First Tuesday Update is our monthly take on current issues in commercial disputes, international arbitration, and judgment enforcement. This month we focus on the federal post-judgment interest rate, which is set by statute, see 28 U.S.C. § 1961. Clients often ask if the federal post-judgment interest rate is variable or fixed. The post-judgment interest rate is variable in that it is based on the weekly average 1-year constant maturity (nominal) Treasury yield, as published by the Federal Reserve System. But is it adjustable or static over the tenure of the judgment? These questions become even more prominent given that the federal rate has experienced two dramatic "U" curves in the last 15 years from the financial crisis of 2008 to the COVID-19 pandemic in 2020 to inflation currently. What if a judgment were entered immediately post-2008, remains unsatisfied, and the current post-judgment interest rate is approximately five times higher (or 50,000 basis points more) than it was at the date of the judgment . . . are you stuck with the lower 2008 rate? The answer is "yes"—the post-judgment interest rate is fixed as of the date the judgment is entered until satisfied, accruing at a single rate for the duration of the outstanding judgment.

* * *

Post-judgment interest rates are established by 28 U.S.C.A. § 1961, which provides as follows:

a) Interest shall be allowed on any money judgment in a civil case recovered in a district court. . . . Such interest shall be calculated from the date of the entry of the judgment, at a rate equal to the weekly average 1-year constant maturity Treasury yield, as published by the Board of Governors of the Federal Reserve System, for the calendar week preceding the date of the judgment. . . .

b) Interest shall be computed daily to the date of payment . . . and shall be compounded annually.

28 U.S.C.A. § 1961 (emphasis added). The clear text of the statute provides that interest is to be calculated from the entry of the judgment and "at a rate equal to" the 1-year constant maturity Treasury yield "for the calendar week preceding the date of the judgment." This language means that the rate is entered as of the date the judgment is entered on the docket and based on the weekly average of the rate that precedes the entry of the judgment.

The US Supreme Court construed § 1961 and said "[w]e think the most logical reading of the statute is that the interest rate for any particular judgment is to be determined as of the date of the judgment, and that is the single rate applicable for the duration of the interest accrual period." Kaiser Aluminum & Chem. Corp. v. Bonjorno, 494 U.S. 827, 838–39 (1990) (emphasis added). The Court reached this determination—a single rate for the duration of the judgment—even though it recognized that "[t]he purpose of post-judgment interest is to compensate the successful plaintiff for being deprived of compensation for the loss from the time between the ascertainment of the damage and the payment by the defendant." Id. at 835–36.

Subsection (b) of § 1961 includes two additional calculations: (i) the amount of interest should be computed daily and (ii) compounded annually. The US District Court for the Southern District of New York provides the following guidance about computing the post-judgment interest rate on a daily basis: take the judgment amount, multiply it by the post-judgment interest rate and divide it by 365 days to calculate the post-judgment interest per day.

See. https://www.nysd.uscourts.gov/forms/how-calculate-post-judgment-interest In addition, compounding the interest annually is calculated by adding the amount of interest earned in a given year to the judgment amount (the principal) and running the same calculation above for determining the daily amount of interest. Interest runs on that new total. After the first year, the calculation will involve the prior year's total plus the previously earned interest.

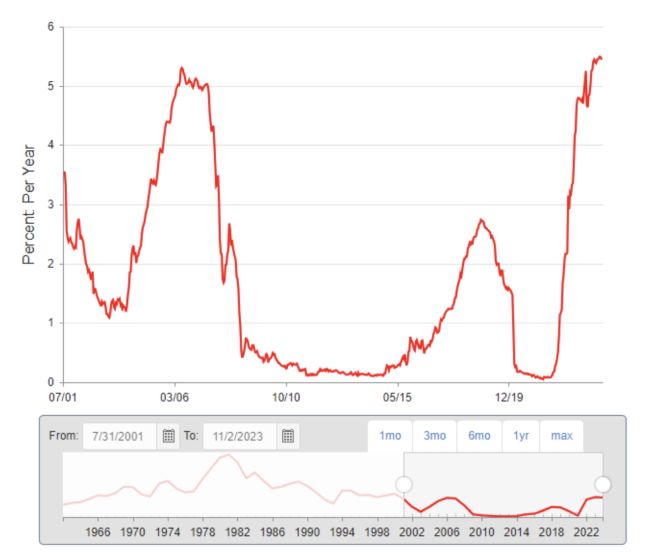

The relevant Federal Reserve data for the applicable post-judgment interest rate identified in § 1961 can be found here. Federal interest rates have substantially changed over the last 15 years from a near zero rate (twice) to now over 5%. The chart below shows the dramatic double "U" the 1-year constant maturity Treasury yield has experienced following the 2008 financial crisis and then again the dip during the pandemic only to steadily climb during a period of inflation. For the week of June 22, 2008, the rate was 2.57%. On January 4, 2009, the rate dropped to 0.45%. Nearly 10 years later, on February 3, 2019, the rate climbed back up to 2.57%. By May 23, 2021, the rate dropped to an astounding new low of 0.05%. On November 2, 2023, the 1-year Treasury constant maturities swelled to 5.38%.

For additional discussion about pre-and post-judgment interest rates in the various states, see our First Tuesday Update on how the rate varies in almost every jurisdiction (both fixed and variable) and whether the interest is simple or compound, and whether the awarding of interest is mandatory or discretionary.

Another issue that can impact the applicable post-judgment interest rate is whether the parties have reached an express agreement about the applicable interest rate in a contract and/or if they seek to enforce an arbitral award. The Second, Fifth, and Seventh Circuits have squarely held that "the parties were free to establish a post-judgment interest rate by contract if they wished to do so." Westinghouse Credit Corp. v. D'Urso, 371 F.3d 96, 102 (2d Cir. 2004); Cent. States, Southeast Southwest Areas Pension Fund v. Bomar Nat'l, Inc., 253 F.3d 1011, 1020 (7th Cir. 2001) ("It is well established that parties can agree to an interest rate other than the standard one contained in 28 U.S.C. § 1961."); ITT Diversified Credit Corp. v. Lift Equip. Serv., Inc., 816 F.2d 1013, 1018 (5th Cir. 1987) ("While 28 U.S.C. § 1961 provides a standard rate of post-judgment interest, the parties are free to stipulate a different rate, consistent with state usury and other applicable laws.").

When it comes to enforcing arbitral awards, ordinarily, once the award is turned into a judgment, the post-judgment interest rate applies unless, based on the cases cited above, the parties reach an express agreement on post-judgment interest. Carte Blanche (Singapore) Pte., Ltd. v. Carte Blanche Int'l, Ltd., 888 F.2d 260, 269 (2d Cir. 1989). (Once a federal court confirms an arbitration award, the judgment has the same effect as any judgment rendered by the court and is "governed by statutory post-judgment interest rates."); Parsons Whittemore Ala. Mach. and Servs. Corp. v. Yeargin Constr. Co., 744 F.2d 1482 (11th Cir. 1984). However, one type of arbitral award may be treated differently—an International Centre for Settlement of Investment Disputes (ICSID) award. Pursuant to treaty, a US court must enforce the pecuniary obligations of the ICSIDaward, but the only Court of Appeal to ever consider this issue expressly declined to decide it. Mobil Cerro Negro, Ltd. v. Bolivarian Republic of Venez., 863 F.3d 96, 125 (2d Cir. 2017)("Because we vacate the judgment, we need not consider whether the District Court properly refused to adjust the interest rate imposed by the ICSID tribunal on the Award.").

There is no question that when a judgment is entered it can have a substantial impact on the post-judgment interest rate. While the statute's text appears clear that the rate is fixed for the duration of the unsatisfied judgment, such a mechanism may not meet the stated purpose of providing post-judgment interest to compensate the judgment-creditor. It may be time for Congress to reassess whether the rate—which is variable—should also be adjusted during the period of time that the judgment remains unsatisfied.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.