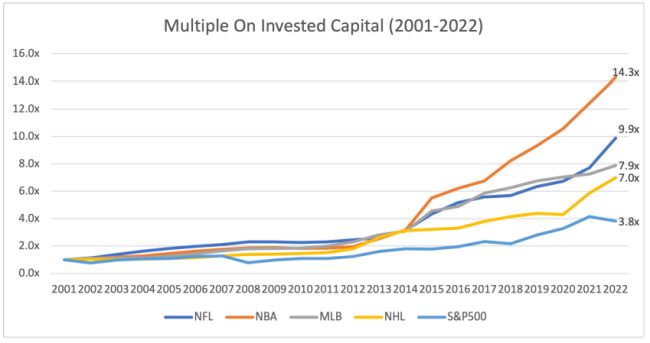

If you had invested in one of the North American sports franchises from 1991- 2022, you would have earned between a seven-fold return (NHL) or over a 14-fold return (NBA) on your investment, bettering the return from the S&P 500 over that period of time by at least a two-to-one ratio. According to Sportico, in the past year alone, the average value of an NFL franchise has increased by 24 percent. The strong growth in the value of these franchises has proven to be particularly attractive to investors, especially in recent years.1 For example, the sale of the Denver Broncos in 2022 was for a 22 percent premium over a third-party's pre-sale valuation.2 Valuation premiums are not only limited to sales of controlling investments; in 2023, a minority share of the parent company of the Toronto Raptors, Toronto Maple Leafs and Toronto FC was sold for a similar premium over a recent third-party valuation for the franchises.3 Not surprisingly, franchise owners have been eager to cash in either in whole or in part.

Based on S&P500 closing share price as of December 31st each year; 2022 closing share price as of December 30th, 2022 NOTE: League and chart data based on latest Forbes' data and rankings as of May 2023 and reflect metrics released by Forbes in each calendar year; NFL data as of August 2022, NBA data as of October 2022, MLB data as of March 2023 (2023 excluded from this graphic) and NHL data as of December 2022.

Source: Forbes and publicly available information

The prestige of being one of very few franchise owners in each league has always kept values high. But what's been the cause of these more recent soaring valuations? The lucrative media rights and sponsorships available for these leagues are a significant contributing factor. Live sports significantly drive cable package sales, accounting for 94 of the top 100 broadcasts in 2022.4 Streaming has also provided the leagues with an additional revenue stream. Similarly, sponsorships of franchises and commercial signage and naming rights of franchises have also proven to be more and more lucrative. Franchises are also constructing modern, multi-billion-dollar, multi-use stadium venues to not only improve the gameday experience, but also serve as more attractive venues for non-sporting events throughout the year and to become destination locations. Finally, the leagues are leveraging their popularity to enter into a variety of other commercial partnerships, branding and endorsements, such as partnerships with sports betting companies5, social media companies6 and collaborations with other media7 and fashion8 brands. The leagues have also been expanding their international influence by hosting more exhibition and regular season games in international markets. Franchises themselves have begun to offer franchise equity to players as part of the overall compensation packages, hoping that the franchises' ever-increasing valuations will make them a more attractive destination.9

Rules and regulations regarding ownership and debt limits can have an outsized impact on franchise valuations. Historically, the leagues emphasized local family ownership of their franchises, limiting the ability of franchises to raise funds from institutional capital investors. Recently, many leagues (excluding the NFL) have begun to liberalize rules regarding institutional ownership of their franchises, allowing these franchises to start capitalizing on their valuation increases. As franchises begin to routinely trade at multi-billion-dollar valuations, the pool of qualified individual investors has shrunk. Many bidders now must form buyer groups that consist of multiple billionaires who pool their resources to make bids on these precious limited assets. Valuations have soared. For example, the Pittsburgh Penguins were recently purchased by the Fenway Sports Group, a conglomerate with multiple billionaire investors dedicated to purchasing and managing sports franchises. Similarly, Josh Harris' ownership group for the Washington Commanders consists of several billionaires like Mitchell Rales and David Blitzer, who both joined the Apollo Global Management founder to buy the franchise at a record $6.05 billion. Some bidders are also spacing out their purchase of a sports franchise's equity over multiple installments to lessen the initial financial outlay, such as with the recent purchases of the Minnesota Timberwolves and Nashville Predators.10 As valuations continue to increase, it is likely that owners of minority stakes will explore liquidity options in order to cash in some or all of their investment. How leagues adapt to these economic realities will be important.

Institutional Investor Interest in Sports

Institutional investors are primarily, if not solely, focused on their return on investment, which makes the everincreasing value of sports franchises an attractive capital investment. What's more, non-controlling investments can come with the right to have their interest bought out at the valuation of the majority owner in a franchise sale.

North American major sports league franchises are attractive investments in part because they lack cyclicality associated with other types of investments. During the Great Recession of 2009, sports franchise valuations resisted the decrease in valuations experienced by other market investments; the opportunity to obtain an asset that seems to be ever increasing in value and resists market forces in economic downturns makes these investments highly sought after for these funds.11

However, institutional investors will need to be aware of some of the risks involved with investing in sports franchises. Often money generated by the franchise is fully invested back into the franchise and its operations, making a sale of their minority interest the only source of liquidity for institutional investors, aside from a total sale of the franchise. The pool of potential buyers for any sale of their minority investment will be more limited than with other investments due to both the ever-increasing rise in valuations of sports franchises and the transfer limitations placed on sales by the leagues themselves. Institutional investors are also not allowed to participate in the governance or management of the franchise.

Since leagues have implemented rules allowing for institutional investment, there has been a flurry of institutional activity. Most active has been Arctos Sports Partners; the just three-year old firm has raised more than $2 billion for sports investments in its first fund to buy minority stakes in professional sports franchises. Arctos has moved quickly to retain minority ownership stakes in franchises, holding stakes in six MLB franchises, four NBA franchises, two NHL franchises and two MLS franchises.12

To view the full article click here

Footnotes

1. NBA Owners Approve Institutional Investors Owning Parts of Franchises – Sportico.com

2. 2021 NFL Team Value Ranking – Sportico.com

3. Maple Leafs, Raptors Parent Nears Stake Sale at $8B Valuation – Sportico.com

4. 2022 TV Recap: NFL Rules Top 100 Ratings List – Sportico.com

5. NFL announces tri-exclusive official sports betting partners; Press release: MLB names FanDuel a new official sports betting partner in North America; NHL announces North American partnership with FanDuel, BetMGM; NFL, MLB and players unions lead latest investment in Fanatics

6. The NFL Partners With Social Media & Video App TikTok | by Kathryn Kuchefski | Instant Sponsor | Medium; TikTok and MLS enter multiyear partnership to deepen the league's presence on the app | TechCrunch

7. My Hero Academia and NBA Fashion Collaboration Announced - Interest - Anime News Network

8. Fashion Takes the Field With The Boss x NFL Collaboration - V Magazine

9. Messi's Miami Contract: $50M-$60M Annually Before Adidas, Apple Money – Sportico.com

10. Predators Sale Closing at Near-Record $880M (frontofficesports.com)

11. Sports Team Ownership Shifts From Billionaires To Investment Funds – Sportico.com

12. Arctos Makes Second Investment in 76ers, Devils at Higher Valuation

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.