This is an extract from Richard Kemp's presentation at The Alternative Legal Management Summit in September 2016.

Supply-side macro-picture: UK GDP, private practice solicitor numbers and demographics

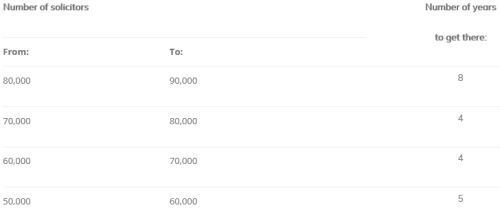

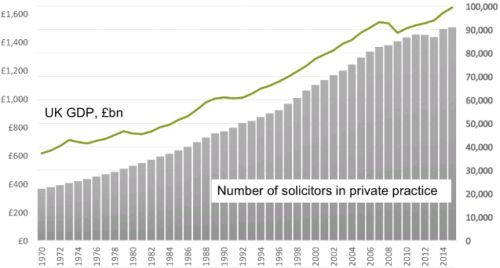

Measured against UK GDP, the role of private practice solicitors in the economy has increased over the last twenty years: there was one private practice solicitor for each £17.7 million of UK GDP between 2011 and 2015, compared with £19.6 million between 1996 and 2000 (an increase in penetration of 10%). However, although the private practice sector continues to grow, that growth has slowed in recent years – strikingly, and the first Table and Chart below show, it's taken 8 years to get from 80,000 to 90,000 (12.5% growth), the same time it took previously to get from 60,000 to 80,000 (33.3% growth) :

Complicating the profession's demographics, the entry rate is also down 17% on 2004/05 and the exit rate is set to tick upwards as the boomers who qualified in the '70s and '80s start to retire, and more people leave private practice mid-career for other opportunities.

The rise of in-house solicitors

The number of in-house solicitors has more than trebled since 2000:

- 2015: 17,393 in-house solicitors

- 2010: 12,479

- 2000: 5,189

By way of contrast, equivalent figures for the Bar (independent and employed) show around 25% growth from 2000 (12,920) to 2015 (15,899).

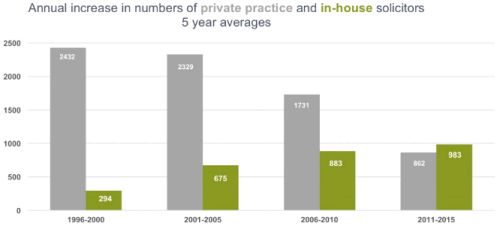

The ratio of in-house to private practice solicitors has become closer and the growth has levelled, having been dramatically in the favour of private practice. There is now 1 in-house to every 6 'in-firm' (up from 1 in 12 just over 10 years ago) and significantly on an annual basis in-house exceeded 'in-firm' growth for the first time in the last five years:

- 2011-2015: 1 in-house: 6 in

private practice

- in-house (983pa) exceeds private practice (962) growth for the first time

- 2006-2010: 1 : 9

- Private practice growth 2x in-house

- 2001-2005: 1 : 12

- Private practice growth 3.5x in-house

- 1996-2000: 1 : 13

- Private practice growth 8x in-house

ABSs & private practice firms

- ABSs: growth

- first licences in March 2012

- 190 registered by October 2013 (SRA research launch date)

- 412 in August 2015

- 94 authorised in first 7 months of 2016

- ABS market share, July 2015

- 4% of all firms by number but

- 11% (£2.4bn) by total (2013/14) turnover

- 50 ABSs with turnover >£10m (29 by end of 2013)

- Areas of greatest penetration

- high volume, commoditised markets

- personal injury and some business markets

A recent excellent study by Leeds University Business School ( Changing regulation and the future of the professional partnership: the case of the Legal Services Act, 2007 in England and Wales , Aulah & Kirkpatrick, University of Leeds, July 2016) noted that although it would be easy to dismiss ABS developments as of little significance, the combination of regulatory reforms and ongoing market forces had dislodged the foundations of the professional partnership in a way that had not previously occurred in legal services in any country. Commenting that rumours of the death of the professional partnership are exaggerated, the report concluded that:

- lawyers will choose from a variety of economic units from which to deliver legal services;

- partnerships may dominate areas of service that require less IT and greater personal skill;

- for the first time a radical alternative way of doing business has been tried and tested in legal services and may eventually come to dominate in high-volume commoditised areas.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.