Washington, D.C. (May 4, 2020) - In response to more than 2,000 public comments to its initial term sheets, the Federal Reserve Board (FRB) on April 30, 2020 unveiled changes to its previously announced $600 billion Main Street Lending Program (Program), although it still did not reveal when lending will get underway. The Program is intended to support lending to small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 pandemic (see our previous alert, "The Federal Reserve and Treasury Announce $1.1 Trillion in COVID-19 Relief Loan Programs for Small & Mid-Size Businesses, and States & Municipalities," from April 10, 2020). The CARES Act authorized the FRB to establish the Main Street Lending Program pursuant to Section 13(3) of the Federal Reserve Act with the approval of the Treasury Secretary. Borrowers interested in the Program will apply for non-forgivable, low-interest loans through a bank.

More Businesses Now Eligible

Key changes to the Program from the original April 9 announcement mean more businesses will be eligible to participate:

- The borrower size limit has been increased from $2.5 billion revenue in 2019 or 10,000 employees to $5 billion revenue in 2019 or 15,000 employees;

- The original program included two

options, but a third has now been added:

- The Main Street New Loan Facility (MSNLF), for businesses obtaining unsecured term loans originated after April 24, 2020;

- The Main Street Expanded Loan Facility (MSELF), for businesses that need to expand a term loan that originated before April 24, 2020;

- New: The Main Street Priority Loan Facility (MSPLF) allows participation by businesses with greater leverage to obtain a new secured or unsecured term loan that originates after April 24, 2020;

- The minimum loan size was lowered to $500,000 from $1 million for the MSNLF as well as the new MSPLF;

- New requirements ease some of the prohibitions on capital distributions for certain types of pass-through entities to cover owners' tax obligations with respect to the entity's earnings;

- Loans obtained through the MSPLF and MSNLF may be unsecured. Loans obtained through the MSELF must be secured if the underlying loan is secured; and

- The same borrower eligibility rules apply to all three loan programs, including requirements that the business was established before March 13, 2020, is a U.S. company with significant operations and a majority of its employees in the United States, and has not received support through another CARES Act Subtitle IV program. Note: borrowers that participated in the Paycheck Protection Program are allowed to participate in the Main Street Program.

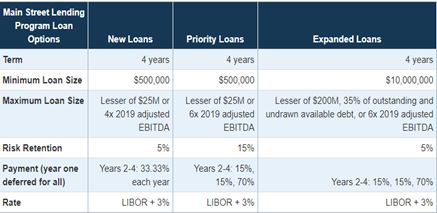

The FRB summarized the program terms for all three types of loans in its April 30 press release as follows:

Required Borrower Certifications and Covenants

In addition to other certifications required by applicable statutes and regulations, borrowers must certify and covenant that they will:

- Commit to refrain from repaying the principal balance of, or paying any interest on, any debt until the loan is repaid in full, unless the debt or interest payment is mandatory and due;

- Commit that they will not seek to cancel or reduce any committed lines of credit with any lender;

- Certify that they have a reasonable basis to believe that, as of the date of origination of the eligible loan and after giving effect to such loan, they have the ability to meet financial obligations for at least the next 90 days and do not expect to file for bankruptcy during that time period;

- Commit to following the compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act, except that an S corporation or other tax pass-through entity that is an Eligible Borrower may make distributions to the extent reasonably required to cover its owners' tax obligations in respect of the entity's earnings; and

- Certify that they are eligible to participate, including in light of the conflicts of interest prohibition in section 4019(b) of the CARES Act.

Retaining Employees

Each participating borrower must make commercially reasonable efforts to maintain its payroll and retain its employees during the time the loan is outstanding. The term "commercially reasonable efforts" is defined under the Program as "undertaking good-faith efforts to maintain payroll and retain employees, in light of the [borrower's] capacities, the economic environment, [the borrower's] available resources, and the business need for the labor." Borrowers that have already laid off or furloughed workers as a result of the disruptions from COVID-19 are eligible for Program loans.

The Program provides new and expanded funding options to entities that previously were not eligible to participate in the other COVID-19 relief packages. Its terms are also broad enough that borrowers with riskier balance sheets can tap into the program.

As those seeking relief under previously announced COVID-19 programs have discovered, the CARES Act provisions were hastily written and can be challenging to interpret and apply. The federal agencies administering these programs are struggling to keep up, and new regulations and guidance are appearing frequently, even while the programs are going into effect. Businesses seeking to take advantage of these important new programs should pay close attention to the rapidly changing rules of the road for these programs, and consult with counsel as appropriate in order to maximize their chances of achieving optimal results.

Originally published Lewis Brisbois, May 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.