The European Patent Office (EPO) recently published a report "Innovation Trends in Additive Manufacturing" investigating trends in additive manufacturing (AM) technologies. The report covers the period from 2001 to 2020, and patent filing numbers are used to determine trends and highlight areas of prolific innovation within AM.

In this article I provide my summary of the report, along with my own commentary and conclusions.

Introduction

Additive manufacturing (AM) is an umbrella term which encompasses a variety of different manufacturing methods. In contrast to more traditional manufacturing methods, such as machining (e.g. milling, turning, grinding etc.) in which material is subtracted from a billet (for example) to provide a finished part, in AM the part is built up, layer by layer.

Three examples of AM methods include:

- Fused deposition modelling (FDM) in which a filament is melted and extruded through a nozzle onto a moveable bed;

- Stereolithography (SLA) in which a laser is used to cure a photopolymer resin; and

- Selective laser sintering (SLS) in which a laser selectively fuses polymer powder to build up a part.

Whilst historically AM processes have been used for rapid prototyping, the potential industrial applications of AM are wide-ranging. As will be considered in more detail below, AM applications include the transportation, energy, and healthcare sectors and beyond.

As mentioned above, the report uses patent filing numbers to determine AM trends generally, as well as more specific trends within the AM field. The metric used to quantify the number of patent filings is the number of international patent filings (IPF). The report defines IPFs as a single invention for which patent applications have been filed at, and published by, multiple patent offices. It is important to note that not every innovation will have an associated patent application filed for it. Similarly, the IPF numbers indicate only patent applications, and not granted patents. That said, the IPFs provide a useful indication of general trends, with the above caveats borne in mind. The graphs in the report also date the IPFs by earliest publication year. Given that patent applications generally publish 18 months after the first family member is filed, a patent application filed in January 2023 will publish ~July 2024. This delay in publication can therefore be considered to give rise to an associated 'lag' in the data sets analysed below.

General Innovation Trends in Additive Manufacturing Technologies

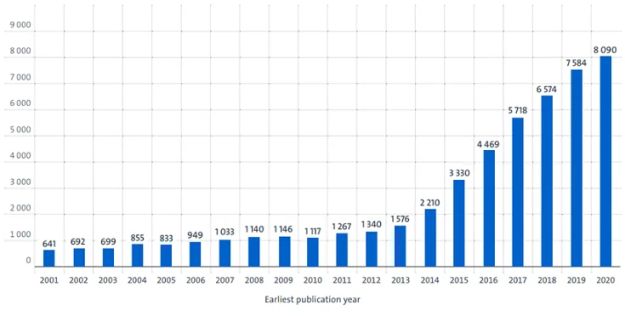

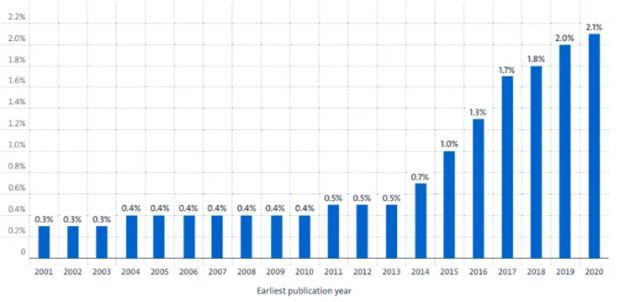

With reference to Figure 1 below, the number of AM international patent filings (IPFs – definition provided above in the Introduction section) having an earliest publication year of 2014 or later has grown significantly. In particular, the increase in IPFs relating to AM technologies has generally increased by around 25% year on year since around 2013. As well as the number of IPFs in AM technologies having increased significantly, the proportion of IPFs related to AM technologies, as a proportion of all technologies for which patent applications are filed, has also been increasing significantly since 2014 (see Figure 2 below). The number of patent families related to AM technologies has therefore increased significantly in recent years, and AM innovations are outpacing many other technology areas as their proportional share of all patent filing numbers continues to increase.

Figure 1 - Trends in IPFs in all Additive Manufacturing technologies, 2001-2020 [Source: Figure 4 of EPO report "Innovation trends in additive manufacturing"]

Figure 2 – Share of Additive Manufacturing IPFs of all technologies, 2001-2020 [Source: Figure 5 of EPO report "Innovation trends in additive manufacturing"]

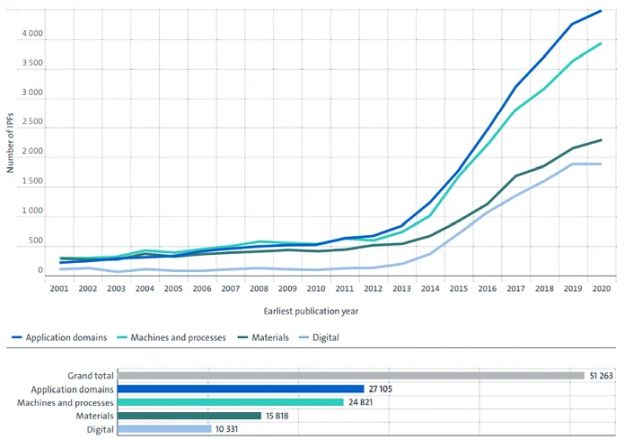

Figure 3 below breaks down the total number of IPFs filed across AM technologies into: application domains (e.g. sectors, such as transportation), machines and processes, materials and digital technologies. As will be appreciated from Figure 3, all four areas have seen significant growth since around 2012 in particular, with the number of filings in the application domains and machines and processes areas outweighing those in materials and digital technologies. Interestingly, whilst the digital sector remains the smallest overall AM area in terms of IPFs, and includes technologies relating to software, data processing and digital design tools, this is the area that has seen the strongest growth since 2013. As discussed below in connection with Figure 8, control and monitoring inventions constitute the majority of IPFs in the digital AM field.

Figure 3 – Trends in Additive Manufacturing technology areas, 2001-2020 [Source: Figure 6 of EPO report "Innovation trends in additive manufacturing"]

Material Innovation Trends in Additive Manufacturing Technologies

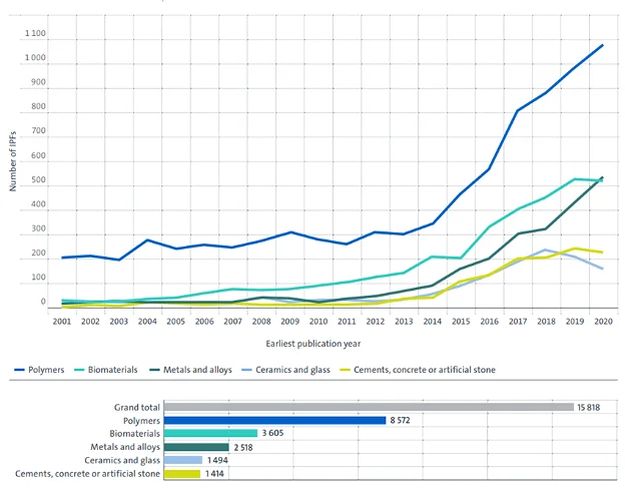

Turning to consider the trends in AM material innovations, as shown in Figure 4, and perhaps not unsurprisingly, AM innovations relating to polymers continue to dominate the materials field and have seen the greatest overall increase in filing numbers. Biomaterials and, separately, metals and alloy material technologies follow someway behind, with ceramics and glass, and cements, concrete and artificial stone following further still. Interestingly, metals and alloys-related innovations have seen the sharpest rise in recent years, with these materials arguably being one of the greatest barriers to the mainstream market that AM faces. One area of particular importance over the coming years will likely be that of material recyclability as organisations continue to strive to meet decarbonisation objectives, and I therefore expect continued innovations in this area.

Figure 4 – Trends in IPFs in Additive Manufacturing materials, 2001-2020 [Source: Figure 8 of EPO report "Innovation trends in additive manufacturing"]

Trends in Additive Manufacturing Innovations by Sector

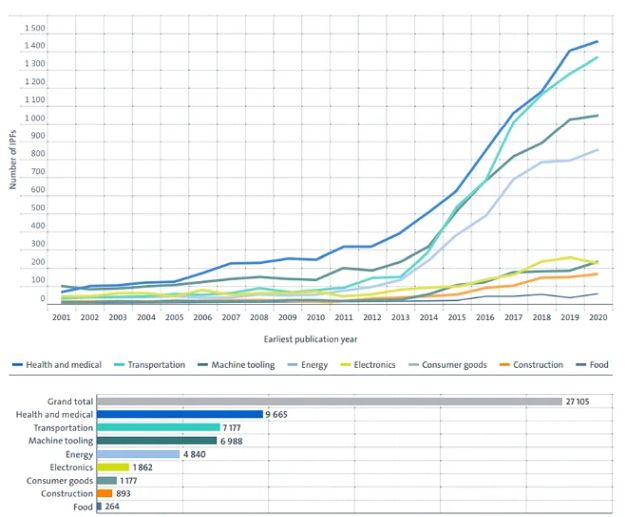

One of the most interesting data outputs of the report, at least in my view, is shown below in Figure 5. Figure 5 breaks down the trends in AM IPFs by sector (or by application domain, as referred to in the report). As a sector, health and medical has seen significant and consistent innovation growth dating back to around 2005, although in recent years the number of transportation IPFs has increased significantly such that the number of transportation-based IPFs is almost equal to that of health and medical. It will be interesting to see whether the transportation area actually overtakes the healthcare and medical area in the future. The machine tooling and energy sectors also enjoy a significant number of innovations. In particular, the share of machine tooling IPFs, as a proportion of all AM IPFs, was somewhat surprising. That said, given the small production numbers, and comparatively complex structures required, AM is well-suited for use in machine tooling.

Innovations in the electronics, consumer goods, construction and food sectors all lag significantly behind the aforementioned front-runners in the field. That said, these sectors may provide fertile ground for AM-based innovation in the coming years.

Figure 5 - Trends in IPFs in Additive Manufacturing by sector, 2001-2020 [Source: Figure 9 of EPO report "Innovation trends in additive manufacturing"]

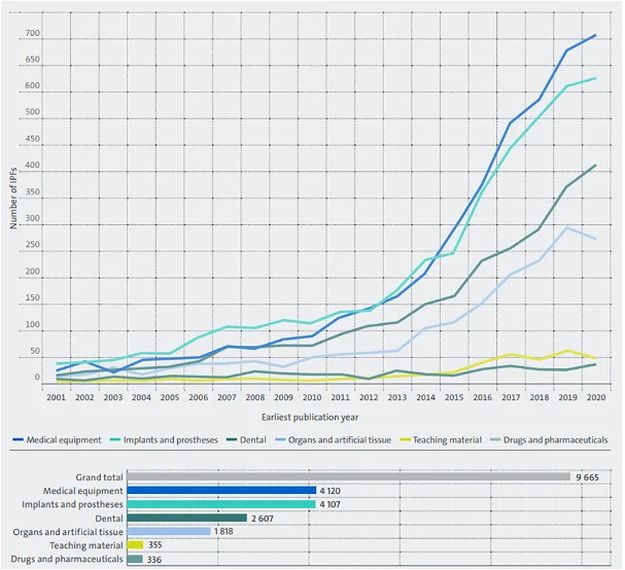

Turning to consider the innovation trends in the AM health and medical sector in more detail, Figure 6 below shows a more detailed breakdown of the number of IPFs in various areas within this sector. The report breaks the health and medical sector down into: medical equipment, implants and prostheses, dental, organs and artificial tissue, teaching material (e.g. material used to aid in the education of healthcare professionals, patients etc.) and drugs and pharmaceutical areas.

Medical equipment and implants and prostheses are observed to be comparatively earlier adopters of AM technologies, and the recent IPF numbers remain consistently high and have seen significant growth. The opportunity to provide custom, patient-oriented products, as well as lightweight and intricate medical devices, means AM is a useful manufacture process in this area. Innovations in the dental and organs and artificial tissue areas also see a significant number of AM-based IPFs, whilst the teaching material and drugs and pharmaceutical areas see fewer filings. An interesting point noted in the report is that in the drugs and pharmaceuticals category, AM provides the opportunity to provide tailored pharmaceuticals, such as doses and drug combinations, which are optimised for a given patient. As mentioned above, this is another example of the customisation which users of AM technologies can utilise in this field. In the medical equipment area, AM can be used to provide improved, customised surgical instruments, surgical guides and templates, and models for surgical planning and execution. AM also provides surgeons with the opportunity to create and use custom visual models for anatomical assessment. As is to be expected, with a globally aging population, the healthcare and medical sector is a particularly important, and promising, area for AM.

Figure 6 - Trends in health and medical IPFs in Additive Manufacture, 2001-2020 [Source: Figure 10 of EPO report "Innovation trends in additive manufacturing"]

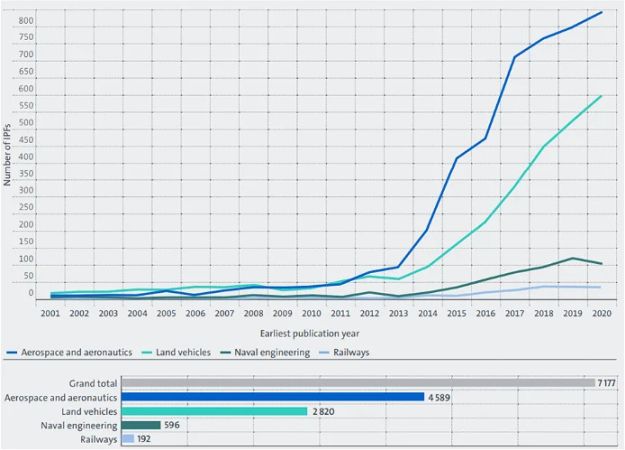

Turning to Figure 7, the report provides a more detailed breakdown of the subcategories within the transportation sector for AM technologies. The subcategories include aerospace and aeronautics, land vehicles, naval engineering and railway technologies.

As a comparatively earlier adopter of AM technologies, not least due to the weight-saving and comparatively low volume production counts, aerospace and aeronautics sees the highest number of IPFs. One particularly interesting application across all transportation areas, particularly for aerospace and aeronautics, is the possibility for AM to revolutionise the supply chain by way of an end user being able to create a required spare part directly (e.g using a 3D printer), rather than having to have it shipped. Land vehicles includes automotive and vehicles without motors, such as bicycles. Whilst the total number of land vehicle IPFs in recent years is lower than that of aerospace and aeronautics, this area has still seen significant growth. Like the aerospace and aeronautics technology area, one limitation to the mainstream use of AM in land vehicles is the range of reliable and certified materials for use in the AM process. Perhaps unsurprisingly, the naval engineering and railway technology areas lag significantly behind the aerospace and aeronautics, and land vehicle, areas by number of IPFs. An issue faced by the naval engineering area is the scalability of AM for large naval vessels (and, as mentioned in the report, the associated costs of purchasing, using and maintaining AM machines with the required part output size). For railway innovations, perhaps a comparatively lower emphasis placed on lightweight components means that AM could be someway off becoming a mainstream manufacture method in this area. Still, innovations in the aerospace and aeronautics, and land vehicle areas will likely continue to grow and continue to dominate AM innovations in the transport sector.

Figure 7 - Trends in IPFs in Additive Manufacture transportation sector, 2001-2020 [Source: Figure 13 of EPO report "Innovation trends in additive manufacturing"]

Innovation Trends in Digital Additive Manufacturing Technologies

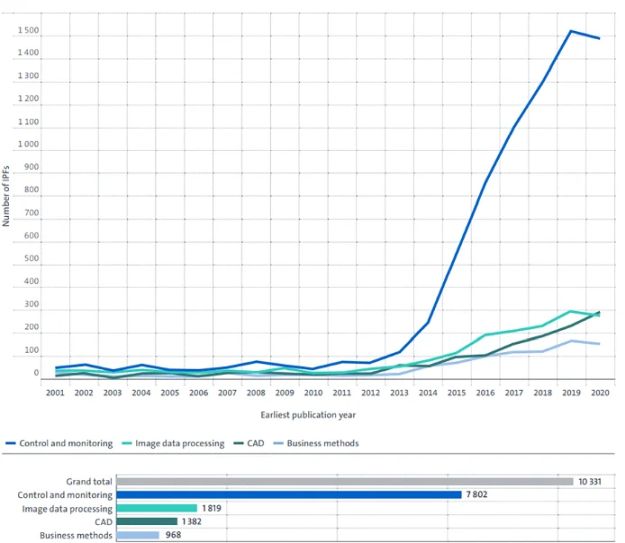

With reference to Figure 8 below, it will be recalled from Figure 3 that the comparatively smallest area of AM innovations is that of digital technologies (in comparison to application domains, machines and processes, and material technologies).

Figure 8 further distils the digital technologies area into: control and monitoring, image data processing, CAD and business method technologies. From Figure 8 it is clear that the control and monitoring subdivision is an area of significant growth which dominates the total number of digital AM innovations. As indicated in the report, the control and monitoring category includes advanced sensors and machine vision technologies, which ensure the accuracy of manufacture, and facilitates the monitoring of parameters in real time. This is with a view to mitigating the significant risk posed by the presence of defects in AM processes due to the layer by layer construction. Image data processing refers to technologies associated with providing a file in an AM-compatible format.

Figure 8 - Trends in IPFs in Additive Manufacture digital technologies, 2001-2020 [Source: Figure 16 of EPO report "Innovation trends in additive manufacturing"]

Trends in Additive Manufacturing IPFs by Territory of Origin

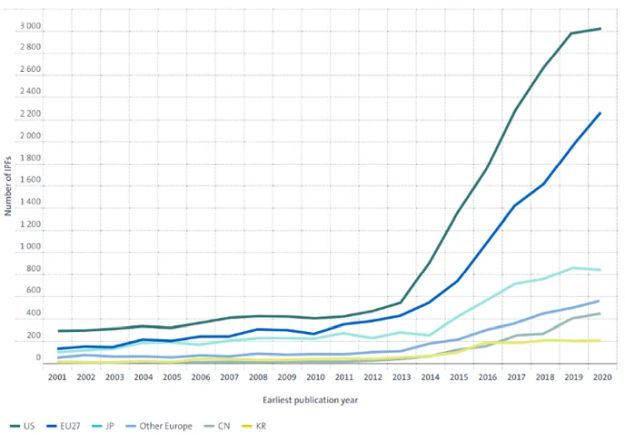

Turning to Figure 9 below, the report also provides insight regarding the territories of origin for the AM IPFs.

With reference to Figure 9, as a territory the US contributes a significant amount of innovation to the AM field: a cumulative 20,000 IPFs, corresponding to 40% of all inventive activity, between 2001 and 2020. The European contribution, including the EU 27 territories and other European territories (e.g. UK), is lower than that of the US but remains comparatively high globally. Europe's share corresponds to around 33% of the inventive activity in the same time period. Japan follows someway behind, and China and Korea lag further behind Japan. This data suggests Europe and the US are the main contributors to AM innovations, and only time will tell whether this trend continues or if the current front runners are superseded by other territories.

Figure 9 - Trends in IPFs in Additive Manufacture by territory of origin, 2001-2020 [Source: Figure 18 of EPO report "Innovation trends in additive manufacturing"]

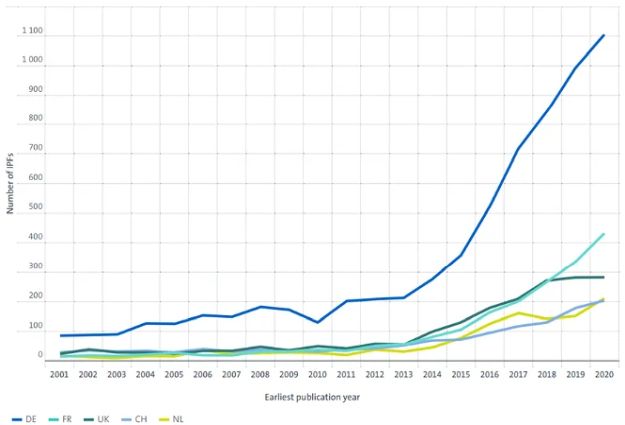

With reference to Figure 10, when the European contribution is distilled further by EPO member states, Germany is the leader for AM innovations in Europe. Furthermore, Germany's contribution has significantly increased since 2013. If the cumulative number of IPFs is considered, Germany is accountable for 41% of all AM inventive activity in Europe, with France and the UK following each having a share of 12%. However, Figure 10 shows that, in recent years, the UK's contribution has stagnated whilst the number of innovations from France has continued to increase (likely aided by major players in the aerospace field). Switzerland and the Netherlands also contribute a significant number of AM innovations.

Figure 10 - Trends in IPFs in Additive Manufacture technologies by top EPO member state, 2001-2020 [Source: Figure 23 of EPO report "Innovation trends in additive manufacturing"]

Top 20 Additive Manufacture Technology Patent Filers

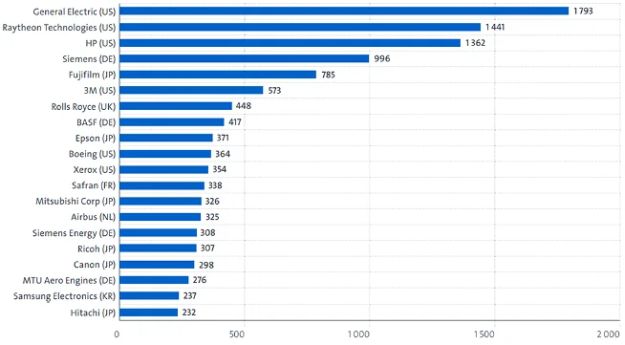

Turning finally to Figure 11, the report provides a breakdown of the top 20 applicants for AM technologies between 2001 and 2020. The list of applicants is dominated by applicants based in the US and Europe, and working in a variety of technology areas including transport, particularly aerospace, energy and specialist printer firms.

Figure 11 – Top 20 applicants of IPFs in Additive Manufacture technologies, 2001-2020 [Source: Figure 25 of EPO report "Innovation trends in additive manufacturing"]

Conclusion

From the data analysis presented in the report it is clear that AM is a technology area which has seen significant growth and will likely continue to see significant growth in the coming years.

AM has the potential to revolutionise the manufacturing field by providing increased design freedom at lower production numbers and at a lower mass cost. AM provides various opportunities across all technology areas, from customised implants in the health and medical sector, to custom machine tooling fixtures to lightweight aerospace structures.

I expect continued AM innovations will improve reliability, provide a wider range of materials and reduce the costs associated with AM use. These will lay the foundation for the proliferation of AM technologies in replacing, or supplementing, existing 'mainstream' manufacture processes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.