The anti-corruption and bribery enforcement landscape is constantly evolving. Companies operating in the Aerospace, Defense, and Government Services (ADG) industry sector must therefore vigilantly track developments in this area and be prepared to adjust their compliance programs and practices to effectively address the most salient risks.

To aid in this effort, we summarize key 2019 developments at United States enforcement agencies and report on Foreign Corrupt Practices Act (FCPA) enforcement actions resolved by U.S. agencies that involved ADG companies.

U.S. enforcement priorities and policies

In March 2019, the Federal Bureau of Investigation announced it would establish a fourth dedicated international corruption squad in its Miami field office (existing squads are located in New York, Washington, D.C., and Los Angeles). The Miami squad will reportedly focus its investigatory lens on corrupt schemes in Latin America that have a nexus to the U.S. This effort aligns with an increased commitment to anti-corruption by several governments in Latin America, including Brazil and Mexico. Perhaps not surprisingly, a number of the FCPA enforcement actions resolved by U.S. enforcement agencies in 2019 related to corruption in Latin America. With the additional dedicated resources now available, we expect to see this trend continue as the year progresses.

For its part, the U.S. Department of Justice (DOJ) announced, several subtle, but important, adjustments to its FCPA Corporate Enforcement Policy, which may shape how FCPA investigations are resolved by DOJ. The Corporate Enforcement Policy aims to provide "additional benefits to companies based on their corporate behavior once they learn of misconduct" in light of the "unique issues presented in FCPA matters."1 Under the policy in place before 20 November 2019, a company that has voluntarily self-disclosed misconduct in an FCPA matter, fully cooperated, and timely and appropriately remediated, will benefit from a presumption that DOJ will decline to prosecute absent aggravating circumstances. Further, even where a criminal charge is warranted, a company may still be eligible for "a 50% reduction off of the low end of the U.S. Sentencing Guidelines fine range," and the appointment of a corporate compliance monitor "generally" will not be required if the company "has, at the time of resolution, implemented an effective compliance program."2

Changes to this policy, adopted during 2019, further refined these principles and requirements as follows:

- Previously, one of the things required for a company to establish that it had self-disclosed was to disclose "all relevant facts known to it, including all relevant facts about all individuals substantially involved in or responsible for the violation of law." Under the revised policy, a company must disclose "all relevant facts known to it at the time of the disclosure, including as to any individuals substantially involved in or responsible for the misconduct at issue." This change reflects DOJ's practice and acknowledges – quite reasonably – that a company must disclose the "relevant facts known to it" when the disclosure occurs, while also replacing the "violation of law" standard with "misconduct."

- Second, to receive full cooperation credit, a company that "is aware of relevant evidence not in the company's possession...must identify that evidence to the Department." This amounts to a simplification of a prior requirement that a company that "is or should be aware of opportunities for the Department to obtain relevant evidence not in the company's possession and not otherwise known to the Department...must identify those opportunities to the Department." By removing the obligation to report potential evidence that the company "should be aware of," the revised policy avoids the importation of a negligence standard into the evaluation of a company's cooperation.

- In July 2018, DOJ announced that the presumption of declination available under the FCPA Corporate Enforcement Policy would extend to companies that self-disclose misconduct that is uncovered during a merger or acquisition, either through pre-acquisition due diligence, or "in appropriate circumstances," during post-acquisition integration. This policy was subsequently formalized in a March 2019 revision to the FCPA Corporate Enforcement Policy. The November 2019 revisions included a further clarification that the "presumption of a declination" applies where a company discovers misconduct "by the merged or acquired entity" (assuming other requirements are met). These changes appear designed to encourage companies to disclose conduct discovered post-merger and to assure the acquirer that it will not face successor liability.

These recent adjustments to the FCPA Corporate Enforcement Policy are consistent with an effort by the DOJ to ensure greater consistency and transparency, while attempting to account for practical realities when investigating and considering enforcement actions against corporations.

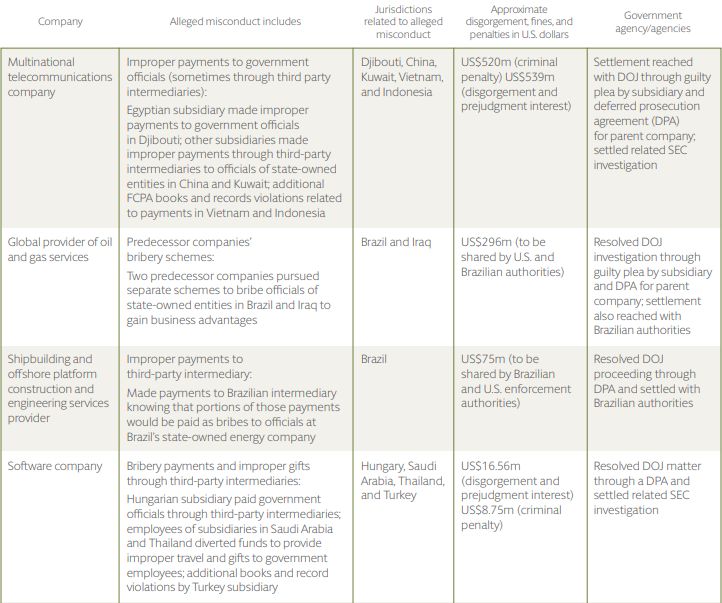

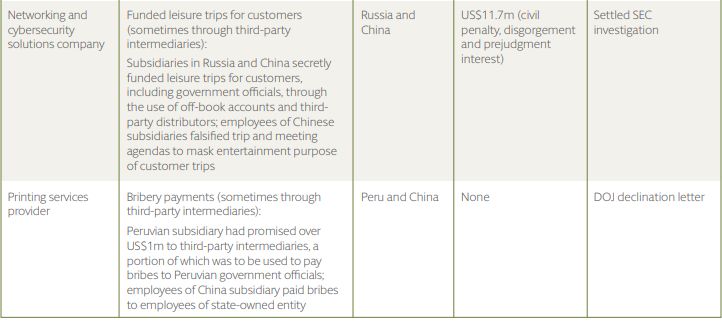

FCPA investigations in the ADG industry sector continued in 2019

A number of FCPA investigations of ADG companies resulted in criminal penalties and disgorgement in varying amounts during 2019. The key allegations, industries and geographic regions involved are summarized on the following page.

Looking forward

We expect that 2020 will bring continued enforcement efforts aimed at curtailing corruption and bribery, and that U.S. officials will continue to cooperate with their foreign counterparts in Latin America and elsewhere. It is too early to tell if DOJ's efforts to clarify policies and thereby encourage more voluntary self-disclosures will cause more companies to make such disclosures. It is clear, however, that ADG companies continue to encounter bribery and corruption risk in large parts of the world. They should therefore continue to monitor enforcement trends and policy changes and update their compliance programs accordingly. Our ADG team, which includes industry-leading lawyers with investigations and litigation experience and a deep understanding of the ADG market, is here to help.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.