Originally published August 29, 2008

Keywords: Securities Offering Reform Initiative, SEC, shelf registration, Rule 415, WKSI, automatic shelf registration statements, Form S-3, Form F-3

Prior to its 2005 Securities Offering Reform initiative, the SEC's rules limited the amount of securities that could be registered under certain shelf registration statements to an amount that, at the time the registration statement became effective, was reasonably expected to be offered and sold within two years from the initial effective date of the registration statement. As part of its Securities Offering Reform Initiative, the SEC amended Rule 415 to eliminate this limitation in many instances. However, at the same time, the SEC provided that certain shelf registration statements can only be used for three years after the initial effective date of the registration statement. For purposes of the three-year test, shelf registration statements that became effective prior to December 1, 2005, the effective date of the SEC's Securities Offering Reform rules, are treated as having an initial effective date of December 31, 2008.

The SEC provided rules for issuers that are not "well-known seasoned issuers" (WKSIs) eligible to file automatically effective registration statements. These rules allow these issuers to continue to use expiring shelf registration statements without having a gap between the expiring and replacement registration statements if the replacement registration statement is filed before the expiration of the old registration statement and is declared effective within 180 days of the expiration date of the expiring registration statement. Thus, knowing when a registration statement is due to expire and planning in advance for this event is extremely important. Even for WKSIs that can file automatically effective registration statements, advanced planning is important to ensure uninterrupted access to the capital markets.

REGISTRATION STATEMENTS SUBJECT TO THE THREE-YEAR LIMIT

Under the SEC's rules, only the following types of registration statements are subject to the three-year limit:

Securities Registered on Automatic Shelf Registration Statements. Automatic shelf registration statements (generally referred to as "WKSI Shelves") filed on or shortly after the effective date of the SEC's Securities Offering Reform rules will expire on or shortly after December 1, 2008. Even if a post-effective amendment to the shelf registration statement was filed, the threeyear period is still calculated from the initial effective date of the registration statement.

Securities Registered on Form S-3 or Form F-3 and Offered on a Delayed or Continuous Basis. Registration statements on Form S-3 or Form F-3 that register securities to be offered on an immediate, delayed or continuous basis, typically referred to as "shelf offerings," by the registrant or certain of its affiliates. This is the type of registration statement typically used for a "universal" shelf registration statement registering various types of securities. As noted above, if the registration statement became effective prior to December 1, 2005, it will expire on December 1, 2008.

Securities Offered on a Continuous Basis. Registration statements that register securities whose offering will commence promptly upon the effectiveness of the registration statement will be made on a continuous basis and may continue for a period in excess of 30 days from the initial date of the effectiveness of the registration statement. This includes combined dividend reinvestment/ direct stock purchase plans that are open to new investors (i.e., purchasers who were not previously security holders of the company) as well as extended offerings on a best efforts basis by issuers that are not eligible to use Form S-3 or Form F-3.

Mortgage Related Securities. Registration statements registering offerings of mortgagerelated securities, including such securities as mortgage backed debt and mortgage participation or pass through certificates.

REGISTRATION STATEMENTS NOT SUBJECT TO THE THREE-YEAR LIMIT

The three-year limit does not apply to shelf registration statements other than those specified above. Thus, registration statements, in each case other than automatically effective registration statements, registering the following types of securities are not subject to the three-year limit:

- Securities that are to be offered and sold solely by

selling security holders;

- Securities that are to be offered and sold pursuant to

dividend or interest reinvestment plans and that do not allow

participation by persons who are not existing security

holders of the company;

- Securities that are to be offered and sold pursuant to

employee benefit plans (typically registered on Form

S-8);

- Securities that are to be issued upon the exercise of

outstanding options, warrants or rights or upon conversion of

other outstanding securities;

- Securities that are pledged as collateral;

- Securities that are registered on Form F–6

(i.e., American Depositary Receipts);

- Securities that are to be issued in connection with

business combination transactions (typically registered on

Form S-4); and

- Shares of common stock that are to be offered and sold by

or on behalf of certain registered closed-end management

investment companies or business development companies.

CALCULATING THE THREE-YEAR LIMIT

In a series of frequently asked questions regarding its Securities Offering Reform rules, the SEC explained that the three-year period would begin on December 1, 2005, and expire on or after November 30, 2008, without regard to how long the registration statement had been effective before that date, for shelf registration statements for delayed or continuous offerings by the registrant or certain affiliates, offerings commencing promptly after effectiveness on a continuous basis for a period in excess of 30 days and offerings of mortgage related securities that were effective before December 1, 2005. For shelf registration statements with effective dates on or after December 1, 2005, the three-year period would begin on the initial effective date of the registration statement, without regard to any subsequently filed posteffective amendments.

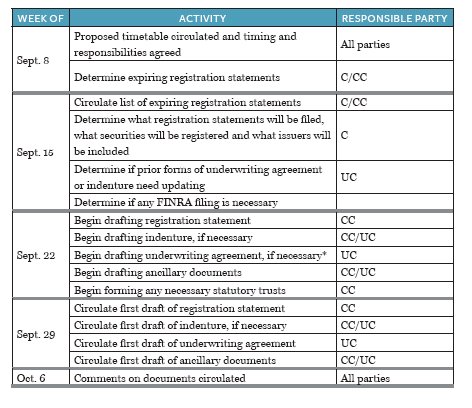

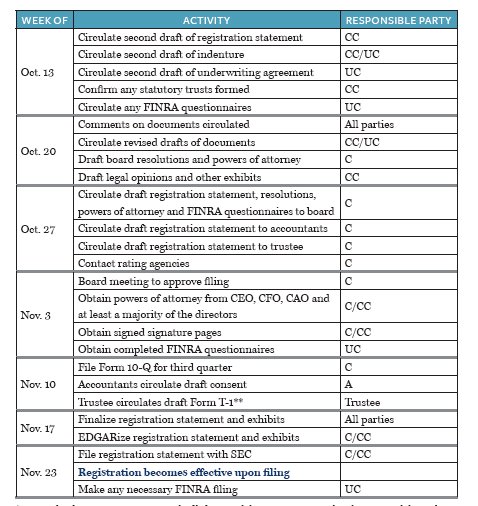

WHAT TO DO ABOUT EXPIRING SHELF REGISTRATION STATEMENTS

The first thing a company should do is identify all of its registration statements in order to determine which, if any, are subject to expiration, and any applicable expiration dates. Once these dates are known, the company can then prepare a timeline for replacing the expiring registration statement. While the preparation of the registration statement itself may not take very long, the timeline should reflect the various issues that may have long lead times, including obtaining board and other corporate approvals, gathering necessary signatures and consents, updating selling security holder information, if applicable, and providing time for various interested parties to review the filing. A sample timetable for replacing a "universal" shelf registration with an automatically effective WKSI shelf is attached as Exhibit A.

An expiring registration statement may be replaced either by an automatically effective registration statement or by a registration statement that must be declared effective by the SEC. An automatically effective registration statement can be filed at any time. While some companies have waited until the morning that an offering commences to file an automatically effective registration statement, waiting until such time can limit a company's flexibility due to the lead time in obtaining certain consents and we strongly recommend that companies that are considering an offering not wait until the last minute to file an automatically effective registration statement.

If the replacement registration statement is not an automatically effective registration statement, the company may continue to offer and sell securities covered by the expiring registration statement until the earlier of:

- 180 days after the expiration of the threeyear period for

the expiring registration statement; and

- The time the "replacement" registration

statement becomes effective.

In the case of a continuous offering of securities that began within three years of the initial effective date of the expiring registration statement, the company may continue that offering until the effective date of the replacement registration statement, if such offering is permitted under the replacement registration statement.

The ability to use a registration statement after the three-year limit, whether for a continuous offering or otherwise, is subject to the condition that the replacement registration statement has been filed before the end of the three-year period for the expiring registration statement.

Exhibit A

Acme Widget Company Shelf

Registration

** Form T-1 may be filed in connection with a takedown pursuant to Rule 305(b)(2) under the Trust Indenture Act of 1939, rather than as an exhibit to the registration statement.

Mayer Brown is a global legal services organization comprising legal practices that are separate entities ("Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; and JSM, a Hong Kong partnership, and its associated entities in Asia. The Mayer Brown Practices are known as Mayer Brown JSM in Asia.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

Copyright 2008. Mayer Brown LLP, Mayer Brown International LLP, and/or JSM. All rights reserved.