Liquidity issues continue to haunt 'independent' electric vehicle (EV) manufacturers as Fisker sees original equipment manufacturer (OEM) partnership talks disintegrate and Lucid secures a ten-figure investment. Nissan announces new partnerships with Mitsubishi and Honda to bolster its EV business unit. Stellantis announced layoffs of 400 salaried employees in its U.S. engineering, technology and software departments.

In regulatory news, Stellantis is to recall 285,000 U.S. vehicles over a side curtain airbag inflation defect per the National Highway Traffic Safety Administration (NHTSA). Tesla will now require auto-drive software demonstrations with all vehicle sales amidst years of ongoing scrutiny over the company's systems. The Securities and Exchange Commission (SEC) reached a settlement with the former CEO of Lordstown Motors related to misleading statements over consumer demand.

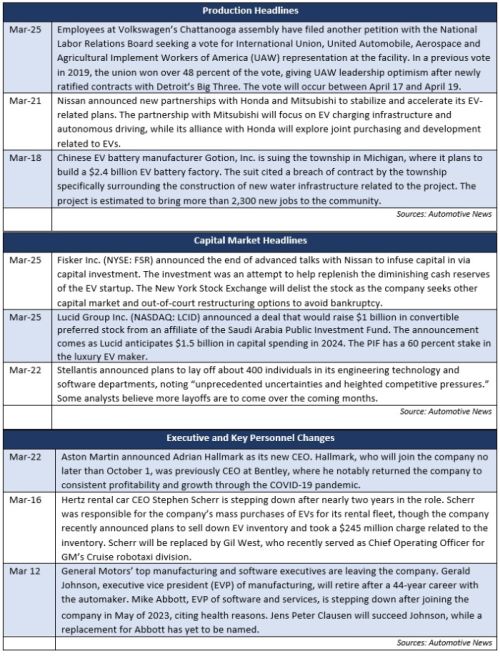

Additional March insights are included below.

Industry Update

February inventory levels ended at 2.49 million units, a 98,000-unit increase from January. Days' supply (DS) closed at 47, approximately 7 percent above the five-year average and an improvement over the last several months. Inventory at Japanese OEMs led the way for the U.S., with a 53,000-unit increase in inventory.

February U.S. light vehicle sales increased approximately 5.2 percent year over year. Vehicle mix continues to remain near record levels, and Crossover Utility Vehicles (CUVs) continue to gain market share.

Industry Focus — Hybrid Powertrain's Moment in the Sun

With tempered expectations around consumer demand growth, manufacturing ramp up and broader market transition to EVs, automakers are caught in development 'limbo' for new products and the significant investments they require. Last week, the U.S. Environmental Protection Agency (EPA) finalized its long-in-the-works ruling regarding its requirements for the number of battery-powered vehicles that need to be sold in the future — including a long-anticipated requirement that half of all new vehicles sold by 2032 must be electric.

A key shift in the EPA's ruling includes the decision to include plug-in hybrids under the standards — a vehicle segment that has largely been left out of automakers' new product roadmaps, despite growing at a slightly faster rate than EVs in 2023.

Several automakers have achieved significant success by effectively 'retrofitting' existing internal combustion engine (ICE) models with hybrid platforms, capitalizing on brand model loyalty and achieving development synergies that are otherwise difficult to capture with EV models. Additionally, hybrids are a middle ground for consumers who are anxious about a transition to EVs. Reduced concerns about range anxiety and more purchasing options priced for the mass market make them an attractive first step to a broader EV transition in line with the EPA's ramp up requirements.

An opportunistic market for automakers — who have hybrids to offer now

A recent Wall Street Journal (WSJ) article noted that U.S. sales of hybrid vehicles have jumped 50 percent year over year in the first two months of 2024, significantly outpacing the growth of ICE and EV models. Automotive research provider Edmunds indicated that hybrids were spending an average of 25 days on dealer lots, less than one third of the time EVs currently are.

Automakers like Ford and Toyota are well positioned for this rapid growth. Toyota notably announced its intention last year to maintain its primary focus on hybrids as a profit center to fuel EV development and growth, and the strategy appears to be paying off so far. More than one-third of Toyota's vehicles sold globally come from hybrid sales, and the company has cited its expansive portfolio of hybrid model offerings — with nearly all models offered as hybrids — as a key enabler to its success.

Ford's F-150 hybrid model has experienced significant growth recently as well, capitalizing on the model's popularity. The automaker cited difficulty keeping up production with consumer demand for its hybrid offering of the increasingly popular Maverick compact pickup truck it launched in 2021.

Stellantis enjoyed significant success with its plug-in hybrids in 2023, touting 124 percent unit growth over the prior year, with its hybrid versions of the Jeep Wrangler, Jeep Grand Cherokee and Chrysler Pacifica — all long-running ICE models enjoying fresh success in hybrid iterations — leading the way.

Other automakers are stuck on their back feet with hybrids. General Motors famously ended its hybrid program in 2019 after a highly successful run with the Chevrolet Volt and a very efficient plug-in hybrid powertrain system, but announced in January of this year it would be restarting hybrid development. The company cited a longer ramp up runway for EVs but a desire to meet environmentally conscious consumers in the middle.

A first step for consumers, but a 'half measure' for automakers

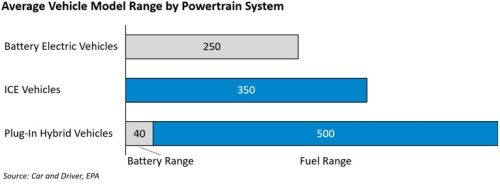

For consumers, a benefits of hybrid ownership is that they come with fewer strings attached than existing EV models. Hybrid owners, plug-in or otherwise, enjoy some of the longest ranges of any vehicles available to consumers today, with an average electric battery range that comfortably covers the average 30 miles driven by Americans per day:

While plug-in varieties of hybrids require access to charging ports to use the hybrid and battery functionality, a longer-term benefit of hybrid offerings for current consumers is the increased certainty around resale values — particularly compared to EVs.

Plug-in hybrids are not without critics, both domestically and internationally. Environmentally-focused groups have criticized the fact that most of the vehicle's range still comes from running an ICE engine and their no-fuel impact relies on consumers regularly charging their vehicles. The European Union's ban on ICE vehicles, set to take hold in 2035, will include all plug-in hybrid models as well.

Automakers have cited hybrids as a distraction on their roadmaps to a full EV transition, and a costly one at that for those not already offering the technology to consumers. With the multiple billions of dollars already allocated to EV investment and the intense scrutiny capital allocation plans have already faced, quick pivots to hybrids will be difficult for automakers that don't currently offer them. Additionally, automotive suppliers that are already stretched thin running dual-track ICE and EV programs face further challenges ramping up with the rapidly growing segment.

Regulatory Landscape

NHTSA announces recall of 285,000 U.S. Vehicles: Stellantis' Chrysler and Dodge brands are recalling 285,000 vehicles in the U.S. due to a defect with side curtain air bag inflation. The company noted they are not aware of any injuries or deaths caused by the defect.

Tesla Auto-Drive Demonstrations: Tesla employees will now be required to install and demonstrate the company's driver assistance technology to consumers before handing vehicles over to buyers. The software, typically a $12,000 add-on, will be available to all U.S. vehicles that can support it for a one-month free trial. The company has faced intense scrutiny over the last several years related to the safety of the system.

Lordstown SEC Settlement: Former Lordstown Motors CEO Stephen Burns settled with the SEC this week related to 'misleading' statements previously made about demand for the automaker's flagship truck. Burns was the founder of the company, which went public through a merger in 2020. The company filed for bankruptcy in 2023.

Originally Published 29 March 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.