It is widely reported that there are already more than 1 billion 5G connections. With this expected to continue growing rapidly in the coming years, 5G is big business and it is unsurprising that there are many companies working to innovate in this area with a huge number of patent applications being filed.

Data from PatBase shows that there are over 200,000 patent families with 5G related patent applications published since just 2020 (with nearly 250,000 grants globally in this time period).

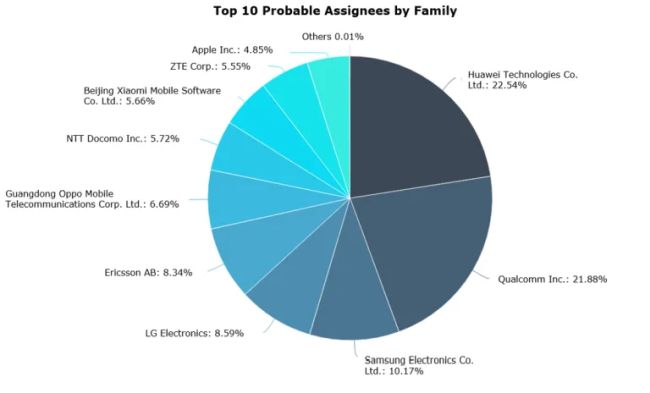

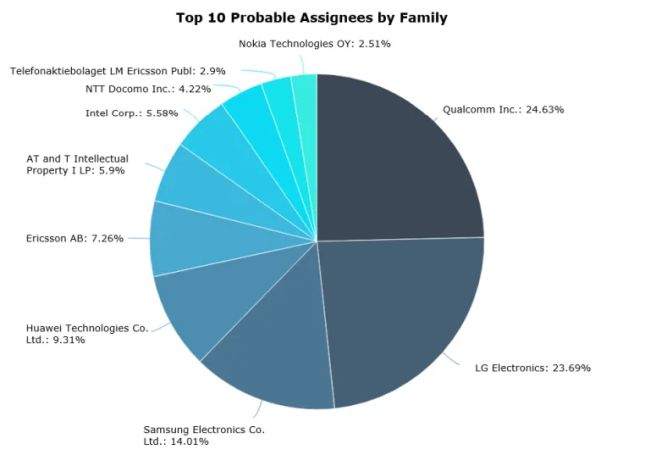

Figure 1 shows the top 10 probable assignees by family for these 5G related patent families:

Figure 1: Top 10 Probable Assignees by Family for 5G related patent applications published since 2020 in IPC classes H04W, H04L and H04B (PatBase). Note that IPC classes H04W, H04L, and H04B are the IPC classes in which the majority of 5G-directed inventions sit, relating to "Wireless Communication Networks", "Transmission of Digital Information, e.g. Telegraphic", and "Transmission", respectively.

It can be seen that Huawei Technologies is a huge player in the 5G arena with nearly a quarter share among the top 10 filers.

3GPP's Release 18 marks the beginning of a new chapter – 5G Advanced. Expected to conclude in 2024, Release 18 is now open and is expected to bring in a series of new developments, further enhancing the existing 5G specification and providing a bridge between 5G and 6G.

In this article, we take a look at some of the big expected development areas for 5G Advanced in Release 18 and beyond, and who the big innovators are.

Extended Reality (XR)

Extended Reality (XR) is an umbrella terms used to refer to immersive technologies such as Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR), which aim to combine the virtual and physical worlds. XR has the capability to impact a variety of areas from gaming to work to daily life. Release 18 is focused on providing support to realise this potential, such as providing the high data rates and bounded latency needed by XR applications, as well considering factors such as how processing load can be brought into the network itself rather than this taking place at the client device.

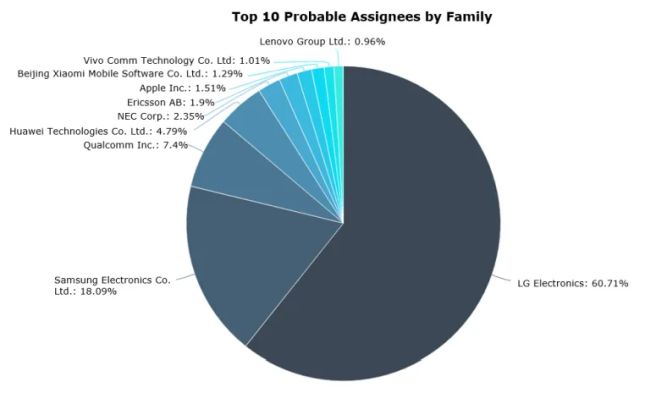

Figure 2 shows the top 10 probable assignees by family for XR related patent families among the 5G families:

Figure 2: Top 10 Probable Assignees by Family for 5G and XR related patent applications published since 2020 (PatBase)

Despite sitting back in fifth place for 5G overall, LG Electronics is by far the biggest filer for XR related applications, taking a huge 60.71% share of the XR related patent families among the top ten, amounting to 3,488 families. It is clear that this is a significant area of focus for LG Electronics at present. Samsung Electronics takes the second spot with a noteworthy 18.09%, while Qualcomm takes third at 7.4%. Huawei Technologies sits back in fourth with just 4.79% despite being the biggest filer for 5G overall.

Massive MIMO

Massive multiple-input multiple-output (MIMO), combined with beamforming, makes use of a large number of antennas in order to allow the transmission and reception of many data signals simultaneously over the same radio channel. While not new to 5G, this is a key area of development for 5G Advanced. There is a desire to increase capacity, for both uplink and downlink, for example in order to support high quality streaming. Work is therefore underway to increased MIMO capacity to support the high data rates that will be required for 5G Advanced, such as through the use of different beamforming methods for different user speeds.

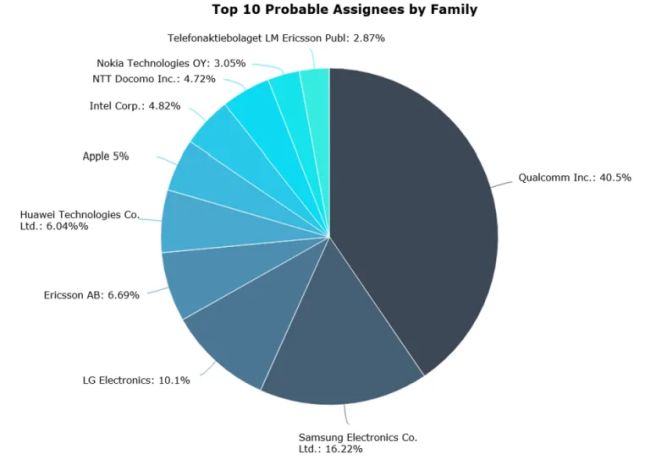

Figure 3 shows the top 10 probable assignees by family for MIMO related patent families among the 5G families:

Figure 3: Top 10 Probable Assignees by Family for 5G and MIMO related patent applications published since 2020 (PatBase)

Qualcomm, Samsung Electronics and LG Electronics again make the top three here, but Qualcomm replaces LG with 40.5% of the published applications among the top ten, and Samsung Electronics takes a significant 16.22% share. LG Electronics, while still noteworthy, is further back at 8.51%. The three together take up a huge 66.82% share among the top ten applicants. Again, despite being the biggest filer for 5G overall, Huawei is not one of the biggest players for MIMO-related applications – its 6.04% share is dwarfed by that of Qualcomm.

Sidelink

Sidelink – the direct communication between devices without the need to relay the data via the network – was first introduced back in 3GPP Release 12. However, the journey for sidelink did not stop there, with work still continuing now in Release 18 to provide enhancements for 5G Advanced. A particular area of focus is the use of device-to-device communication to relay data between devices, effectively using user devices as a network for transmitting information between each other.

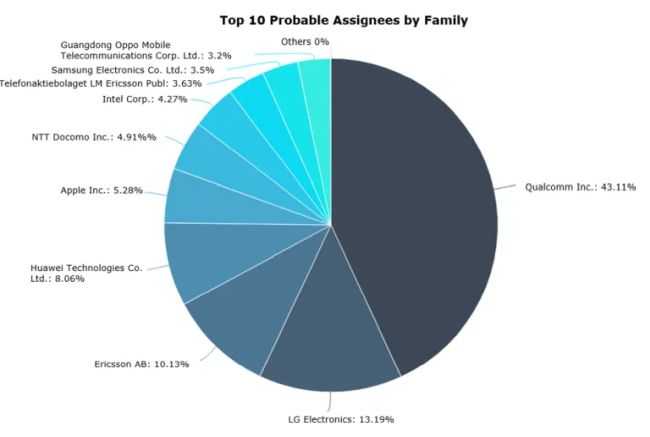

Figure 4 shows the top 10 probable assignees by family for sidelink related patent families among the 5G families:

Figure 4: Top 10 Probable Assignees by Family for 5G and sidelink related patent applications published since 2020 (PatBase)

Qualcomm is by far the biggest filer for sidelink related inventions, with a huge 43.11% share. As was the case for all of the areas discussed above, LG Electronics is again in the top three, with a 13.91% share. However, despite being a top three filer in the other key development areas, it is noteworthy that sidelink does not appear to be an area in which Samsung Electronics has decided to focus heavily. It sits back in ninth place with 3.5% share. Instead, Ericsson takes the third place spot with a 10.13% share.

AI/ML

This discussion would not be complete without mention of artificial intelligence (AI) or machine learning (ML). As with many other technologies and industries, AI/ML is set to have huge impacts on a variety of areas in the 5G Advanced specifications. Particular areas of focus in the development of 5G Advanced are the use of AI/ML for network energy efficiency, enhanced mobility and load balancing.

Among the roughly 200,000 patent families including 5G-related patent applications published since 2020, 36,037 of these mention AI or ML. While it is of course the case that not all of these will have AI/ML as their core focus, this shows just how widespread the adoption of AI/ML is becoming in this area.

Figure 5 shows the top 10 probable assignees by family for these AI/ML related patent families:

Figure 5: Top 10 Probable Assignees by Family for 5G and AI/ML related patent applications published since 2020 (PatBase)

Samsung Electronics returns to the top three here, bringing us back to the normal pattern of LG Electronics, Samsung Electronics, and Qualcomm making up the top three. Again, these three take up a majority share among the top ten filters, sitting at a combined 62.33%. Qualcomm and LG Electronics are fairly evenly split in this area, with Samsung Electronics having a smaller share among the big three. Huawei Technologies and Ericsson sit behind the top three, taking a noteworthy 9.31% and 7.26% respectively.

Summary

While there are no huge surprises in the big innovators in these four key development areas of 5G Advanced, there are still some noteworthy results. The most significant relates to Huawei Technologies – while Huawei is the biggest filer for 5G related applications overall, it does not reach the top three in a single one of the four key development areas discussed here. Instead, LG Electronics, which sits back in fifth place for 5G overall, has clearly established itself in the top three for these areas of 5G Advanced, alongside Qualcomm and Samsung Electronics.

For these top three, there are clearly some key focus areas, with LG focusing heavily on XR, and Qualcomm focusing heavily on sidelink-related technologies. Samsung Electronics appears to be consistently focusing on all these areas with the exception of Sidelink technologies.

This is the only anomaly across the four development areas – it is the only area that does not have Qualcomm, Samsung Electronics, and LG Electronics making up the top three, with Ericsson taking the third place spot in place of Samsung Electronics. Otherwise, the data strongly suggests that it is these three companies that are innovating the most heavily in these key areas of 5G Advanced.

It will be interesting to see if this pattern continues as we head deeper into the development of 5G Advanced and towards 6G.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.