Recent trends and tax law changes are making the Internal Revenue Code (I.R.C.) Section 179 Energy Efficient Commercial Building Deduction (179D deduction) more attractive and lucrative than ever, which means this an opportune time to explore the deduction that offers substantial benefits for energy-efficient buildings. Here are a few frequently asked questions to help you better understand how it may apply to your business.

Q: What is the 179D tax deduction?

The 179D tax deduction, also known as the Energy Efficient Commercial Buildings Deduction, is a federal tax incentive in the United States designed to encourage energy efficiency in commercial buildings. Originally established by the Energy Policy Act of 2005, the 179D deduction was permanently codified in 2020, and most recently enhanced by the Inflation Reduction Act of 2022.

Q: Who is eligible for the 179D tax deduction?

Eligible parties for the 179D tax deduction include commercial building developers, building owners, designers and contractors.

For taxable properties such as commercial buildings, building owners who have purchased energy efficient equipment for either a new construction project or renovation to an existing building are eligible. For tax-exempt properties such as government buildings, churches and schools, designers of energy-efficient systems are eligible for the deduction. This may include architects; mechanical, electrical and plumbing design engineers; and design build contractors.

Q: How much is the 179D tax deduction worth?

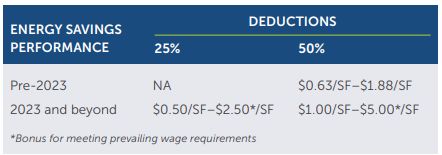

The 179D tax deduction allows for a potential deduction of up to $5.00 per square foot of eligible commercial buildings. Commercial real estate projects whose construction started prior to January 29, 2023, and will be placed into service in 2023 and beyond will be able to qualify for the enhanced deduction of $2.50-$5.00 per square foot without needing to meet prevailing wage requirements under the Inflation Reduction Act.

Q: What types of projects are eligible?

Many commercial buildings adhering to the latest building codes may qualify for the 179D deduction. Examples of projects include warehouses, offices, hotels, shopping centers, strip plazas, manufacturing plants, etc. In addition, the 179D deduction is available for multifamily projects that are four stories or higher. Single family homes and residential buildings three stories or less are not eligible for the deduction.

Q: What is the ideal project size for 179D?

While any size commercial building is eligible for the 179D deduction, the ideal project size is greater than 50,000 square feet so that the benefits of pursuing the deduction outweigh the cost of performing the study. However, with the latest deduction amount increasing to up to $5.00 per square foot, projects less than 50,000 square feet may still benefit from the deduction. Reach out to Kaufman Rossin for a complimentary eligibility analysis to determine if your project may be able to qualify

Q: Can the 179D tax deduction be claimed retroactively?

Yes, the 179D tax deduction can be claimed retroactively for eligible buildings by filing Form 3115 – Application for Change in Accounting Method for a change in accounting.

Q: How can you claim the 179D tax incentive?

A Section 179D study is required to determine eligibility to claim this deduction. First, construction drawings are collected, and the building design is reviewed to evaluate the project's eligibility for the deduction. Next, an analysis is performed comparing the building's energy and cost performance to a standard reference building. Then, a professional engineer, licensed in the state where the building is located, must provide documentation certifying the property meets Section 179D's requirements. Form 7205 is completed and included in the entity's tax return.

Whether you've previously taken advantage of energy-efficient tax deductions, or you're just learning about them, it's important to work with a qualified firm for Section 179D and other technical tax incentives. Kaufman Rossin has CPAs and licensed professional engineers on staff who understand how to maximize these provisions. Contact us to learn how your real estate projects may be able to qualify for the Section 179D deduction and other tax savings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.