On Friday, July 30, 2011, the United States Bankruptcy Court for the Middle District of Florida approved the Plan of Reorganization (Plan) for Fiddler's Creek, LLC, and numerous subsidiaries and affiliates, under Case No. 9:10-bk-03846-ALP.

Unfreezing the CDD Workout Arena

Up until the Fiddler's Creek bankruptcy, there was no "worst horrible" litigation solution or work out structure for a stalled master planned community with Community Development District (CDD)/bondholder financing. Now there is a spectrum of CDD workout solutions starting with several non-bankruptcy plans and ending with the litigated Plan for Fiddler's Creek.

Trilogy of Issues/Articles

This article is the first of a series of articles that will discuss different portions of the Plan that deal with CDD assessments and the payments by the CDD of principal and interest to the bondholders. In this article, first, we will discuss the typical master planned community debt structure involving CDD assessments and traditional bank financing. Next, we will discuss the most typical request that a developer and its bank have in restructuring CDD debt for these types of communities. Finally, we will conclude with discussion of sections of the Plan that deal with the CDD debt and general observations.

The Typical Master Planned Community Debt Structure

The typical structure for these master planned communities involves a few thousand acres of undeveloped land with one or more CDDs established by the developer for the purpose of borrowing money from bondholders and using that money to build infrastructure such as roads, water, and sewer. The CDD imposes assessments on the developer's land and the CDD collects the assessments and pays the principal and interest to the bondholders. If the assessments are not paid, there is a lien on the developer's land that is co-equal to a lien for ad valorem taxes. The assessments are collected either "on the roll" by the tax collector or "off the roll" directly by the CDD against the developer via a direct pay agreement between the developer and the CDD. In addition, the developer usually borrows money from institutional lenders such as local, regional, and national banks for the development of additional infrastructure not paid for by the CDD (e.g., additional roads, water, and sewer or community recreational facilities, such as clubhouses and pools). CDD special assessments service the bond debt and CDD operation and maintenance assessments pay for ongoing CDD operations. See the Master Planned Community/CDD Finance Structure Chart available online (http://tinyurl.com/3nvxkvy).

Developer/Lender Workout Request

The most typical realistic workout request by a developer and/or its lender is a forbearance of the principal and interest payments on the bonds for a two-to three-year period.

If the developer desires to enact a non-bankruptcy approved workout of the CDD financing, it would have to negotiate with the CDD for revisions or amendments to the CDD assessment structure and the CDD would have to negotiate and amend the payment schedule of principal and interest with the bondholders. The main difference between a non-bankruptcy approved workout and a bankruptcy approved plan of reorganization such as the Fiddler's Creek Plan, is that the non-bankruptcy workout plan would require consent from 100 percent of the bondholders. There typically are four to seven institutional bondholders when a CDD is created. In addition, some of the institutional bondholders usually have sold their positions to other bondholders, some of which are non-institutional.

Fiddler's Creek Facts

Fiddler's Creek involved two CDDs which issued approximately $105 million in bonds for infrastructure to a community that would ultimately contain 6,000 residences but at the time of the bankruptcy contained approximately 2,000 residences. There was approximately $170 million of bank debt, not including the CDD debt, and a value of the community based on the developer's figures was approximately $270 million.

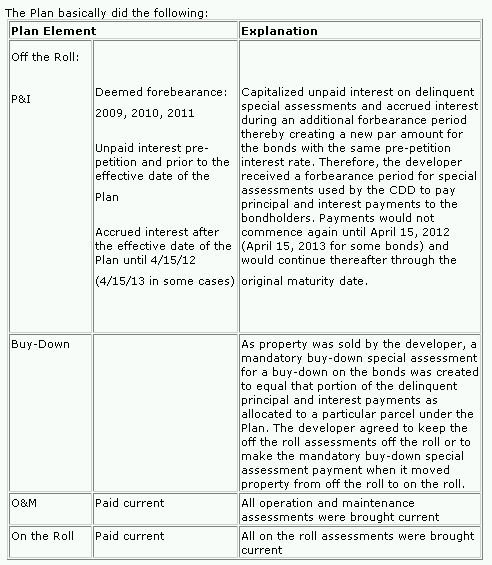

The Fiddler's Creek CDD Workout Structure

Benefits to the Developer and the Institutional Lenders

When the developer defaults on the payment of CDD assessments, the CDD has a lien co-equal with taxes, meaning that the CDD assessments are a first lien on the property prior to any additional secured financing by any lender. Normally, the CDD has a right to foreclose the off the roll assessment lien and that foreclosure would wipe out the secured financing lien/mortgage from any lender. In the Plan approved by the Court, the developer and its lenders achieved a forbearance period required to catch its breath (or to weather the economic storm), which could not have been obtained in a non-bankruptcy modification unless 100 percent of the bondholders consented thereto. The ability or failure to obtain 100-percent bondholder approval to non-bankruptcy modifications has been the main hurdle for obtaining non-bankruptcy approved modifications.

Open Issues and Interesting Observations

The Plan effectively lumped the CDD assessments and the obligations between the CDD and the bondholders together. Each CDD may have to amend its assessment resolutions, via Chapters 190 and 170, Florida Statutes, to comply with the new payment terms. In addition, it was unclear whether the taxability of the bonds would be an issue but the Court did not seem concerned with this issue. Most CDD bonds are tax-exempt, and there can be problems with retaining the tax-exempt status if major modifications or changes in securities are made that do not comply with certain restrictions for tax-exempt financings under the Internal Revenue Code and applicable Treasury Regulations thereunder. In addition, the trustee for the bondholders vehemently opposed the CDD's approval of the Plan but the Court held that the bondholders did not have standing to object in the Plan because the bondholders were a creditor of the CDD and not a creditor of the developer, which was the debtor in the reorganization. The trustee for the bondholders still has ongoing litigation against the CDD for breach of its fiduciary duties and loan covenants between the CDD and the bondholders.

Upcoming Articles

We will present future articles discussing the actions by the CDD boards, and the objections of the bondholders' trustee to the approval of the Plan by the CDD boards, together with some discussions of issues and techniques which have been used and are possible in non-bankruptcy approved CDD assessment and bond modifications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.