Editor's Comment

We have a new coalition Government. The electorate has given a clear mandate for change. There is plenty of hope and goodwill but it will still have to deal with the financial turmoil the country is currently enduring.

Unfortunately the problems we face won't go away because a new Government has arrived. The new Government does however give us hope that they can provide a clear roadmap as to how they perceive we can get out of the current recession and what steps will be taken to resuscitate our economy.

Significant restructuring of the banking sector will be a key item on the agenda of the next Government. Key stress tests on the balance sheets of Irish banks are awaited, although no good news is anticipated on this front.

There is an urgent need for a proper functioning banking system extending credit to enable businesses and consumers to reemerge from the economic crisis. Businesses need to secure vital credit from the banks. We still appear to be some months away from this.

The country needs clear decisive action from our new Government to restore public confidence and hence encourage consumer spending allied to job creation programmes.

The new Government has stated that it will try to renegotiate the EU bailout package deal terms, especially the interest rate being charged and to extend the period for repayment.

We have an opportunity to start focussing on the positives of Ireland Inc and leadership has a huge role to play in emphasising the possibilities. We have to accept that the new Government will not have a magic wand to deal with the issues and we are all in for a long road to recovery. We have to hope that the new Government will set out a clear path to recovery and soon.

In this newsletter we look at issues arising from the last Budget in the 2011 Finance Act. We highlight topical tax points to be aware of, take a look at the significant changes made in the pensions area and the new controversial universal social charges. We offer some tips on improving your budgeting and forecasting to achieve more realistic estimates. Philip Lawlor, chief economist at Smith & Williamson Investment Management, gives us a brief overview of the global economy. We hope you find these topics of interest

THE TAX BILL -TEN TOPICAL TAX THINGS YOU MIGHT LIKE TO KNOW, BUT THEY DON'T WANT YOU TO...

By Brian Egan and Gordon Hayden

- If a bank enforces its security over an asset, and forces a sale of the asset, the bank must pay any capital gains tax (CGT) liability arising directly out of the sale proceeds. In situations where there have been equity releases on property in recent years (followed by a slump in property values) it is very possible that CGT liabilities will arise even though the sale proceeds would not be enough to clear the bank debt. Property developers, banks and NAMA might take note as this is sure to create issues for them.

- On a similar theme, if a bank appoints a receiver over a tax incentive property, and a clawback of capital allowances previously claimed by a tax investor occurs on a sale by that receiver, it is arguable under the law that the receiver/bank may become liable for the tax on the capital allowance clawback to the Revenue. Tax investors and banks might take note.

- Continuing the banking theme, under principles established in a European Court ruling, a bank operating through a subsidiary in one European country, which writes off the value of loans to customers and creates losses in its accounts as a result, may be able to seek a valuable tax deduction for those losses in another European country. The exchequer in countries with profitable headquartered banks might bear some cost for banking mistakes in another country.

- Tax paid by vendors of land on foot of signing a contract, where completion of the contract is now clearly not feasible, can be recovered if the contract is cancelled and the sale abandoned. In many cases it is more attractive to seek 20% tax back off of the Revenue (who have money) and keep your land, than it is to seek 100% consideration through the courts from property developers (who are largely without money).

- Property developers who are largely without money (because of debts due to banks which far exceed the value of lands purchased), but who may have ongoing income may be in a position to not pay any tax on salaries, rents, fees, profits – simply by offsetting the rolled up interest on loans (which may never get paid) against their other income. Refunds of PAYE paid can be obtained directly from the Revenue.

- A real expectation exists among tax professionals generally, that the CGT rate will increase from the present 25% in 2012 or 2013. Those who know a disposal of assets on which a taxable gain will arise is an inevitable certainty for them, might consider accelerating the timing of such a disposal to take advantage of the present rate.

- It is still possible to avoid paying Irish CGT (and avoidance is a perfectly legal activity don't forget) on non-specified asset disposals by taking up residence in another country with which Ireland has a tax convention. Those expecting to realise €millions in gains might consider their options.

- It is still permissible to organise your affairs in a tax efficient manner. Whether you personally or your company should hold assets and debt, what level of salary or pension your spouse should be paid for working in the family business, if you or your spouse are not Irish domiciled – tax can be mitigated.

- Medical professionals may, in suitable commercial circumstances, be able to incorporate their businesses (transfer the businesses to a company) thus reducing income tax bills significantly and benefiting from lower corporate tax rates and a more flexible pensions regime. Men (and women) in white coats might take note.

- Despite many lengthy legislative changes and developments in the world of Irish taxation, it is still possible to reduce your tax bills in a sensible way if you obtain the correct advice.

PENSION CHANGES IN BUDGET 2011

By James O'Hanrahan

The Irish Budget announced on 7 December 2010 has introduced many changes to pensions and their interaction with the taxation structure that operates here in Ireland. The various pension measures announced are expected to yield the Exchequer some €235m in tax savings. The following are a summary of the main pension changes.

1. Marginal rate tax relief retained

Relief on personal pension contributions remains at one's marginal tax rate. Though the Government's four year plan aims to reduce this to the standard rate between now and 2014, they have indicated that they are willing to talk to the pension industry to examine alternatives that might produce similar savings than the one currently proposed.

2. Reduction in earnings limit

This is now down to €115,000 for 2011 from €150,000 in 2010. Any contributions paid in 2011 but backdated to 2010 must use the lower figure of €115,000.

3. Loss of pay related social insurance (PRSI) and health levy relief

Personal pension contributions by employees will not get relief from PRSI and the health levy. This brings them into line with the self employed who never got this relief.

4. 50% loss on employer PRSI relief

The employer in 2011 will see his PRSI relief reduced by 50% on pension contributions that are paid by employees.

5. There is no change to employer pension contributions

They will continue to be fully deductible for corporation tax purposes and will still have no benefit in kind effect on employees.

6. Tax free lump sums reduced to €200,000

Amounts between €200,000 and €575,000 will be taxed at the standard rate along with PRSI and the Universal Social Charge (USC). Amounts in excess of €575,000 will be taxed at the marginal rate plus PRSI and the USC. These are lifetime limits and not a limit per pension arrangement.

7. Standard fund threshold reduced to €2.3m

This is the maximum pension fund allowed from 7 December 2010. If your fund was between €2.3m and the old standard fund threshold (SFT) of €5.4m then you can apply to the Revenue by 7 June 2011 to seek a personal fund threshold (PFT). If you have a PFT from before 7 December 2005, you get to keep it and need not apply again for a new PFT.

8. Deemed distribution of approve retirement fund (ARF) increased to 5%

This is effective from the 2010 year of assessment and is an increase from the current rate of 3%.

9. New ARF option

All defined contribution schemes will have automatic access to an ARF. However, their approved minimum retirement fund (AMRF) requirement will increase to €120,000 approximately. With deemed distribution on ARFs increased to 5% this may not be a disadvantage as the deemed distribution does not apply to AMRFs.

10. Sovereign annuities

This may result in higher annuity rates in the future but with the risk of a loss of the annuity were the Irish Government to default on its debt in the future. Its greatest effect may be on the liabilities of defined benefit pension schemes.

Overall, it could be advised that the self employed should look to incorporate and proprietary directors should ensure their spouse's are building up allowable pension pots of €2.3m.

BUDGETING AND FORECASTING - DON'T BE TAKEN BY SURPRISE

By Dan Holland

You will have to deal with many unexpected events during your business life, but by ensuring you do everything you can to anticipate scenarios and outcomes you'll be better equipped for a fast and effective response as and when they arise.

The importance of budgets and forecasts

Budgets and forecasts are an essential part of the business and scenario planning process, as well as being a key risk management tool in your business. They are used both internally and externally – your bank will almost certainly take a keen interest in your calculations.

Budgets are typically fixed in advance and remain static for the duration of a selected period. They provide management with the ability to identify how and, more importantly, why actual results differ from those that were originally expected. It may be that sales have been over or underachieved, that margins have varied or that an unwelcome bad debt has arisen. There may have been unexpected currency fluctuations, or overheads may be out of line.

While budgets normally remain fixed for the selected period, forecasts are updated as and when actual financial results become known. A forecast therefore acts as a rolling estimate for a given period, providing an informed view of likely outcomes based on current trading, as opposed to budgeted activity.

Many businesses prepare their monthly management accounts (an essential management tool) and compare these to both their budgets and their forecasts. Significant variations from forecast may indicate that market conditions may be changing more rapidly than anticipated, as the forecast information has been regularly updated. Significant variations against budget may indicate that original expectations may have been unrealistic and may lead management to consider longer term changes that may be required in the business.

A business's ability to prepare meaningful and accurate budgets and forecasts improves over time. Early attempts often overestimate income and underestimate costs. Budgeting in a subsequent year is generally easier than budgeting in the current year – more facts are known and the areas of variance will have been identified and can be built in more accurately.

Help with the budgeting process

Here are some tips to help you prepare your budget.

- Look at your track record of meeting budgets and consider whether your new projections are achievable. If your past performance demonstrates evidence of poor or over enthusiastic assumptions, take note of these and make suitable adjustments.

- Challenge your assumptions, or get someone else to do it for you. Talk to your management team and your external advisers – they will all have views and these can be used to clarify and tighten your expectations.

- Make sure your profit and loss, balance sheet and cash flows are fully integrated and reconciled.

- Think about sensitivity and prepare different versions of your budget based on different scenarios. Ultimately you will have to choose which final version you use, but it will be good to know that if your sales are 30% less than you anticipate, you will still have enough cash to survive.

- Ensure that you regularly review your budgets and forecasts against your actual financial results. If variances arise, analyse these and understand the likely impact on your business. Take action early to counter any threats.

Always remember that cash is king and, if you rely on your bank for finance, be aware that their view of your ability to prepare accurate budgets and forecasts will play a significant part in any lending decisions they may make.

MARKET OUTLOOK

By Philip Lawlor,

World

Global equities – admirable resilience but more tests to come

Considering the array of events encountered in Q1 2011 (North African turmoil, allied intervention in Libya, surging oil prices and the Japanese earthquake and tsunami) equity markets have displayed remarkable resilience.

The principal driver behind this resilience has been liquidity. At a corporate level, strong balance sheets and free cash flow generation have delivered a pick up in dividend payouts, stock buy backs and merger and acquisition activity. At a macro level, negative real interest rates and steep yield curves have also been supportive of risk assets. Also, the Federal Reserve has been very explicit in acknowledging that the generation of equity wealth effects was the cornerstone of their QE2 programme.

Looking forward, the markets have to contend with several obstacles. One of the key issues will be gauging the impact of a potential cessation of US QE2. While it is extremely hard to predict the precise consequences of the removal of substantial liquidity support, it will undoubtedly add to overall market uncertainty. While QE2 will probably end in June, headline US interest rates are unlikely to change for quite some time. By contrast, the ECB appears to be on the cusp of tightening. Markets often find it difficult to calibrate to a world where the central banks of the two key reserve currencies have divergent monetary policies. The third potential headwind for markets lies with the risk of a compression in margins as corporations find it increasingly difficult to pass on rising input costs. We are at the stage of the cycle where value traps emerge. The rising oil price is also a deflationary shock to global growth.

The sustained rally in global equities that ran from September last year to mid- February has now entered a period of consolidation. This is likely to persist until we get greater clarification over the outlook for corporate earnings and margins post the second quarter earnings releases.

Europe

Not such a 'grand bargain'

While the EU leaders have just agreed a 'grand bargain' aimed at providing a permanent crisis resolution mechanism, the provisions of the agreement fell some way short of what was initially indicated. The principal shortcoming is that due to intense domestic euro scepticism the German chancellor, Angela Merkel, has pushed for a substantial watering down of German capital commitments to the European Stability Mechanism (ESM). Also, a key signatory for the mechanism, Finland, has to await an election in mid- April where the 'True Finns', an anti-euro party, has been gaining support. It is hard not to reach the conclusion that the conflict between EU-level crisis resolution and national politics has yet to be fully resolved. Elsewhere, the Eurozone continues to face other pressure points. Having seen the Government resign due to opposition to its proposed austerity plan, the Portuguese bond yield has soared to 8.7% – an unsustainable level. Markets are now fully expecting Portugal to join Greece and Ireland as the recipients of an EU/IMF led bail out.

What is notably different this time round is that the contagion risk that was apparent in 2010 has dissipated. For instance, the spread between the yield on Spanish bonds and German bonds has contracted throughout 2011 reflecting a decline in Spanish default risk.

The ECB has indicated that it is close to lifting interest rates as inflation has moved above its 2% target. The widening of interest rate differentials with the US has contributed to the almost 9% appreciation of the euro relative to the dollar in Q1. Ironically, once the ECB start tightening, the focus of the currency market could switch from interest rate to growth differentials which could see the euro start to weaken relative to the dollar. Should you have any questions please speak to Hellen. 00 353 1 614 2520 hellen.dalton@smith.williamson.ie

Asia

Japan

The triple whammy of an earthquake, tsunami and nuclear reactor melt-down came as a heavy blow for an economy that was showing tentative signs of recovery. It now looks as though GDP will contract 1-3% in 2011. For 2012 the rebuilding stimulus should then produce between 2-3% growth. Initial concerns that supply-chain disruption would be significant now look overdone. In the immediate aftermath of the quake the yen appreciated significantly (in anticipation of capital repatriation), the G7 subsequently initiated a concerted intervention to weaken the yen which has been a partial success.

UNIVERSAL SOCIAL CHARGE

By Brian Eagan

A summary of the new Universal Social Charge and its effects on individuals

The introduction of the Universal Social Charge (USC), a single charge consolidating and replacing the income and the health levy from 1 January 2011, was among the most significant announcements in the Irish Budget 2011. Despite initial indications by the minister in his 2011 Budget speech, PRSI remains a separate charge from the USC.

Who is liable and on what income?

All individuals are liable to the USC where their income exceeds €4,004 for the year. In addition to income chargeable to income tax, certain income exempt from income tax is included e.g. dividends from companies exempt from corporation tax and income covered by the artists exemption.

The USC applies on a similar basis to the income levy, which means that it is charged before allowances and reliefs are given. Lessors/passive investors will pay the USC on gross income before deduction for capital allowances. However, a deduction for capital allowances from the profit of a trade, profession or farming is allowed.

What income is exempt?

There are a number of sources of income which are exempt, the most noteworthy being deposit interest subject to DIRT, social welfare payments and similar types of payments. A detailed list is available from the Revenue's website, www.revenue. ie, inserting the following 'universalsocial- charge-faqs.pdf' into the search field.

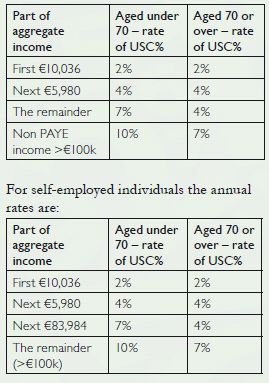

Rates of USC

For individuals within PAYE the annual rates are:

How is the USC collected?

Employers are responsible for deducting the USC from salaries etc. and remitting it to the Revenue with the PAYE/PRSI liability. Self-employed individuals must make a payment of the USC along with their preliminary income tax payment.

USC and preliminary income tax 2011

The preliminary income tax payment for 2011 (due for payment on 31 October 2011) must include a payment in respect of the USC. If a taxpayer wishes to calculate this payment based on their 2010 income tax liability they must recalculate this to exclude the health and income levy and include the USC as if it had applied for that year. We recommend that you contact us regarding the appropriate payment to avoid any exposure to interest on underpayment of same.

We recommend that all individuals, particularly those with income outside of PAYE, should contact us to quantify their likely liabilities which are due for payment on 31 October 2011. We look forward to meeting with you to discuss any aspect of the USC and how it applies to you..

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.