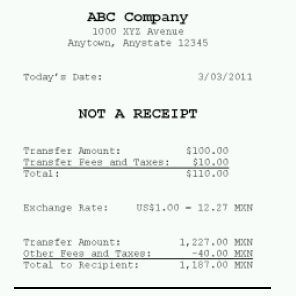

The proposed rule would require a remittance transfer provider to provide to each "sender" of a remittance transfer a disclosure describing the amount of currency that will be received by the "designated recipient" of the transfer, the fees that will be charged by the remittance transfer provider, and the exchange rate. This disclosure must be expressed in the currency into which the funds will be exchanged. This disclosure would be provided when the sender requests a remittance transfer and before the sender makes any payment.

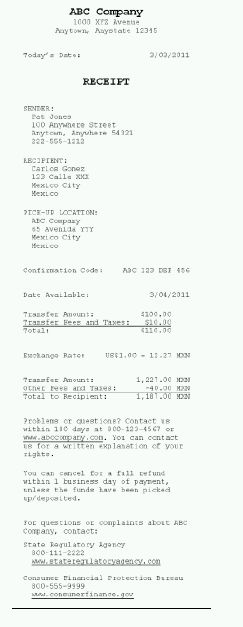

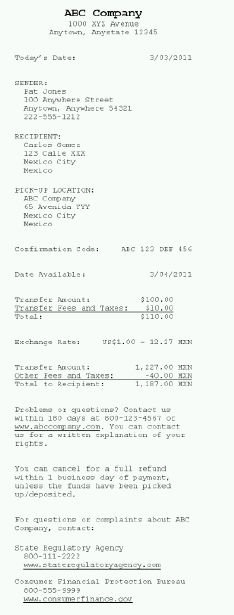

The remittance transfer provider must also provide the sender with a receipt showing all of the information above, as well as the promised date of delivery, the name and telephone number or address of the designated recipient, a statement about the sender's error resolution rights (see below), contact information for the remittance transfer provider, and contact information for the remittance transfer provider's primary regulator and the CFPB, as well as a toll-free number established by the CFPB.

Under the proposed rule, banks and credit unions are only required to provide a "reasonably accurate estimate of the foreign currency to be received" if the transfer is conducted through a deposit account that the sender holds with the bank or credit union and the bank or credit union is unable to know the exact amount of foreign currency that will be received. This safe harbor would sunset on July 20, 2015. In addition, all remittance transfer providers, bank and non-bank, may provide estimates for those countries where local law or other circumstances do not permit the provider to determine a precise exchange rate.

The FRB has proposed model forms for the required disclosures, and also has proposed that remittance transfer providers may provide the initial "pre-payment" disclosure and the receipt at the same time, prior to payment, as a combined disclosure. See Figure A (initial disclosure), Figure B (receipt), and Figure C (combined disclosure).

The disclosures must be provided to the sender clearly and conspicuously, in writing and in a form that the sender can keep. Disclosures must be provided in English and in each of the foreign languages principally used by the remittance transfer provider at the office from which the transfer is being initiated or, if applicable, in the foreign language used by the sender to conduct business with the remittance transfer provider. (The Dodd-Frank Act provision required that disclosures must be provided "in each of the foreign languages principally used by the remittance transfer provider." The ability to provide disclosures in the language used by the sender would afford the remittance transfer provider much-needed flexibility and avoid the need for extraneous foreign language disclosures that would not be relevant to the sender.)

The proposal would allow electronic disclosures, as long as they are in a form that may be retained by the sender, where the sender requests the transfer electronically. In addition, the proposal would allow verbal disclosures for telephone transactions.

ERROR RESOLUTION PROCEDURES

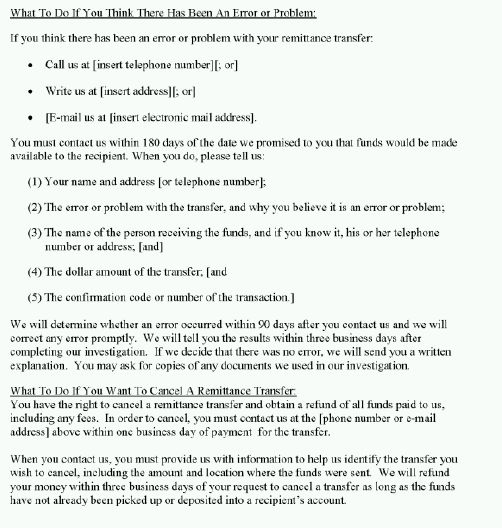

The FRB's proposal sets forth error resolution procedures that would take the place of the EFTA's existing error resolution procedures for electronic funds transfers. See EFTA §§ 908 and 909 (EFTA error resolution and unauthorized transaction provisions). Under the proposed rule, if a remittance transfer provider receives notice that an error occurred from a sender within 180 days of the promised delivery of the remittance transfer, the provider must, within 90 days, conduct an investigation and report the results of the investigation to the sender within three days of completion. Where the provider determines that an error has occurred, the provider would be required to offer the sender the option of obtaining a refund or making available to the designated recipient the funds necessary to resolve the error. The provider would only be required to refund fees where the provider failed to make funds available to the designated recipient by the date of availability specified in the receipt or combined disclosure. See Figures B and C. (In other words, a refund of fees would not be required for errors where the recipient still receives the transferred money on or before the availability date.)

Providers would be required to provide senders with a notice of their dispute rights. The FRB has proposed a model form for these purposes. See Figure D.

LIABILITY OF AGENTS

Because many remittance transfer providers offer their services almost exclusively through agents, the liability of remittance transfer providers for the acts of their agents was a key consideration for the FRB in proposing the rule. The FRB has proposed two alternative approaches to address the issue:

Alternative A: "A remittance transfer provider is liable for any violation of [the proposed rule] by an agent when such agent acts for the provider."

Alternative B: "A remittance transfer provider is liable for any violation of [the proposed rule] by an agent when such agent acts for the provider, unless: (a) The remittance transfer provider establishes and maintains written policies and procedures designed to assure compliance with [the proposed rule] by its agents, including appropriate oversight practices; and (b) The remittance transfer provider corrects the violation to the extent appropriate, including complying with the error resolution procedures set forth in [the proposed rule]."

The "qualified" vicarious liability of Alternative B is preferable for providers, and also makes sense from the consumer's perspective, to the extent that it encourages the provider to develop procedures to supervise agents and to correct any errors caused by an agent. In addition, because the EFTA provides for civil liability to private plaintiffs (see EFTA § 916), as well as criminal liability (see EFTA § 917), any extension of vicarious liability to remittance transfer providers needs to strike a careful balance to avoid discouraging the use of agents. Although agents must be adequately supervised by providers, networks of agents can frequently reach senders of remittance transfers more effectively and fulfill services more efficiently than centralized providers of remittance transfer services.

KEY POINTS FOR COMMENTERS

The FRB's proposal generally adheres quite closely to the Dodd-Frank Act's requirements and, as a result, the FRB and, eventually, the CFPB may have little leeway to vary from the proposal in a final rule.

Nonetheless, each company that provides remittance transfers should read the rule closely and, in particular, focus on the required disclosures to ensure that they are consistent with the company's existing remittance transfer origination and fulfillment procedures.

The liability of remittance transfer providers for the acts of their agents is another key point for providers to raise in comments in response to the FRB's proposal, and we recommend that providers express strong support for the "qualified" vicarious liability expressed in Alternative B in the FRB's proposed rule.

Figure A: Proposed Model Form for Pre-Payment Disclosures

Figure B: Proposed Model Form for Receipts

Figure C: Proposed Model Form for Combined Disclosures

Figure D: Proposed Model Form for Error Resolution and Cancellation Disclosures

Footnotes

1. See http://www.gpo.gov/fdsys/pkg/FR-2011-05-23/pdf/2011-12019.pdf.

2. Remittance transfers of less than $15 are not subject to the proposed rule. See EFTA § 919(g)(2)(B) (excluding from the remittance transfer provisions "small-value" transactions determined by rule to be excluded from the receipt requirements of EFTA § 906(a)); 12 C.F.R. § 205.10(e) (excluding transfers of "$15 or less" from the receipt requirements of EFTA § 906(a)).

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved