The EU Securitisation Regulation1 (the "Securitisation Regulation") will come into effect on 1 January 2019, bringing a number of changes to the European risk retention regime for CLO transactions2; in particular, Article 7 of the Securitisation Regulation will increase the scope and nature of the transparency and disclosure requirements applicable to issuers, sponsors and originators of CLO transactions3.

On 22 August 2018, the European Securities and Markets Authority ("ESMA") released its draft regulatory technical standards (the "ESMA Draft RTS") setting out detailed requirements for information to be provided to satisfy Article 7. 4 Under the ESMA Draft RTS, CLO transactions would have been required to provide information under Annexes 4 (Corporate Underlying Exposures) and 12 (Investor Report Information) and, for 'public' transactions (where a Prospectus Directive5 compliant prospectus is produced6), Annexes 14 (Inside Information) and 16 (Significant Event Information) (the "CLO Reporting Annexes").

The unduly burdensome nature of the CLO Reporting Annexes has caused significant market consternation, with participants particularly concerned about the operational practicalities and cost of enhanced reporting – and exacerbated by the lack of any introductory transitional period7. However, on 30 November 2018, indicative relief was provided by a statement from the Joint Committee of the European Supervisory Authorities8 (the "Joint Statement"), as discussed in this Client Alert.

THE JOINT STATEMENT

The Joint Statement indicates that, on the basis of market concerns raised, it is "unlikely" that the ESMA Draft RTS will be adopted by 1 January 2019. Instead, the transitional provisions of Article 43(8) of the Securitisation Regulation (the "Transitional Requirements") will apply to the underlying exposure and investor reporting obligations under Article 7(1)(a) and (e).

The Transitional Requirements look to the considerably less onerous reporting obligations under Annexes I to VIII of the CRA3 Delegated Regulation9, but nonetheless prescribe that such information should be made available in accordance with Article 7(2), rather than under the regime envisaged by CRA310 itself.

WHAT DO THE TRANSITIONAL REQUIREMENTS MEAN FOR CLOS?

Although there is good news in the short-term as regards the scope of reporting required for CLO transactions (detailed further below), CLO transactions closing on or after 1 January 2019 will still have to comply with the primary transparency requirements set out in Article 7, notwithstanding the Joint Statement and application of the Transitional Requirements. Such compliance will impose a number of new obligations, such as (i) the disclosure of all transaction documentation prior to pricing, (ii) the provision of a transaction summary with structure diagram (other than for transactions where a Prospectus Directive compliant prospectus is produced), and (iii) the ongoing reporting of 'inside information' and 'significant events' such as material breaches of transaction documentation and changes in the structural or risk characteristics of the securitisation. The Transitional Requirements will then supplement the following Article 7 requirements that the ESMA Draft RTS were mandated to cover, including the manner in which such information is to be made available:

Article 7(1)(a) – Underlying Exposure Reporting

Annexes I to VII of the CRA Delegated Regulation set out the information to be reported by securitisation transactions with respect to their underlying exposures as required by Article 7(1)(a) (the "Exposure Reporting Requirements"). The Exposure Reporting Requirements stipulate specific requirements for certain asset classes such as residential mortgages, auto-loans and SME loans. However, there is no dedicated annex in the Transitional Requirements applicable to transactions where corporate loans comprise the underlying asset class and, accordingly, we expect that CLO transactions will not be subject to the Exposure Reporting Requirements whilst the Transitional Requirements apply.

Article 7(1)(e) – Investor Reporting

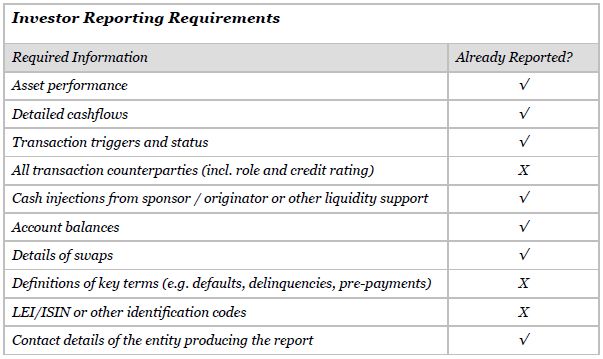

Notwithstanding that the Exposure Reporting Requirements should not apply to CLO transactions, Annex VIII of the CRA Delegated Regulation (the "Investor Reporting Requirements") will apply to CLO transactions. Although not overly extensive, transaction parties should review the Investor Reporting Requirements for any slight broadening of the reporting typically covered in their monthly and payment date reports – see the "Investor Reporting Requirements" summary below which highlights the Investor Reporting Requirements and the extent to which these are not typically already caught by CLO transaction reporting.

Article 7(2) – Publication of Information

The Transitional Requirements provide that information must nonetheless be made available in accordance with Article 7(2). On 12 November 2018, ESMA published its draft technical standards on " securitisation repository application requirements, operational standards and access conditions"; however, it appears unlikely that these will be adopted and in force by 1 January 2019. In the absence of a securitisation repository, 'public' transactions will instead be required to make all required reporting information (including the Investor Reporting Requirements) available by means of a website satisfying the criteria listed in Article 7(2)(a) – (e)11. For 'private'12 transactions, information must simply be made available to investors, potential investors and regulators. In the absence of a Delegated Regulation implementing Article 4 of the implementing technical standards accompanying the ESMA Draft RTS, information can also continue to be provided in its usual format, and not "in an electronic and machine- readable form via common XML templates".

REGULATORY APPROACH TO THE TRANSITIONAL REQUIREMENTS

In the Joint Statement, the European Supervisory Authorities recognise that, as at 1 January 2019, Article 7 will apply in a "non-standardised manner". They advocate enforcement in a "proportionate and risk-based manner", taking into account the "type and extent of information already being disclosed by reporting entities", whilst cautioning, however, that neither the European Supervisory Authorities nor national regulators possess "any formal power to allow the disapplication of directly applicable EU legal text".

Given the extensive reporting already being provided by most CLO transactions, and assuming that market participants make reasonable efforts to comply with the Investor Reporting Requirements, it would appear that there will be limited enthusiasm to take regulatory action in respect of the Transitional Requirements themselves, though compliance with the primary disclosure requirements of Article 7 will nonetheless be expected.

LOOKING AHEAD

Although the Transitional Requirements are a welcome reprieve in the short-term and the spectre of the ESMA Draft RTS and CLO Reporting Annexes appears to have retreated from the immediate horizon, it remains the case that Article 7 will need to be supplemented by secondary legislation drafted by ESMA in due course (the "ESMA Final RTS"). However, we expect that, once effective, the ESMA Final RTS will apply going forward to all post-1 January 2019 transactions, superseding compliance with the Transitional Requirements13, albeit that there is now some prospect for primary legislation allowing a transitional period for the adoption of any new reporting standards.

Frustratingly, market participants will remain forced to transact into the unknown from 1 January 2019, despite the Joint Statement and application of the Transitional Requirements. Notably, Article 7 requires that the issuer, sponsor and originator of a securitisation transaction must designate "one entity to fulfil the information requirements" and the absence of the ESMA Final RTS will therefore require such designated entity to take regulatory responsibility for as-yet unknown obligations. From a practical perspective, flexibility can be built into the amendments and expenses provisions of transaction documentation in order to enable compliance with the ESMA Final RTS and the likely associated costs to be met. However, this does not solve the regulatory uncertainty that unfortunately prevails with respect to Article 7 compliance for CLO transactions closing whilst the Transitional Requirements apply.

Footnotes

1 Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017.

2 The Securitisation Regulation is of general application to "securitisations"; however, this Client Alert confines our observations to particular effects on the CLO market.

3 Article 7 obligations are not expressly limited to issuers, sponsors or originators established in the European Union. However, although Article 5(1)(e) of the Securitisation Regulation (which requires investors to ensure compliance with the transparency obligations) does not appear to apply where the issuer, sponsor or originator is established outside the European Union, the position is not wholly clear and, as a matter of practice, we expect that some investors may request Article 7 information from non-EU issuers, sponsors and originators to satisfy the investor's regulatory obligations.

4 The European Banking Authority had similarly released its own, rather less contentious, draft regulatory technical standards on 31 July 2018.

5 Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003 (as amended).

6 As is required when the transaction is listed on an EU regulated (primary) market, as opposed to a non-EU market or EU exchange-regulated (secondary) market, such as the Global Exchange Market of Euronext Dublin.

7 In paragraphs 18-19 of its Final Report promulgating the ESMA Draft RTS, ESMA observed that the scope of its mandate did not allow for it to provide for a transitional period, but recommended that the European Commission consider adopting a 15-18 month transition period.

8 Comprised of ESMA, the European Banking Authority and the European Insurance and Occupational Pensions Authority.

9 Delegated Regulation (EU) 2015/3 of 30 September 2014 supplementing Regulation (EC) No 1060/2009 of the European Parliament and of the Council.

10 Regulation (EC) No 1060/2009 of the European Parliament and of the Council as amended by Regulation (EU) No 462/2013.

11 Requiring, for example, data quality control systems and the ability to keep a record for at least five years after the maturity date of the securitisation transaction.

12 I.e. where no Prospectus Directive compliant prospectus is produced or required.

13 I.e. we expect that post-1 January 2019 transactions will not be grandfathered and will have to use the new reporting templates from the ESMA Final RTS when it becomes effective.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.