OLG REVIEW RECOMMENDS MODERNIZATION AND PRIVATIZATION

by Michael D. Lipton, Q.C., Kevin J. Weber, and Jack I. Tadman

On March 16, 2012, the Ontario Lottery and Gaming Corporation ("OLG") released a Strategic Business Review (the "Review") which set out wide-ranging plans aimed at modernizing commercial and charitable gaming in Ontario.

The Review made three broad recommendations, the details of which entail a substantial alteration of the present nature and scope of OLG operations:

- Become More Customer-Focused,

- Expand Regulated Private Sector Delivery of Lottery and Gaming, and

- Renew OLG's Role in Oversight of Lottery and Gaming.

Recommendation 1: Become More Customer-Focused

The Review's recommendation that OLG operations become "more customer-focused" boils down to a commitment to make gaming opportunities more accessible to customers. Specific recommendations include expanding the location of slot facilities beyond casinos and racetracks and expanding the location of lottery terminals beyond convenience stores and into supermarkets and large retailers.

While the location of slot facilities anywhere in the province will be subject to municipal plebiscites, the OLG is committing to allow for the availability of slots outside traditional gaming and betting venues, where municipal approval is forthcoming.

The Review identified the Greater Toronto Area ("GTA") as a land-based gaming market where customer interest is not being met. Shortly after the release of the Review, OLG chairman Paul Godfrey confirmed that the province is interested in building a casino in the GTA.

Recommendation 2: Expand Regulated Private Sector Delivery of Lottery and Gaming

This recommendation represents a major change in philosophy for the OLG and state-conducted gaming in Ontario. Presently, casinos and racetrack slots facilities in Ontario are operated by a mix of OLG and private sector entities. The OLG directly employs about 7,700 people, while indirectly using the services of 10,000 private sector employees. The Review expresses the benefit of instituting a consistent system across the province, whereby regulated private operators are engaged by the OLG to run the day-to-day operations of all existing OLGoperated gaming facilities and all new facilities.

To do so, OLG would implement a consistent set of terms and conditions for operating a land-based gaming site in a manner that is fair, transparent, and encourages private sector investment. Location and site designs would be approved and overseen by OLG, but initiated, built, and paid for by the private sector.

Casinos and other gaming facilities would accordingly be conducted and managed by the OLG, in a manner that maximizes private sector investment, while the OLG would gradually cease to be involved in the day-to-day operational aspects of these facilities in favour of private sector employees. Ticket lotteries would also be entirely operated by the private sector, removing the operational role currently carried out by the OLG.

Recommendation 3: Renew OLG's Role in Oversight of Lottery and Gaming

In concert with the shift towards privatization, the Review envisions that the OLG will enhance its regulatory oversight role by improving its business and infrastructure to manage all aspects of customer interaction. This will include customer and game management (databases, approval of marketing programs), market management (high-level planning for new gaming sites, product strategy), oversight (integrity, security, legal compliance), and responsible gaming.

iGaming

In addition to outlining its primary three recommendations, the Review provided details on OLG's online gaming ("iGaming") launch.

The OLG website is now expected to begin a staged rollout of iGaming products in late 2012, completing the launch of all initial products in 2013. The OLG will be offering lottery ticket sales, interactive casinostyle games, and peer-to-peer games such as poker. There is an indication that iGaming will be available on mobile devices as well as computers.

Comment

The goal of the Review was to suggest recommendations that would modernize lottery and gaming in Ontario. The Review notes that the "lottery and casino games available in Ontario were designed in the 1970s and 1990s for the core gaming demographic of the time." Citing advances in technology, changes to customer shopping patterns, demographic shifts, and a decrease in visits from American customers as reasons for declining revenues, the Review notes a relative lack of participation by adults under the age of 45 in Ontario government-run gaming.

Thus, the OLG is aiming to increase gaming participation by "younger" adults, and in this connection, it is recommending that the OLG increase the accessibility of all forms of gaming to places frequented by such younger adults. The OLG's iGaming project obviously fits within this rubric, making gaming available to a younger demographic that spends a great deal of time online, both at computers and on mobile devices.

The changes proposed by OLG will be expensive. In keeping with the "modernization" theme, the Review notes recent Ontario-based privatepublic partnerships in areas such as health care that have, to positive effect, shifted the risks associated with public capital investment to the private sector. The Review proposes that by entering into these types of private-public partnerships in the gaming sector, the OLG will also benefit from the knowledge and experience of working with top-tier gaming providers, while being able to focus its efforts on well-defined control and oversight functions.

DETROIT CASINOS' FEBRUARY REVENUES INCREASE FROM SAME MONTH LAST YEAR: MICHIGAN GAMING CONTROL BOARD RELEASES FEBRUARY 2012 REVENUE DATA

by Ryan M. Shannon

The Michigan Gaming Control Board ("MGCB") released the revenue and wagering tax data for February 2012 for the three Detroit, Michigan, commercial casinos. The three Detroit commercial casinos posted a collective 12.6% increase in gaming revenues compared to the same month in 2011. Aggregate gross gaming revenue for the Detroit commercial casinos also increased by approximately 12.9% compared to January 2011 revenue figures.

MGM Grand Detroit posted positive gaming revenue results for February 2012 as compared to the same month in 2011, with gaming revenue increasing by slightly more than 13.9%. MGM Grand Detroit continued to maintain the largest market share among the three Detroit commercial casinos and had total gaming revenue in February 2012 of approximately $53.4 million. MotorCity Casino had monthly gaming revenue approaching $43 million and posted an 11.2% improvement in February 2012 over its February 2011 revenues.

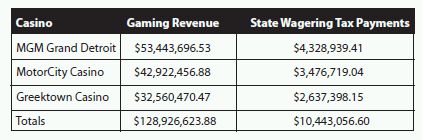

Greektown had gaming revenue of over $32.5 million, which is a 12.3% improvement over its February 2011 revenues. The revenue data released by the MGCB also includes the total wagering tax payments made by the casinos to the State of Michigan. The gaming revenue and wagering tax payments for MGM Grand Detroit, MotorCity Casino, and Greektown Casino for February 2012 were:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.