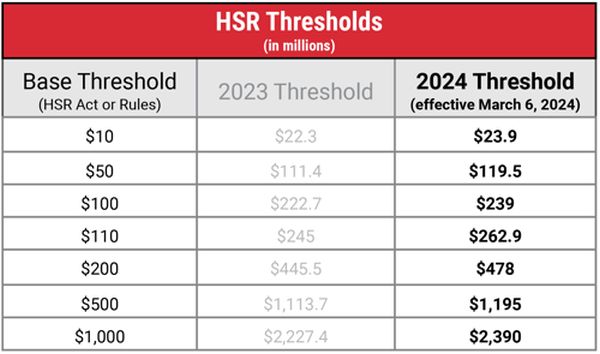

The Federal Trade Commission (FTC) has announced new, higher premerger notification thresholds. The new minimum size-of-transaction threshold will be $119.5 million.

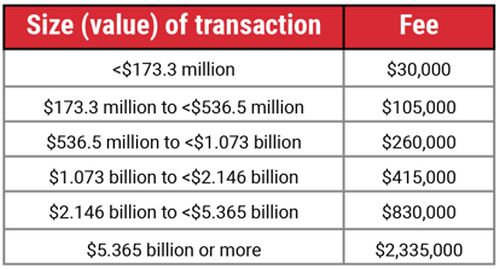

The FTC simultaneously announced adjustments to the premerger notification filing fees and fee tiers as required by the Merger Filing Fee Modernization Act of 2022 (contained in the Consolidated Appropriations Act of 2023). The six-tiered fee structure includes a maximum filing fee of $2.335 million for transactions valued at $5.365 billion or more.

Both the threshold adjustments and the new filing fee structure take effect March 6, 2024. An important distinction is that the applicable Hart-Scott-Rodino (HSR Act thresholds are those in effect when you close, and the applicable HSR filing fees are those in effect when you file.

2024 HSR Thresholds

Under the 2000 amendments to the Hart-Scott-Rodino (HSR Act, 15 U.S.C. 18a, the act's jurisdictional thresholds are adjusted annually to reflect changes in nominal (non-inflation-adjusted) gross national product (GNP). The 2024 thresholds reflect an approximately 7.3 percent increase over the 2023 thresholds. The new $119.5 million minimum size-of-transaction threshold is an increase of $8.1 million from the $111.4 million 2023 threshold.

The annual adjustments pursuant to the 2000 HSR Act amendments have resulted in the minimum size-of-transaction threshold more than doubling from the $50 million threshold established by those amendments (which increased the original $15 million threshold established in 1976).

Adjustments to size-of-transaction thresholds

Transactions that are never reportable: A transaction that results in holdings of $119.5 million or less will not require HSR notification.

Transactions that are always reportable: At the other end of the size spectrum, a transaction that results in holdings of more than $478 million will trigger HSR notification and waiting requirements unless an exemption from filing applies.

Transactions that may be reportable: For transactions resulting in holdings falling between these two size-of-transaction thresholds (that is, greater than $119.5 million but no greater than $478 million), whether HSR applies depends on whether both parties meet the size-of-person thresholds. (Note that these thresholds apply to the size of the parties and not merely to the size of the acquiring entity and the acquired entity, so it is necessary to look to the ultimate parent entity of each and include all entities controlled by it.)

Adjustments to size-of-person thresholds

The adjusted size-of-person thresholds for 2024 are $23.9 million and $239 million, meaning that acquisitions resulting in holdings greater than $119.5 million but no greater than $478 million will not require HSR notification unless one person has total assets or annual net sales of $23.9 million or more and the other person $239 million or more. (Note that, additionally, if the acquired person is not engaged in manufacturing, it must have annual net sales of $239 million or total assets of $23.9 million.)

What other thresholds change?

The HSR Rules (16 CFR parts 801-803) provide several exemptions that contain dollar value limitations described by the parenthetical "(as adjusted)." Those limitations (for example, the nexus with commerce limitations for the exemptions for acquisitions of foreign assets (16 CFR 802.50) and acquisitions of voting securities of a foreign issuer (16 CFR 802.51)) will also be adjusted upward.

The HSR Rules also provide "notification thresholds" for voting securities acquisitions (see 16 CFR 801.1(h)), setting forth levels of holdings that would require another HSR notification. (Note, however, that once the 50 percent level is reached, no additional notification is required.) As the dollar values for these notification thresholds are set forth with the parenthetical "(as adjusted)," they will similarly be adjusted upward.

New Filing Fees

The Merger Filing Fee Modernization Act of 2022 established the six-tiered fee structure that the FTC implemented for transactions filed on or after February 27, 2023. Previously (since 2001), there were three tiers of filing fees based on the size of transaction.

Beginning this fiscal year (2024), the filing fee tiers are to be adjusted annually to reflect changes in GNP. In addition, the fees applicable to each tier are to be adjusted annually based on changes in the consumer price index.

As a result of those adjustments, these are the tiers and fees for transactions filed on or after March 6, 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.