As the world reacts and tries to adapt to the unprecedented global pandemic of COVID-19, there is a trigger point for many ultra-high net-worth (UHNW) families to ensure they are well planned and protected in unanticipated and volatile times. In times such as these, entrepreneurs will look to ensure they rationalise and protect their business and investment interests, often taking difficult decisions to ensure sustainability.

With well over half of the world's population currently facing constraints on their daily routine, it's inevitable that families are spending more time together, either physically in the same home, or virtually, with all generations utilising modern technology to communicate effectively and often.

This provides an opportunity for UHNW families and their advisers to discuss, strategically assess and re-valuate wealth transfer plans and structures - such as addressing inter-generational responsibilities, preparation and pain points, reviewing existing fiduciary arrangements or revalidating priorities for the family agenda (i.e. family succession, family governance etc.). We have summarized some key areas that deserve a closer look for Latin American families and their trusted advisers.

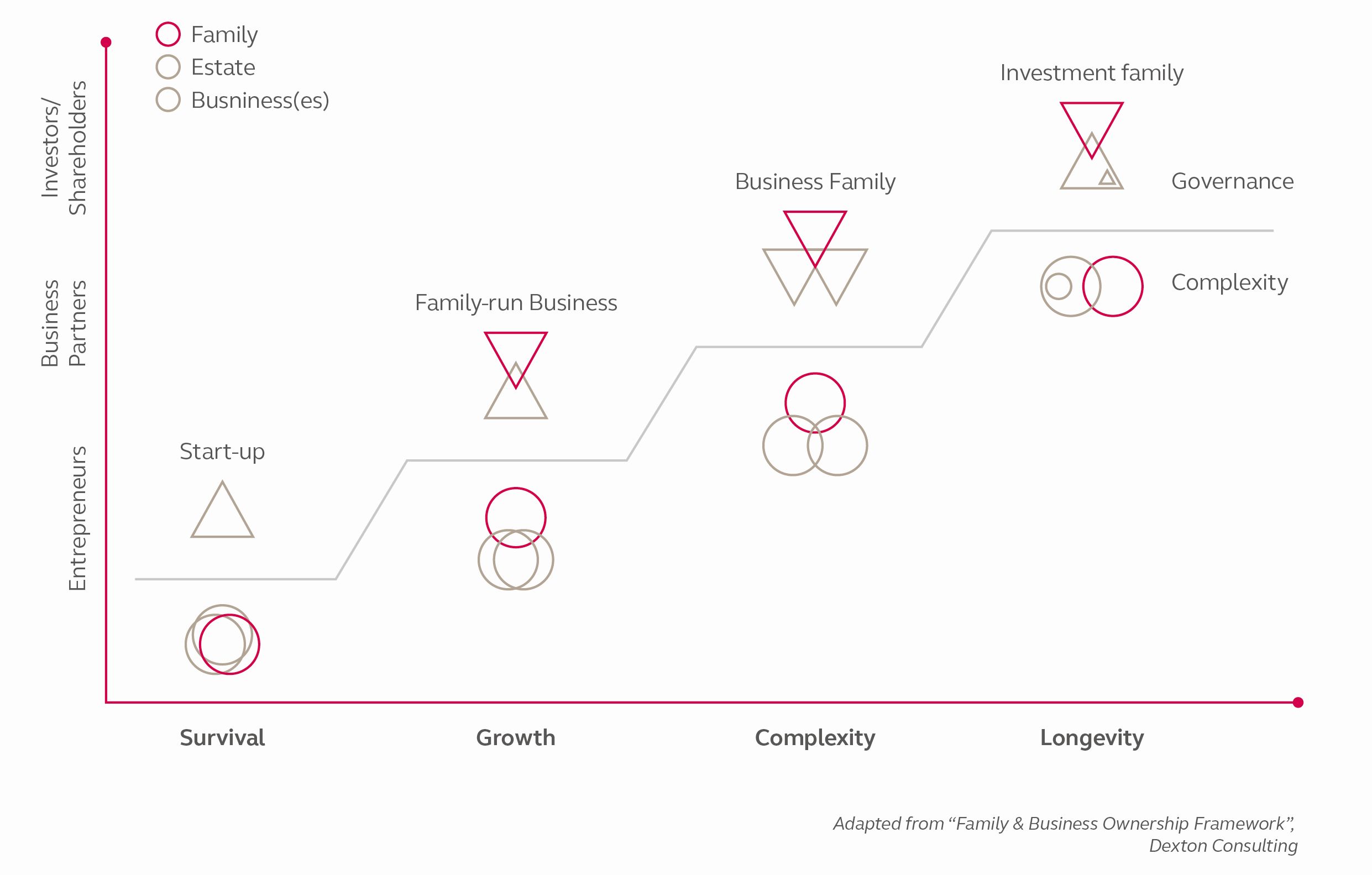

The roots of family-owned businesses and their importance run deep in Latin America's socioeconomic DNA. EY's Global Family Business Report estimates that 85% of companies across the region are family-owned and they account for 60% of regional GDP and employ around 70% of the active workforce. Family-owned and controlled businesses serve as the backbone of Latin American economies and wealth. Typically, closely held and founder controlled at the earlier stage, the family ventures develops into a formal family business or enterprise, establishing governance frameworks, allowing for non-family member participation and defining clearer lines of demarcation between the family's business and its generated wealth. Subsequently, the family enterprise may transform into a well-diversified 'investing family' or Single Family Office, where the original corner stone – the family business – may turn into an asset among several holdings rather than the sole source of family income:

What sounds convincing in theory has proven extremely challenging

in practice for many multi-generational business families in Latin

America, where successful inter-generational wealth transfers and

business planning show significant gaps. Almost 50% of family

businesses in the region continue to be managed by the first

generation and only 10% are controlled or supervised by the 3rd or

4th generation. A shocking 70% of wealth deteriorates from the 1st

to the 2nd generation and out of the remaining 30%, only 12-15% of

it is successfully transferred to the 3rd generation.

Experts broadly agree on four areas of concern and risk that regionally-embedded families and their legacies fail to consider:

- Estate planning and inter-generational wealth transfer process. The absence of wealth structuring solutions and/or inadequate use of such from a holistic family wealth and asset protection perspective.

- Family coordination and communication. The absence of clear and regular inter-generational dialogue and a framework for such.

- 'Next Gen' preparation. A significant lack of adequate 'Next Generation' preparation to successfully lead, direct and/or participate in family interests, investments and business affairs.

- Asset diversification. The absence of efficient asset allocation approaches (i.e. concentration of total family wealth) as well as high levels of third-party provider costs, leverage-related risk, and exposure to contingent liabilities.

Vistra has been supporting entrepreneurial families from Latin America for several decades. Our experienced cross-cultural team understands the challenges of recurring fiscal, regulatory, economic and political changes for multi-generational families, their businesses and international investments. By navigating and implementing agendas for successful inter-generational wealth transfer, we have been able to support clients and their advisors with:

- Experienced trusteeship and safeguard of family assets across multiple jurisdictions and asset classes including one-shop-stop virtual Single Family Office solutions.

- The preparation and support of the 'Next Generation' by providing experienced professional board directors and global estate and company administration teams that work hand-in-hand with family members.

- The development of tailor-made estate plans considering all necessary components for a successful inter-generational wealth transfer and future protection*.

- The performance of family portfolio analyses and on-going risk monitoring services leveraging the benefits of an independent and flexible fiduciary organization.

- The provision of consolidated reporting functions under a centralized and easy-to-access dashboard platform for several family members/beneficiaries^.

- The design of a family governance protocol to ensure principles are embedded within the decision-making frameworks

- The creation of a philanthropic agenda across family generations reflecting the increased desire for an ESG aligned approach.

Originally published 6 May, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.