1 General news

1.1 Draft Legislation for Finance Bill 2013 and Tax Policy Update

The Government consulted on a number of tax policies, following their announcement in Budget 2012 and on 11 December the Government published the response to these consultations alongside draft legislation to be included in Finance Bill 2013. This was in line with this Government's objective to confirm the majority of intended tax changes at least three months ahead of publication. The draft legislation will be open for technical consultation until Wednesday 6 February 2013.

www.hm-treasury.gov.uk/d/fb2013_overview_of_legislation_in_draft.pdf

www.hm-treasury.gov.uk/d/draft_clauses_and_ens_for_finance_bill_2013.pdf

Smith & Williamson briefing notes are available on various matters where draft legislation has been published as set out below:

- High value residential properties

www.smith.williamson.co.uk/uploads/publications/241-briefing-note.pdf

- Statutory residence test.

www.smith.williamson.co.uk/uploads/publications/243-briefing-note.pdf

- Cap on income tax reliefs

www.smith.williamson.co.uk/uploads/publications/247-briefing-note.pdf

- General Anti-Abuse Rule, to target abusive tax avoidance schemes.

www.smith.williamson.co.uk/uploads/publications/246-briefing-note.pdf

- Transfer of assets abroad

www.smith.williamson.co.uk/uploads/publications/245-briefing-note.pdf

- IHT exemption where donee spouse is non-domiciled

www.smith.williamson.co.uk/uploads/publications/240-briefing-note.pdf

1.2 Draft Finance Bill 2013: Measures with effect on 11 December

The Exchequer Secretary to the Treasury (David Gauke) issued a written ministerial statement announcing the following measures that will have effect from 11 December 2012 or shortly afterwards and which will be included in Finance Bill 2013.

Debt cap: Group treasury company election

Legislation will be introduced to ensure that only the financing expenses and financing income related to treasury activities are included in the election. If a company's activities are all or substantially all treasury activities and its assets and liabilities relate to those treasury activities then its financing income and financing expenses can be included in the election. If a company's treasury activities are not all of its activities then the election will only apply to its financing expenses and financing income that relate to the treasury activities.

The legislation amends section 316 Taxation (International and Other Provisions) Act 2010 and will take effect for periods of account of the worldwide group beginning on or after 11 December 2012.

Corporation Tax: Deferral of payment of exit charges

The Government is amending legislation to address the way in which HMRC collects corporation tax charges levied on unrealised profits or gains when a UK resident company that is registered in a European Economic Area (EEA) territory transfers its place of effective management to another EEA State (often described as an "exit charge"). This follows a decision by the Court of Justice of the European Union. The amendment will offer such companies the option to defer payment of the exit charge over a period of time provided that certain conditions are met. The change is intended to protect public finances, support businesses with cash-flow issues, and ensure UK law remains compatible with EU law.

The legislation will have effect to permit companies to submit claims for deferral of exit charges that fall due from 11 December onwards.

VAT forestalling road fuel

Draft legislation sets out the Government's intention to impose an open market value (OMV) on supplies of road fuel made by taxpayers to employees and other connected persons where fuel is supplied at less than the OMV.

The draft legislation will apply from 11 December. However until the date of Royal Assent to Finance Bill 2013 affected taxpayers should declare output tax according to the invoiced value. After Royal Assent, to the extent that the amount charged is less than OMV and any part of the fuel has not yet been made available, these amounts will become incorrect and taxpayers will need to correct the under declaration of output tax in the usual way. How to make corrections is explained in Notice 700/45, which is available on the HMRC website.

In addition, the following measures will come into effect on 1 January 2013 and will be included in Finance Bill 2013:

Annual investment allowance (AIA)

To encourage investment and exports as a route to a more balanced economy, the Chancellor announced on 5 December 2012 a temporary increase to the AIA to support investment in the economy.

Legislation will be introduced to temporarily increase the AIA limit on qualifying expenditure that effectively receives 100 per cent relief from £25,000 to £250,000. The AIA is available to most businesses, regardless of size. The increase in the AIA will apply to qualifying expenditure incurred between 1 January 2013 and 31 December 2014. This measure supports investment by accelerating the rate of relief on investment in qualifying assets.

Bank Levy

The Government has set out its intention that the Bank Levy should raise at least £2½ billion each year. The full Bank Levy rate will increase from 0.105 per cent to 0.130 per cent from 1 January 2013 to restore expected yield for future years and to offset the benefit of corporation tax rate cuts to banks. The half rate for chargeable equity and long term chargeable liabilities will be increased from 0.0525 per cent to 0.065 per cent.

UK Swiss Remittance basis

Legislation will be introduced to ensure that, where levies are made under the terms of the Swiss UK Tax Cooperation Agreement, those levies are not treated as remittances for UK tax purposes. To ensure that policy objectives behind the original agreement are delivered in full, this legislation will be effective from 1 January 2013, which is the date that the agreement is expected to come into force.

Amendments to Controlled Foreign Companies (CFC) rules

The Government is introducing legislation to prevent a potential loss of tax by amending the new CFC rules and limiting double taxation relief (DTR) in order to close avoidance and planning opportunities. In line with the new CFC rules the legislation will affect CFCs with accounting periods beginning on or after 1 January 2013.

Part 9A Taxation (International and Other Provisions) Act 2010 (TIOPA) will be amended to ensure that the new CFC rules apply to profits from all finance leases, including those made by way of a hire purchase or similar contract.

Part 9A TIOPA will also be amended to ensure that throughout the new CFC rules, questions of accounting treatment where accounts have not been prepared under either UK generally accepted accounting practice or international accounting standards are considered by reference to international accounting standards.

Part 2 TIOPA will be amended to limit the amount of DTR that can be claimed as a credit by a UK company or given by deduction to a UK company. The limitation will apply when one or more UK companies form part of an arrangement whereby a loan is made from one CFC to another CFC, where the latter is the ultimate debtor in relation to that loan. Where one or more UK companies form part of a conduit in such an arrangement the DTR will be limited to the corporation tax due in respect of the UK corporation tax profits that arise from that arrangement. The new limitation will apply to a UK company that derives profits from such an arrangement which involves CFCs with accounting periods beginning on or after 1 January 2013.

In addition the Government is introducing legislation to amend section 236(4) TIOPA with effect from 1 January 2013 to ensure the arbitrage rules do not apply merely as a result of the application of another territory's CFC rules that are similar to those within Part 9A TIOPA.

1.3 UK and Isle of Man to sign enhanced tax information exchange agreement

HM Treasury has published the following note:

The Government is to sign a tax information sharing agreement with the Isle of Man which will provide HMRC with a range of additional information about potentially taxable income in Manx bank accounts. This is part of a package of measures being developed by the UK and the Isle of Man as part of a shared commitment to combat tax evasion.

Under the enhanced information exchange agreement, the UK and Isle of Man will automatically exchange a wide range of information on tax residents, on a reciprocal basis. To minimise burdens on financial institutions the agreement will follow, as closely as practicable, the UK-US Agreement to improve International Tax Compliance and to implement FATCA. The agreement will be concluded to the same timetable as the agreement currently being negotiated between the Isle of Man and the United States.

Exchequer Secretary to the Treasury, David Gauke said:

"This agreement will significantly boost the UK's ability to tackle cross-border tax evasion. Automatic information exchange is an important tool in boosting HMRC's ability to clamp down on those who seek to hide their money overseas. Our ground breaking agreement with the US sets a new standard in international tax transparency and today's agreement between the UK and Isle of Man to move to much greater levels of automatic exchange is the next step in this process.

For years people said this couldn't be done, so I welcome the progress we have made so far with the Isle of Man. We are looking to reach similar agreements with other jurisdictions and are in discussions with Jersey and Guernsey about enhanced information exchange as part of our common commitment to combat tax evasion."

Details of the necessary operational and implementation requirements are still being discussed and will be announced in due course.

2 Private client

High value residential properties 2.1

We now have the second instalment of the Government's measures to tackle the 'enveloping' of high value residential properties in companies with the publication of the draft Finance Bill 2013 on 11th December. This contains detailed legislation for the proposed annual charge, to be called the Annual Residential Property Tax (ARPT) and modifications to the 15% SDLT charge introduced in March. Disappointingly, the draft legislation on the proposed extension to the capital gains charge to cover the disposal of high value residential property by certain "non-natural persons" did not see the light of day on the 11th. It is likely that HMRC is still working on the fine detail, particularly the inter-action with other charging provisions such as TCGA s13, s86 and s87. However, we were given a broad steer on how the new CG charge will work. The attached briefing note sets out in some detail the proposed measures.

By way of commentary, one would observe that on the whole the consultation process appears to have worked reasonably well. Accepting that the Government was never going to concede on the underlying policy, the focus was on securing sensible exclusions to cover those situations where a property is held in a company for genuine commercial reasons and where there is no tax avoidance present. In the main this has been achieved and the briefing note summarises the reliefs that will be available. It is particularly noteworthy that the exemption for property developers (which was the only meaningful exemption in the original legislation governing the 15% charge) no longer has a requirement for a two year trading history. This will be very helpful where a development is to be in an SPV and will also facilitate structuring of joint ventures.

Whilst these exclusions should cover most situations there is an obvious problem in having wide scope legislation with specific exclusions in that it is difficult to foresee all potential situations which should be taken out of the charge. Undoubtedly anomalies will emerge which may give rise to unfair results. In addition, much of the statutory language is very subjective in nature, which will lead to some uncertainty in applying the tests. Perhaps most disappointing is that the exemptions will not come into force for the purposes of the 15% SDLT charge until Royal assent, usually sometime in July. This will, undoubtedly, lead to some paralysis in the market as purchasers wait until the exemptions take effect.

With regard to the extension to the capital gains charge, there are two very significant developments. The first is that it appears that it will not now apply to offshore trusts, as was originally proposed. This can only be sensible, bearing in mind the policy objective. The second is that there will, it seems, be a rebasing as at 6th April 2013, with only gains accruing after that date falling into charge. This will take away some of the urgency to take action in that it will not now be quite as crucial to get a property out of a corporate envelope before 6th April. Given that the legislation will not appear until next month, there will be a sigh of relief at this as the timetable would, otherwise, have been very tight. Presumably to comply with EU law requirements there will need to be consultation on how the CGT charge should apply to disposals by UK non-natural persons, at a rate of 28%. The examples of calculations shown in the response document also indicate there will be no indexation of the rebased cost. However for further details on how the CGT rules, and indeed the further administrative aspects and exemptions for the ARPT, we will need to wait until at least January.

As to the right course of action in response to these new charges, there will be no single right answer. For some, where an exemption is due, it may well be that no action is required. For many, though, it may be sensible to consider the options for collapsing existing structures and the associated costs and risks. Extracting properties without crystallising or increasing exposure to tax charges will need some care. There will be a variety of fact patterns and each must be approached on its own merits with an appropriate bespoke solution. We do, though, now have some certainty on the shape of the provisions to enable us to make sensible assessments of the possible options that should be considered.

www.smith.williamson.co.uk/uploads/publications/241-briefing-note.pdf

2.2 Holdover relief claims and Heritage Maintenance Funds

The Government announced at Budget 2012 that it would aim to introduce a measure in Finance Bill 2013 to remove an unintended double income tax charge on income reimbursed to beneficiaries of heritage maintenance funds (HMF)

The double income tax charge applied because the trustees would be liable to income tax on the income generated within the HMF and in addition the owner-beneficiary of the actual heritage property was also taxed when he received a reimbursement from the HMF. The effective tax rate on the reimbursed income could be as high as 75%.

The unintentional, but not uncommon, circumstances where a double charge to income tax would arise were:

- The beneficiary (who was also the settlor of the HMF) operated a trade or rental business from the heritage property (usually a house opening business);

- A CGT holdover relief claim was needed when assets were gifted

to the HMF on its creation or on a re-settlement;

- As a result of the Finance Act 2006 it was necessary for the trustees to make an income tax election which was the only way in ensuring the CGT holdover relief claim was possible.

It was the enforced income tax election which resulted in the reimbursed income also being taxed which led to the double income tax charge. In effect, this taxable reimbursement reduced the otherwise allowable trading expenditure of the owner.

After a period of informal consultation over the summer, legislation will be introduced next summer with effect from 6 April 2012, so that it will not be necessary for the trustees to make an income tax election to ensure a CGT holdover relief claim is possible.

When the original announcement was made in Budget 2012 the implication was that these changes may only apply to HMFs which had been resettled. However, it is notable that they are actually intended to apply on both a re-settlement of a HMF as well as on the creation of a new HMF.

The change in the legislation will mean that a beneficiary of a HMF who operates a business, for example a house opening business, from his heritage property will be able to claim a tax deduction for genuine allowable expenses and will also be able to receive a tax free cash receipt from the HMF.

This should substantially reduce the overall tax burden for beneficiaries of HMFs with the circumstances noted above and will certainly produce a noticeable increase in cash-flow which is very welcome news indeed.

3 PAYE and employment matters

3.1 Simplification of employee benefits, expenses and termination payments

Paragraph 2.96 of the Autumn Statement says that the Government "will ask the Office of Tax Simplification (OTS) to carry out a review of ways to simplify the taxation of employee benefits and expenses and employee termination payments. This will include an initial scoping exercise to identify which areas are most complex for taxpayers. Further details will be provided by the OTS shortly."

IR35/Controlling Persons/Office

3.2 Holders

The Government has dropped the proposal that had been put forward for consultation that would have made those who engage "controlling persons" through personal service companies liable for tax under PAYE and Class 1 NIC on fees paid. That proposal had been made because workers fulfilling the role of office holders through intermediaries were escaping the IR35 net either by default (and a lack of resource within HMRC to enforce the legislation adequately) or because the legislation was perceived as being flawed as it only imposed liability to tax where the underlying relationship between the parties amounted to employment thus excluding the holding of an office.

This news was very welcome to all those businesses that engage with individual office holders through personal service companies or other intermediaries. For the office holders, however, that was not the end of the matter.

A draft clause for inclusion in the Finance Bill has been published which will amend section 49 ITEPA 2003, which defines the engagements to which IR35 applies, and increase its scope from April 2013. The existing legislation currently refers only to circumstances in which the worker would be regarded as an employee of the client, had they contracted directly, and this is to be expanded to include situations where either the worker or the intermediary holds an office with the client.

The change in the legislation is intended to close the unintended loophole in the IR35 regime. It impacts on the same population that was being targeted under the proposals that were issued for consultation, but it now relies on the owners of the intermediary organisations, rather than the clients for whom they work, to recognise their compliance obligations and apply them. In practice, little is likely to change unless and until HMRC ramp up the pressure on the users of personal service companies and other intermediaries to comply with IR35.

4 Business tax

New cash basis for small businesses 4.1

The Government has issued draft legislation following the consultation on "Simpler income tax for the simplest small businesses". A Smith & Williamson briefing note will be available shortly.

The Chartered Institute of Taxation has issued the following press release regarding the new system.

"Describing this legislation as 'Simpler Income Tax for the Simplest Businesses', is misleading: the latest proposals are anything but simple. Far more changes need to be made in a short period of time to ensure this new regime is intelligible to and workable for small businesses.

As drafted, the proposals permit small businesses to move in and out of the cash basis each year, yet provide restrictive rules on losses and interest relief. A wide range of technical tax adjustments will still have to be made. The result of this will be a need to make detailed calculations every year to make sure you do not lose out. No unrepresented person will be able to cope adequately with such computations, which means incurring costs for advice to get a fair result. That is a further burden on small business and one that would be unnecessary in a properly designed simple system.

HMRC's radical revisions to the Office of Tax Simplification's proposals have resulted in additional rules that make the system far more complex than necessary and inherently unattractive as a package to small businesses at a vulnerable stage in their development.

We note that the Government has now partially addressed the problem for businesses with turnover over £77,000 where the business owner has to use the cash basis for Universal Credit, which will potentially mean such businesses only have to prepare two sets of accounts - one for direct tax and Universal Credit and one for VAT purposes, instead of three sets. But reducing an additional burden from triple to double does not look like a good deal for small business.

The CIOT has suggested a rethink to prevent the new regime being seen as anti-business. We note that HMRC have already indicated a willingness to consult further and hope the Government will challenge HMRC to grasp this opportunity to make life truly simpler for smaller businesses and make real and significant changes to the proposals. Missing this opportunity for genuine simplification would be a real loss for the UK's small businesses."

4.2 Enterprise Investment Scheme

HMRC's Venture Capital manual provides the following guidance at VCM21050 (www.hmrc.gov.uk/manuals/vcmmanual/VCM21050.htm):

A company whose new shareholders ask it for certificates enabling them to claim relief (whether income tax relief or CGT deferral relief) cannot issue them without first obtaining authority from HMRC. To do this the company must furnish HMRC with a statement to the effect that the conditions for the relief (apart from any which relate to the subscriber) have been satisfied so far, and that it intends to ensure that they continue to be satisfied. It is therefore not possible for a company to obtain authority to issue certificates once it has ceased to satisfy any condition. Thus, coming under the control of another company would make the issue of certificates impossible even where, had relief already been obtained, it would have been preserved by the operation of ICTA/S304A, ITA/S247 or TCGA92/SCH5B/PARA8 (see VCM20550).

For EIS relief, ITA s185 provides that the issuing company must not at any time in period B (the period beginning with the issue of the shares and ending with the termination date relating to the shares - the third anniversary as described in ITA s256) be a 51% subsidiary or under the control of another company. However ITAs247 sets out the conditions for continuity of EIS relief where the issuing company is acquired by a new company, and s247(4) specifically disapplies s185 in relation to an exchange of shares.

Application by the company for clearance that a share issue meets the requirements for EIS relief must be made on form EIS1. If approved, HMRC will send the company form EIS2 as authorisation that the company can issue forms EIS 3 to the subscribers of the qualifying share issue indicating that the individuals can claim EIS relief. A company has two years from the end of the tax year in which the shares were issued (or the conditions for relief were meet if later) to file form EIS1 (ITA s205).

We have had experience of HMRC refusing to issue form EIS2 and the accompanying blank EIS3 forms where a company had applied for shares to be EIS shares, but after the share issue and prior to the filing of form EIS1 the company had been taken over (form EIS1 was filed within the time period specified in ITA s205). There had been previous EIS share issues for the relevant company which had been approved.

The reason given for the refusal was the guidance quoted above in VCM21050, and HMRC's interpretation of s247(1)(e)(ii) which was that the compliance certificate (EIS2) had to be issued prior to the issue of the takeover shares.

This interpretation appeared to ignore the particular provision of ITA s247(4) disapplying ITA s185, and the fact that s247(1)(e) says no more than at some time before the issue [of the takeover shares] compliance certificates have been issued. There is no requirement that such certificates have to have been issued before the share for share exchange in respect of all issues of EIS eligible shares prior to the exchange. As there is a two year period in which to file form EIS1 it may well be that the documentation to support a qualifying EIS share issue is finalised after a takeover.

We have now received confirmation from HMRC that it now agrees with this more practical interpretation of the legislation.

5 VAT

5.1 Input VAT on tax services provided to partnerships

The disallowance by HMRC of input VAT on tax services provided to a partnership was the subject of a First tier Tribunal case concerning Mundays LLP. The Tribunal concluded that input tax on approximately 52% of regular costs was recoverable as a business expense. This was despite the fact that generally 82% of the costs were allowed as deductible for direct tax purposes.

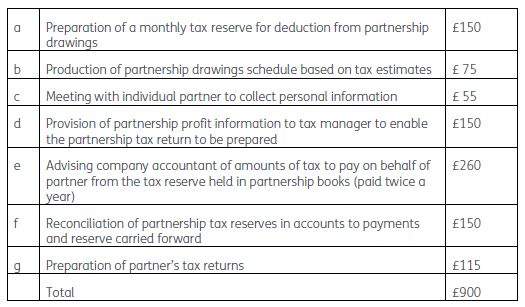

The tax advisers provided tax advice for the partnership, allocating their costs between different services per partner (there were 23 partners) as follows:

In addition ad hoc tax work was provided on recalculating tax reserves when partners joined and left the partnership (referred to in the case as item (h)).

The Tribunal concluded items (c) and (g) related to the partners individually and not to the partnership business. The Tribunal concluded that expenditure on item d was an inevitable expense of carrying on the business in partnership and would form part of the partnership's general overheads and for VAT purposes would be fully recoverable.

Items a, b, f and h were found to have a purpose (keeping the tax reserve as working capital for the business) and a benefit to the business (not a purpose), where the benefit was some assurance that cash was available to meet tax liabilities of individual partners therefore avoiding reputational risk to the business potentially caused by non-payment of tax. They concluded that input VAT on these costs should also be fully recoverable.

The Tribunal concluded that the remaining costs (items c, e and g) were not incurred for the purpose of the partnership business and input VAT on these costs should be disallowed.

The argument had been put forward that these costs were de minimis from a VAT perspective in line with a concessionary treatment operated by HMRC and set out in HMRC's manual VIT13700. However as the practice was concessionary and in the context of the total cost per year to the partnership, these amounts were not small and HMRC were therefore entitled to refuse repayment of the related input tax.

www.bailii.org/uk/cases/UKFTT/TC/2012/TC02374.html

6 Tax publications

NTBN239: Finance Bill 2013 - Draft Clauses - Heritage Maintenance Funds

Outline of the measure to remove an unintended double income tax charge on income reimbursed to beneficiaries of heritage maintenance funds.

NTBN240: Finance Bill 2013 - Draft Clauses - Inheritance Tax

Outline of the draft Finance Bill 2013 clauses increasing and linking the IHT exemption to the nil rate band, for transfers from a UK domiciled individual to their non-UK domiciled spouse/civil partner and the introduction of an election to be treated as UK domiciled for IHT purposes.

NTBN241: High Value Residential Property in the UK

Outline of the draft Finance Bill 2013 clauses in relation to the purchase and ownership of high value residential properties in the UK.

NTBN242: Autumn Statement 2013 - Taxation of Pensions

Summary of the changes announced in the Autumn Statement 2012 to the taxations of pension savings: reduction of annual and lifetime allowances from April 2014 and an increase to the capped drawdown limit.

NTBN243: Statutory Definition of Tax Residence

Outline on the draft Finance Bill clauses in relation to the proposed statutory residence test to apply from 6 April 2013.

NTBN245: Reform of two key offshore anti-avoidance provisions - Finance Bill update

Overview of the draft Finance Bill clause on proposed amendments to the rules for (1) gains attributed to members of a close NR company, s13 TCGA 1992 and (2) the transfer of assets abroad.

NTBN246: GAAR - Finance Bill update

Outline of the draft legislation and discusses the draft guidance for the new General Anti-Abuse Rules as published on 11 December 2012.

NTBN247: Finance Bill 2013 - Draft Clauses - Limit on income tax reliefs

Background and explanation of the proposed cap on currently unlimited income tax reliefs from 6 April 2013

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.