On December 28, 2022, staff of the New York State Department of Public Service (DPS) and the New York State Energy Research and Development Authority (NYSERDA) released the much-awaited New York's 6 GW Energy Storage Roadmap: Policy Options for Continued Growth in Energy Storage (Roadmap). This Roadmap builds upon a prior roadmap issued in 2018 and puts forward a comprehensive plan to deploy six gigawatts (GW) of energy storage by 2030 – a goal Governor Kathy Hochul announced in her January 2022 State of the State address, and which doubled New York's existing commitment at that time.

A key headline of this Roadmap is the proposal of a new, centralized procurement mechanism for bulk energy storage projects: the Index Storage Credits (ISC). The ISC would be similar to the Index REC structure used for NYSERDA's procurement of "Tier 1" large-scale onshore renewable energy and Offshore Wind renewable energy certificates (RECs). As projected in the Roadmap, solicitations using this mechanism would account for a full half of the 6 GW goal.

We expect DPS to notice the Roadmap in early January to allow at least 60 days of public comment on its policy proposals. This timeline would tee up the Roadmap for Public Service Commission (Commission) approval in the second quarter of 2023, with the resulting utility tariff amendments and NYSERDA program implementation guidelines to be formalized in the third quarter of the year.

Current State of the Market

According the Roadmap, a total of 1,301 megawatts (MW) of storage, representing about 87% of the 2025 target, has been awarded or contracted as of October 2022, but only 130 MW installed. Approximately 12,000 MW of proposed energy storage projects are presently in interconnection queues in New York.

The Roadmap notes key barriers to deployment, including (i) technology costs such as supply chain constraints, material price increases, and increased competition for battery cells, (ii) delayed and costly interconnection processes, (iii) and downward pressure on capacity revenue.

Thus, despite the recent passage of the Inflation Reduction Act, and its Investment Tax Credit for standalone energy storage projects, the Roadmap recommends additional financial support to reach the 6 GW deployment goal.

Policy Recommendations

For bulk storage, the Roadmap proposes a two-pronged approach: (1) procurement by NYSERDA of 3,000 MW of bulk storage projects through the new ISC mechanism, which is intended to provide long-term certainty to projects while maximizing value to ratepayers; and (2) a Commission directive to the utilities to study and identify energy storage projects that would provide cost-effective, non-market transmission and distribution services.

For retail and residential storage, the Roadmap proposes extending the current NYSERDA-provided, region-specific incentives to include 1,500 MW of program blocks for retail projects and 200 MW for residential storage programs.

Index Storage Credit Mechanism

The ISC mechanism is similar in many respects to the "Index REC" approach adopted by the Commission and utilized in NYSERDA's Tier 1 REC and Offshore Wind REC solicitations. The ISC is, in part, a response to high bulk energy storage project attrition in prior NYSERDA solicitations, and the limited ability of a fixed, up-front contracting mechanism to respond to dynamic market and supply chain issues.

Under this proposed structure, energy storage developers would bid a "Strike Price" into a NYSERDA-administered competitive solicitation. For awarded projects, payments would be determined by comparing the Strike Price to a "Reference Price" based on an index of expected wholesale market revenues. Funding for such payments would likely be provided through bill collections from New York's load-serving entities.

Key proposed features of the ISC structure include:

- Each ISC should represent one MWh of energy storage capacity that is operational on a given day. Each day a storage project is operational, it would be credited with and compensated for a number of ISCs equal to the MWh of storage discharge capacity of the unit. There would be no performance, discharge, throughput, or operational requirements under the ISC contract.

- A contract term of 15 years.

- Grid-connected electric, chemical, mechanical or thermal-electric storage technologies will be eligible. Behind-the-meter resources not interconnected into the transmission and distribution systems are ineligible.

- NYSERDA will have flexibility to set duration requirements, but most solicitations will likely focus on 4 megawatt-hour (MWh) to 8 MWh systems. Given the clear benefit of storage with average duration of eight hours, NYSERDA may explicitly allocate or carve-out awards for those 8 MWh systems.

- No contractual limits on payments owed to or paid by NYSERDA during the contract term.

- Include an Inflation Adjustment, e., "a one-time adjustment to reflect changes in certain pre-determined cost indices between the time the project is bid to a NYSERDA procurement and the time at which the project proceeds to construction."

- Reference Price would include energy arbitrage and capacity revenue streams, but not ancillary services.

- Energy arbitrage would use the difference between the average of the top four and bottom four hours in the day-ahead energy market to calculate the daily Reference Energy Arbitrage Price. Round-trip efficiency losses would not be accounted for, but would be offset by ancillary service revenues and other revenues not captured by the Reference Price.

- Reference Capacity Price would account for location-specific and resource-specific variations in expected wholesale capacity market revenues, including those due to NYISO Market Accreditation rules. Specifically, the Roadmap recommends calculating the Reference Capacity Price in a manner that adjusts the Monthly NYISO ICAP Auction value of capacity in the locality where the storage is sited according to the prevailing Capacity Accreditation Factor for each storage duration typ

- A Project cannot receive both a Tier 1 or Offshore Wind REC Award and the ISC.

Retail Program (includes VDER Projects)

The original Retail Storage Incentive Program was designed to support distribution-connected projects up to 5 MW in capacity. The Roadmap recommends expanding upon this successful program, but with certain changes to avoid backlogs and "boom-and-bust" cycles when new incentive blocks are released. Specifically, the Roadmap recommends that NYSERDA (1) provide a detailed analysis of region-specific incentive rates, as well as a forecast of potential future block rates, to provide transparency and certainty; (2) continue to communicate adjustments to incentive rates early in the process to allow project developers to adjust accordingly, and (3) create a public-facing VDER calculator for energy storage projects across the state (the current calculator only covers Con Edison projects).

Procurement Amounts/Timelines

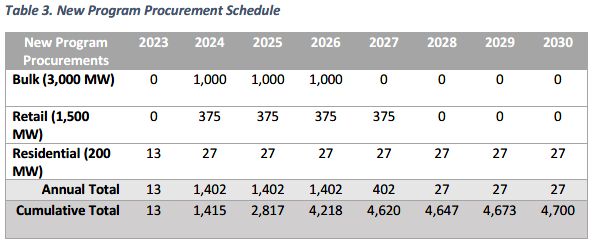

Per the above, residential storage is expected to amount to 200 MW by 2030, representing at least 20,000 installations over the next seven years. Bulk storage, by contrast, is expected to provide 3 GW by 2030.

The Roadmap recommends that the State's procurement strategies should reflect different development timelines. Because bulk storage projects take four to six years to complete the interconnection process, NYSERDA should frontload bulk storage procurements to meet the 2030 goals – "starting as soon as possible and only as late as the end of 2026."

Long Duration Storage Innovation

Whereas the 6 GW storage target focuses on energy storage with short duration (e.g., 4-hour to 8-hour operation), the Roadmap also identifies a post-2030 need for long-duration storage to "provide an alternative to hydrogen-based or zero carbon fuel-based firm resources." To meet New York's long-term resource adequacy needs, the Roadmap recommends that NYSERDA's Innovations program "continue to evaluate further funding needs within the existing program framework, particularly related to the ability to begin demonstrating projects at a larger scale" – i.e., on the order of 50-100 MW.

Total Cost

The total cost of these proposed procurement programs is estimated at between $1.0 billion and $1.7 billion. This equates to an estimated increase in customer electric bills of 0.32% – 0.54% (or $0.34 – $0.58 per month for the average residential customer) on average across New York for the 22-year period during which these programs would make payments to awarded projects. Procurements are expected to take place during the next seven years to meet the 2030 goal with contract terms lasting 15 years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.