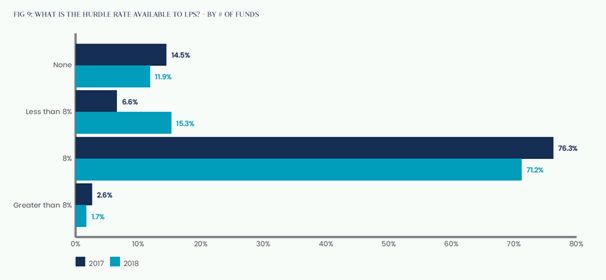

Hurdle rate

Despite a decade of persistently low interest rates, the 8% hurdle still stands strong, as evidenced in three quarters of the funds sampled (by targeted capital).

However, a small but growing number of funds are pitching sub-8% hurdles, accounting for around one-fifth of targeted capital in this year's survey.

The hurdle can go as low as 4% for a credit fund but otherwise, if sub-8%, it is usually fixed at 6% or 7%. The highest hurdle encountered in the analysed sample was set at 10%. Almost exclusively, the rate of return is compounded annually.

It is still very rare to encounter funds without any hurdle: only 4% of capital targeted was by funds with no hurdle (compared to 7% by capital targeted last year).

Carried interest

Whole-of-fund vs. deal-by-deal

Even though ILPA recommends that a standard all-contributions-plus-preferred-return-backfirst model should be recognised as best practice ("whole-of-fund" carry), only European funds have tended to favour this approach.

North American fund managers still prefer the more manager-friendly deal-by-deal waterfall (albeit often enhanced or modified to include the return of all/partial costs, impairments and fees), which offers an accelerated payment of carried interest to the fund manager.

The competitive balance between the two versions of carry has fluctuated in recent years. The 2015 survey found that whole-of-fund carry was making inroads into the US market. However, the use of the deal-by-deal model surged on both sides of the Atlantic in the 2016 sample, and then stabilised at 36% in the North American funds analysed both in the sample for the 2017 research and in this year's survey.

Whilst US-centric managers usually tend to operate a deal-by-deal model, pure deal-by-deal structures are increasingly rare, because various modifications allow investors to recoup a bigger share of their capital spent before any carried interest is paid.

The European funds offering deal-by-deal/modified waterfalls are often funds based in Europe, but run by US-based managers (one third of the European funds using deal-by-deal waterfalls). They may employ parallel structures with both a European and a US/Cayman-based vehicle to access different pools of investors.

Conversely, European managers setting up European funds sometimes offer two types of waterfall (whole-of-fund and deal-by-deal) within the same partnership entity, so investors can elect whichever option they prefer.

Just under 20% of the deal-by-deal/modified waterfalls appear in European funds run by European managers, with no possibility for an investor to opt for whole-of-fund distributions. In the North American-based funds (Delaware), 36% offered whole-of-fund waterfalls. Interestingly, the Asian managers basing their funds in the Cayman Islands all opted for the whole-of-fund waterfall.

It appears that managers are becoming increasingly creative and are offering investors a greater variety of economic options.

The significant increase in whole-of-fund carry in North America and the enhanced profile of deal-by-deal carry outside of the US demonstrates the globalisation of the fundraising market; it is increasingly difficult to predict the model of distribution from the geographic location of the manager. US managers wishing to woo European investors may opt for a whole-of-fund waterfall and, naturally, European managers may adopt local customs when fundraising in the US.

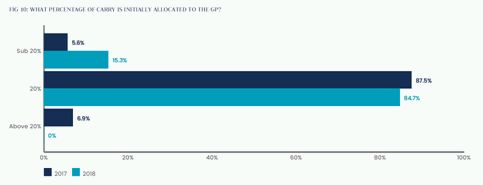

20% Carry

The vast majority of the funds (as shown below) have a carried interest rate of 20%.

Figure 10 does not show the funds that charge a higher rate of carried interest, as such rates are not charged on a standalone basis. Carried interest above 20% (at 25% or even 30%) appears in funds which either have a ratchet (starting from 15% or 20%), or where investors can opt for another class of interest, bearing a higher carried interest rate and compensated by a lower management fee.

In the reviewed sample, tiered or ratcheted carry appeared in 17% of funds.

Interestingly, some larger funds give investors the option to elect different carried interest rates. This is usually linked to paying different management fee rates, with higher carried interest offset by a lower management fee. One such example from this year's survey involves a fund offering a 1.5% management fee and 20% carried interest option, vis-á-vis a 0.75% management fee but with a 30% carried interest.

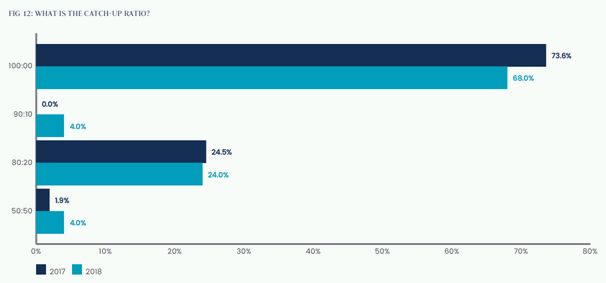

Catch Up

Almost 90% of funds have a catch-up mechanism allowing a manager to rebase its profits, thus neutralising the preferred return.

As illustrated by Figure 12 below, a 100% catch-up to the management house is the most common formulation (68% of funds). In other instances, the catch-up is slowed by the impact of future distributions also being distributed to investors (in varying proportions).

Compared to last year's data, there are now more staggered catch-ups in the sample. In 2017, 74% of sampled funds had a built-in 100% catch-up. In 2018, 68% of sampled funds had a 100% catch-up, with the remainder employing a GP/LP catch-up model.

Carried interest variations

Although a 20% share of a fund's profits remains the market rate for carried interest, the trend to offer carried interest innovations continues from last year. The following variations have been encountered:

|

SUPER CARRY |

Carried interest higher than the typical 20%. |

|

RATCHET-BASED CARRY |

The percentage of carried interest increases as the fund achieves certain benchmark cash multiples (e.g., carried interest set at an initial 10% until the fund returns 2x the amount of LPs' called capital, then ratchets up to 20% until the fund returns 3x LPs' capital, and ratchets up to 30% above a "3x" multiple). |

|

DEAL-BY-DEAL CARRY ENHANCEMENTS / HYBRID CARRY |

Deal-by-deal carry but with certain investor protections: interim clawbacks along with escrowing some of the carry and/or offering guarantees of the GP's clawback obligation or carried interest distributed, subject to certain minimum returns achieved by the investors or the value of the fund reaching a certain level. |

|

HYBRID CARRY TWIST |

A take on hybrid carry that diverts deal-by-deal carry distributions to the LPs until they have received amounts equal to the sum of called capital, preferred return and undrawn capital. The LPs themselves do not have to return diverted carried interest to the fund but, subsequently, the GP is allowed to catch-up on the diverted distributions. |

|

DUAL WATERFALL CARRY |

LPs choose the type of carry to pay: a whole-of-fund carry waterfall in which the LP is charged the full management fee or an alternate waterfall in which the LP pays deal-by-deal carry in exchange for discounted fees. |

|

DUAL RATES OF CARRY |

The LPs elect between paying lower management fees with the higher carry percentage and higher management fees with the lower carried interest rates (under the same waterfall). |

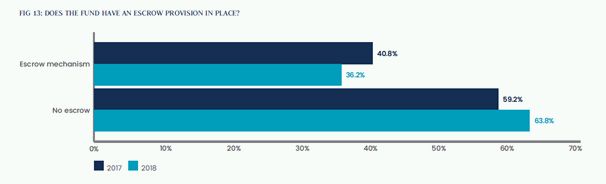

Belts and braces: Escrow

Escrow provisions feature in 36% of the surveyed funds.

ILPA's recommendation is for deal-by-deal waterfalls to include carry escrow accounts with significant reserves (30% of carry distributions or more) and to require additional reserves to cover potential clawback liabilities.

The amounts deposited in an escrow across the surveyed cohort range from 25% to 100%, with the latter being prevalent in just under 50% of the funds with an escrow arrangement.

The actual share of carried interest deposited in escrow per se may not be quite as straightforward as the headline numbers make out, as the conditions of release and the valuations allowing earlier release of carried interest may have a significant bearing on the actual amounts retained in escrow.

Belts and braces: Escrow

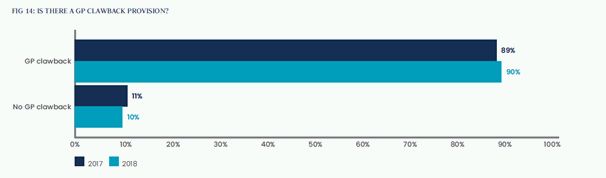

90% of the surveyed funds have a carried interest clawback and it is now an entrenched feature of the funds landscape. This is even more important where the waterfall is structured on a deal-by-deal basis.

Having a GP clawback effectively equalises the deal-by-deal distributions to the whole-of-fund carried interest.

Last year's research identified that 71% of funds with deal-by-deal waterfalls had a guarantee in place backing up the GP's obligation to return carried interest. In this year's sample, 65% of funds with a deal-by-deal waterfall have these in place, ensuring that the amounts released from escrow or due to be clawed-back can be returned.

MJ Hudson's PE Fund Terms Research 2018: Part I – Economics can be downloaded at https://www.mjhudson.com/private-equity-fund-terms-report-2018-part-i-economics/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.