The US regulatory and litigation pathway for biosimilars (the Biologics Price Competition and Innovation Act of 2009; BPCIA) was signed into law in March 2010 and therefore turns ten this year. Although the approval of biosimilars took years to ramp up, the FDA has approved 26 biosimilar products as of December 2019, 10 of which were approved in 2019. These include biosimilars of 9 of the world's most clinically important biologic medicines; 15 of these approved biosimilar products are now marketed.

Litigation followed many biosimilar applications, but most cases have now been resolved. Some biosimilars were approved without litigation and some litigations were completed without FDA approval of the biosimilar.

Biosimilar approvals and marketing

The FDA has approved biosimilars of simple biologics, such as Neupogen (filgrastim, Amgen; recombinant G-CSF), as well as more complicated products, such as glycosylated recombinant proteins (Amgen's Epogen; recombinant erythropoietin), pegylated proteins (Amgen's Neulasta; pegfilgrastim) and glycosylated monoclonal antibodies (mAbs), including Genentech's Herceptin (trastuzumab) and AbbVie's Humira (adalimumab).

Biosimilars are also being approved for clinical indications of innovator biologics through extrapolation. Such extrapolation — in which evidence obtained by a biosimilar maker for one indication is extrapolated to approved indications of the reference biologic, without testing the biosimilar in the additional indications — offers extraordinary savings, as biosimilar makers can avoid trials for each indication.

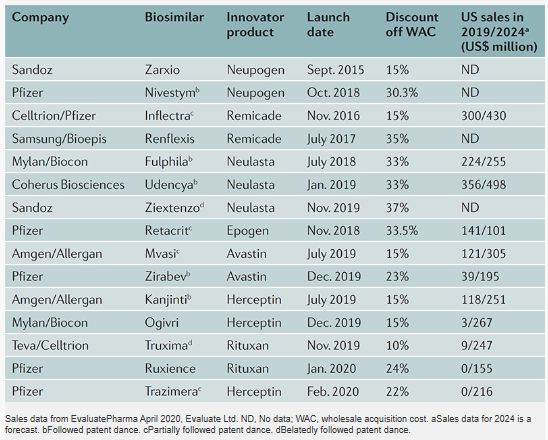

The first biosimilar, Sandoz's biosimilar of Neupogen, was approved by the FDA in March 2015, 5 years after the BPCIA was passed (Table 1). A biosimilar of Janssen's Remicade (infliximab), a blockbuster treatment for rheumatoid arthritis and Crohn's disease, was the first biosimilar mAb to reach the market and was launched in 2016. Another Remicade biosimilar was launched in 2017, at more than twice the discount of the first (35% versus 15% reduction in the wholesale acquisition cost (WAC) of the innovator product).

Sales data from EvaluatePharma April 2020, Evaluate Ltd. ND, No data; WAC, wholesale acquisition cost. aSales data for 2024 is a forecast. bFollowed patent dance. cPartially followed patent dance. dBelatedly followed patent dance.

There are now biosimilars of seven innovator products on the US market. Biosimilars have launched at 10–37% off the WAC of the innovator products, with the second and third biosimilars of the same innovator product typically coming in at greater discount than the first. Many biosimilars were launched prior to the completion of patent litigation concerning their biosimilars.

Biosimilar litigation

The litigation pathway for biosimilar products has also matured in the past 10 years. The litigation pathway is highly orchestrated and starts when the biosimilar maker provides the innovator company with regulatory and manufacturing information, after the FDA accepts its application for review. The parties then exchange positions on infringement and validity and negotiate which patents to assert (the BPCIA 'patent dance').

From the beginning, litigation under the BPCIA has been a 'choose your own adventure'. Some biosimilar makers have bypassed the litigation pathway entirely and not provided information to the innovator, leaving the innovator to sue the biosimilar maker without clear information. The first such litigation, involving Sandoz's Neupogen biosimilar, went all the way to the Supreme Court. In June 2017, the Supreme Court upheld the biosimilar maker's decision to bypass the patent dance entirely, but noted that one main reason for biosimilar makers to follow the BPCIA's patent dance is that it provides significant control over the timing and scope of litigation. Most biosimilar makers have followed the litigation pathway, even before the Supreme Court's ruling (Table 1, supplementary table).

In the next decade, biosimilar makers are likely to continue to take advantage of the patent dance. Biosimilars cannot be approved until the innovator product has been on the market for 12 years, providing time and incentive to proceed in an informed manner.

Originally published by Nature Reviews Drug Discovery, May 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.