The Federal Energy Regulatory Commission ("FERC" or "Commission") issued on April 16, 2020 two orders1 largely denying requests for rehearing of its prior decisions that, among other things, subjected to minimum offer price thresholds energy resources participating in PJM Interconnection, L.L.C.'s ("PJM") capacity market which receive so-called "State Subsidies".2 FERC reaffirmed that a resource within broadly-defined categories (e.g., renewable resources) receiving State Subsidies must offer capacity in PJM's forward capacity market at or above an administratively-established price floor (i.e., the minimum offer price rule, or "MOPR"), regardless of such a resource's actual incremental costs. Potential and likely ramifications of the Commission's actions, arguments opponents of the April 16 Orders are likely to raise and potential paths forward for industry market participants are set forth below. Additionally, the most promising arguments that could be used to invalidate the April 16 Orders, some of which are discussed below, have not been raised before or addressed by FERC.

The April 16 Orders are likely to generate further controversy and litigation at FERC and in appellate proceedings, as well as some secondary effects, discussed below. The PJM capacity market will inevitably be impacted by the resulting heightened uncertainty; both market incumbents and new resources will not know with confidence (because of the sheer breadth of litigation discussed below) what rules ultimately will apply to them, potentially for many years and auctions to come.

A. PJM Specific Issues and Review of the April 16 Orders

PJM's internal processes and compliance filings will unavoidably be filled with disputes over the "details" of codifying and fleshing out the Commission's broader holdings, which will affect billions of dollars of investment whose owners will jockey for administrative advantage in the determination of the costs of providing generation from multiple competing generation resources.

There will also be questions and concerns regarding the validity of the results of future PJM capacity auctions. While the Commission reiterated that past auction results will not be re-opened (see, e.g., PJM MOPR Order I, 170 FERC ¶ 61,034 at P 89), no Commission can bind its future members, and case law indicates that the Commission retains the authority to rectify its legal error retroactively. Thus, even the resources that are successful under the new paradigm must reckon with the risk of subsequently having results of future auctions overturned.

With the issuance of the April 16 Orders, at least some of the issues debated in their respective proceedings should now be ripe for judicial review, perhaps in an appeal lodged, and consolidated with the pending appeal regarding the December 20, 2019 PJM MOPR order,3 at the U.S. Court of Appeals for the District of Columbia Circuit. Given the importance of the orders to notions of federalism and the proper spheres of federal and state regulation, any decision by a Court of Appeals may find its way to the Supreme Court.

The pendency of multiple, interconnected but not always clearly delineated, proceedings means that the Commission or litigants may contend that an issue raised in one of such proceedings should have been raised in another one of the related cases, and the issue is untimely or beyond the scope of the docket in which it is initially raised, further compounding the risks presented by the litigation around the expanded rule.

B. Undue Discrimination

The April 16 Orders concluded that new resources participating in PJM's capacity market and receiving state subsidies distort prices in PJM's capacity auctions and thus are subject to PJM's MOPR.4 However, opponents argue that the April 16 Orders failed to adequately explain why fossil-fired resources that have received, and still receive, considerable out-of-market support in the form of governmental subsidies are exempt from the MOPR notwithstanding similar price distortion concerns. If this facet of the April 16 Orders is upheld, it may have significant implications for renewable resources and state legislatures seeking to promote such resources.

According to a 2019 report by the International Monetary Fund, the U.S. provided $649 billion in fossil fuel subsidies in 2015, representing approximately 3.6 percent of the U.S. GDP.5 Opponents of the PJM MOPR argue that there are a number of federal benefits for oil and gas producers, including, but not limited to (i) the intangible drilling costs deduction, which allows companies to deduct from taxable income costs incurred from domestic drilling of wells,6 and (ii) last-in, first-out accounting, which allows fossil fuel companies to reflect lower inventory for purposes of calculating taxable income.7 Some coal-fired resources also enjoy federal benefits, including, but not limited to, credits for clean coal investments and carbon dioxide sequestration.8

While there may be merits to providing subsidies to these types of fossil resources, opponents argue that the April 16 Orders failed to adequately explain why traditional generation resources receiving out-of-market support in the form of governmental subsidies are exempt from PJM's MOPR while certain renewable resources receiving state subsidies are not. The Commission has previously stated that "[i]t is axiomatic that resources receiving out-of-market subsidies need less revenue from the market than they otherwise would."9 However, the Commission ultimately determined that receipt by renewable resources of one type of state subsidy was more problematic than fossil-fired resources receiving any type of federal subsidy. Adversaries of the MOPR could cite the IMF Report, other similar reports and/or federal tax laws to argue that fossil-fired resources are eligible to receive significant and substantial federal benefits. Some may argue that just as a subsidy would allow a renewable resource to bid in a lower capacity price than it otherwise would, so too might a subsidy for a fossil resource. Thus, opponents of the MOPR argue that the Commission ostensibly found a distinction without a difference, in that even though renewable and fossil resource classes both receive out-of-market support, renewables are disproportionately impacted by PJM's MOPR.

When presented with its failure to address undue discrimination claims, FERC stated that such an analysis was unnecessary.10 However, the April 16 Orders (and the orders underlying them) require consideration of a critically important question of administrative law: can an independent federal agency impede or eviscerate policies that are implemented by a state and that are traditionally within the domain of the state? The answer to this question will largely depend on the facts and circumstances of the specific federal and state actions/policies being reviewed. The implications of this issue are profound in the energy context. If the Commission's actions on this score are upheld, states may contend that they will be significantly hampered, or precluded outright, from undertaking meaningful efforts to increase renewable energy development and proliferation. Additionally, renewable resources will claim that their state benefits have been nullified by applying the MOPR to their auction bid, while having to compete with fossil-fired resources still receiving federal benefits that facilitate lower, market-distorting bids.

The April 16 Orders raise important constitutional questions, as well, that have not been articulated by participants or addressed by the Commission to date. While numerous participants have discussed the economic harms associated with the Commission's expansion of PJM's MOPR to certain resources, no entity has raised other key federal constitutional justifications for the states' actions.

C. Federal/State Tensions – The April 16 Orders Immediate Effect on ISO/RTO Markets

The April 16 Orders exacerbate a tension between federal policy/jurisdiction regarding capacity pricing and state policies/jurisdiction associated with capacity procurement. That longstanding tension is now rising to the forefront as federal and certain states' priorities diverge. How and where such tensions arise under the current formulation of the MOPR (to say nothing of applying the philosophy to other products and markets, as foreshadowed by statements noted in Part D., below) depends on Independent System Operator ("ISO")/Regional Transmission Organization ("RTO") membership and capacity market structure, as well as each state's policies regarding renewable resources. Below the states are broken down into four categories based upon such criteria.

- States With ISO/RTO Membership With a Centralized and Mandatory Capacity Market

PJM, ISO New England ("ISO-NE") and the New York Independent System Operator ("NYISO") have centralized, mandatory capacity markets. These markets have either already been directly affected by the April 16 Orders or will likely be in the future. The states with policies that are significantly supportive of renewables will be most affected. Such states may consider requiring their utilities to withdraw from the ISO/RTO or they may pressure such ISO/RTOs to no longer have mandatory capacity markets.

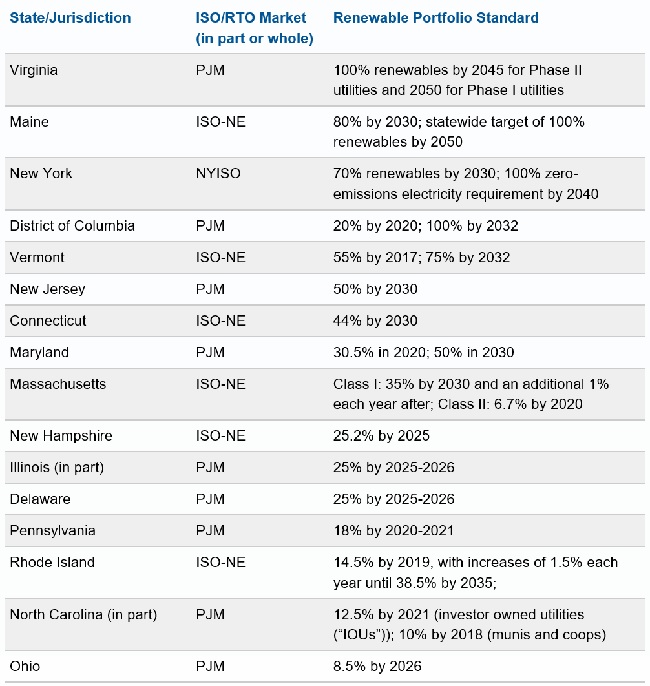

New York, Maine, Virginia, the District of Columbia, Vermont, New Jersey, Connecticut, Maryland, Massachusetts, New Hampshire, Illinois (in part), Delaware, Pennsylvania, Rhode Island, North Carolina (in part) and Ohio (1) have a significant number of utilities as members of either PJM, ISO-NE and NYISO and (2) have renewable portfolio standards. The chart below lists each state, the ISO/RTO where its utilities are members, and highlights a few of the renewable portfolio standard goals.11

Only West Virginia has a significant number of utilities as members of PJM but does not have a renewable portfolio standard. Thus, West Virginia should not be directly affected by this order.

- States With ISO/RTO Membership Without a Centralized or Mandatory Capacity Market

The California Independent System Operator ("CAISO"), Southwest Power Pool ("SPP"), and Midcontinent Independent System Operator ("MISO") do not have centralized or mandatory capacity markets. The states with significant utility membership in those ISO/RTOs should not be directly affected by FERC's policies regarding capacity market pricing.

California has significant renewable goals, including requiring 100 percent clean energy by 2045, but CAISO does not have a centralized capacity market.

A significant number of utilities located in Arkansas, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Oklahoma and Wisconsin are either members of SPP or MISO. SPP does not have a centralized capacity market, and MISO's capacity market is voluntary. The support for renewables in these states varies from a lack of any standard (Arkansas, Kentucky, Louisiana, Mississippi and Nebraska) to a requirement that IOUs procure 25 percent of their capacity from renewable resources (Illinois and Minnesota). However, due to the structure of the capacity markets in which the utilities in these states participate, there should not be a conflict between state and federal policies focused on capacity markets.

- States Without Significant ISO/RTO Membership

States that either do not have renewable portfolio standards or that do not have a significant amount of utility membership in an ISO/RTO should not be directly affected by FERC's policies regarding capacity market pricing.

Alabama, Florida, Georgia, Idaho, Tennessee and Wyoming do not have renewable portfolio standards, and either none or an insignificant portion of the states' utilities are members of an ISO/RTO.

Arizona, Colorado, Montana, Nevada, New Mexico, North Carolina, Oregon, South Carolina, Utah and Washington have varying renewable portfolio standards (South Carolina's requires that IOUs procure 2 percent of their generation capacity from renewable resources by 2021 while New Mexico requires that 100 percent of electricity be supplied by zero-carbon resources by 2045). However, either none or an insignificant portion of such states' utilities are members of an ISO/RTO. Thus, there should not be a conflict between federal capacity pricing and state procurement policies.

- ERCOT

The Electric Reliability Council of Texas's ("ERCOT") electric energy markets are not FERC jurisdictional. Furthermore, ERCOT does not have a centralized capacity market and Texas' renewable portfolio standards have already been met.

- Potential for Organized Wholesale Market Exits

Efforts by some segments of the market to reduce uncertainty appear to be increasing the likelihood that some participants may leave or significantly diminish their engagement in PJM (or potentially other affected markets described above). Those departures could produce efforts to impose exit fees or some other form of responsibility for legacy costs on the participants seeking to leave PJM. For example, when Duke Energy Ohio and Duke Energy Kentucky left MISO, MISO imposed an exit fee on those utilities in order to address their remaining financial obligations under the MISO tariff. Exits from PJM would be an especially challenging situation given that PJM (and its non-RTO predecessor in some form) has been in operation for over 90 years and its most important participants have relied on its operations for decades. Moreover, while to date much of the impetus for clean energy programs has produced state-level action, the current PJM MOPR likely will have proponents of clean energy reconsider whether they need to focus more of their efforts on federal legislation and regulations. If they reach that conclusion, and are successful, the PJM MOPR may represent a pyrrhic victory for opponents of administratively- or legislatively-favored renewables programs.

D. Expansion of the Philosophy to Other Products and Markets

The potential expansion of the philosophy animating the April 16 Orders to other markets and products is becoming clearer. At his first meeting as a Commissioner, Commissioner Danly stated that ensuring accurate price signals in the market should be a goal not just of capacity markets, but of the energy market and for demand response as well. Moreover, PJM MOPR Order I (at P 97) noted the arguments of one participant that FERC's statements concerning out-of-market support could be read to apply to energy and ancillary service markets. The Commission responded by inviting "new filings to initiate a separate proceeding" to address other products (id. at P 100).

The April 16 Orders raise a host of issues, including those articulated above, that will necessarily need to be addressed in further administrative and judicial proceedings. Given the impact the orders are expected to have on renewable resources, as well as state legislatures seeking to promote renewable energy agendas, litigation over PJM's MOPR will be contentious and last at least several years before any resolution is reached. Whatever the outcome, the April 16 Orders (and the underlying orders upon which they are based) will have significant consequences for participants in organized electricity and capacity markets for years to come.

Footnotes

1 https://www.ferc.gov/whats-new/comm-meet/2020/041620/E-4.pdf and https://www.ferc.gov/whats-new/comm-meet/2020/041620/E-5.pdf

2 Calpine Corp. v. PJM Interconnection, L.L.C., 171 FERC ¶ 61,034 (2020) ("PJM MOPR Order I"); Calpine Corp. v. PJM Interconnection, L.L.C., 171 FERC ¶ 61,035 (2020) ("PJM MOPR Order II") (together with PJM MOPR Order I, the "April 16 Orders").

3 Calpine Corp. v. PJM Interconnection, L.L.C., 169 FERC ¶ 61,239 (2019).

4 See, e.g., PJM MOPR Order I, 170 FERC ¶ 61,034 at P 4; PJM MOPR Order II, 170 FERC ¶ 61,035 at P 2.

5 David Coady, Ian Parry, Nghia-Piotr Le and Baoping Shang, IMF Working Paper, Global Fossil Fuel Subsidies Remain Large: An Update Based on Country-Level Estimates, at p. 35, App. 5 (May 2019) (accessed at https://www.imf.org/en/Publications/WP/Issues/2019/05/02/Global-Fossil-Fuel-Subsidies-Remain-Large-An-Update-Based-on-Country-Level-Estimates-46509) ("IMF Report").

6 26 U.S.C. § 263 (2018).

7 26 U.S.C. § 472.

8 26 U.S.C. § 48A; 26 U.S.C. § 45Q.

9 Calpine Corp. v. PJM, 171 FERC ¶ 61,034, at P 28 (2018).

10 PJM MOPR Order I, 170 FERC ¶ 61,034 at P 69.

11 All data regarding renewable portfolio standards can be found here: https://www.ncsl.org/research/energy/renewable-portfolio-standards.aspx#sc

Originally published 24 April, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.