There are a number of reasons why executives choose to defer the payment of current compensation under a nonqualified deferred compensation plan. For example, some executives do not need the compensation to be paid currently, and so a nonqualified arrangement helps to manage cash flow over the course of one's employment period. Another reason is that the deferral arrangement permits the executive to defer tax recognition of the compensation until a time when the executive is in a lower tax bracket (e.g., at or after retirement). But a more compelling reason is that there is an inherent tax advantage in the deferral mechanism itself. That is particularly evident in times such as these, when combined federal, state and local income tax rates for individuals (including the new 3.8% tax on net investment income) are relatively high.

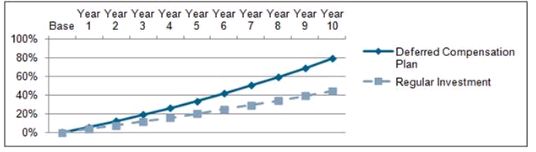

The tax advantages of a deferral arrangement (due to the effects of the tax-free compounding) are illustrated in the below chart: Assume an executive is scheduled to be paid compensation in 2015, and can choose to receive that compensation currently in 2015 or, alternatively, defer payment of the compensation for a period of 10 years. Also assume that the earnings component under the deferred compensation plan is the same as the amount the executive could earn by investing outside the plan (e.g., 6% is earned per year in either scenario). The chart below illustrates how, after 10 years, a deferral election can result in a higher after-tax value than if the same compensation were to be paid currently and invested outside of the plan. These favorable results are similarly available for members of the board of directors who choose to defer their annual cash retainers received for service on the board.

Investment Return on Deferred Compensation Plan versus Regular Investment

* The illustration above assumes the following:

(i) a federal rate of 39.6% and a California rate of 13.3%

(ii) a 6% annual return

(iii) a blended annual income and capital gains tax rate of 37.5% on the regular investment

**The after-tax benefit of a deferral election increase with a longer period of deferral and higher tax rates

Because of the current high individual tax rates, anticipated to last into the foreseeable future, it makes sense for executives and directors to consider deferring current compensation. Deferral elections must be made prior to the calendar year in which they take effect, and therefore, companies should start thinking now about putting arrangements into effect so that deferral elections can be made effective in November/December 2014 for calendar year 2015 compensation (different deferral timing rules may apply to deferrals of retainers by directors).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.