Public M&A – as with all M&A – saw a drop in global activity in 2023 with fewer mega, transformational deals in particular. But activity continued, in particular with takeovers of smaller companies, and towards the end of the year we saw signs of a return to normal levels of activity.

As interest rates stabilise and the markets face less uncertainty, we expect public M&A activity levels to continue to pick up.

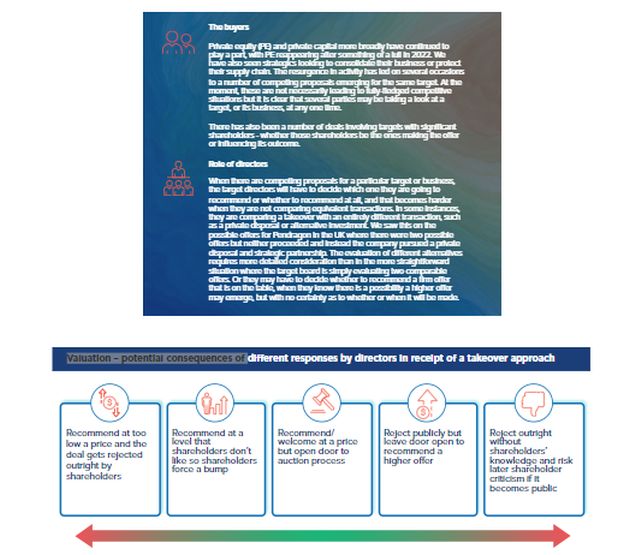

Parties are no longer deterred by the regulatory regimes discussed in our "Merger control, FDI and FSR" section – they have simply become part of the transactional jigsaw, which may affect the timetable but rarely fatally disrupt a deal. The biggest issues for public M&A parties in 2023 were the different valuation expectations that parties and/or their shareholders had, and how to bridge those expectations; and for target directors, deciding at what point a deal should be recommended – or which deal to recommend, when they may be comparing very different proposals.

❝ In Australia, the buy-side triumvirate of corporates, private equity and private capital are hungry for deals, and no target is too big. Listed company boards need to execute their strategic plans and make sure their shareholders understand the path to value creation. Failing on either count puts boards squarely in the sights of a takeover proposal.❞

Amelia Morgan, Sydney

❝ In France, there were significantly fewer transactions in 2023 than 2022: there were 56 deals involving a French public company target in 2023, compared with 80 in 2022.❞

Frédéric Bouvet, Paris

❝ In the UK, although average deal values were lower, an uptick in activity, particularly in Q4, meant we saw more firm offers in 2023 compared to 2022, with mid-market public-to-private transactions a bright spot. We expect this trend to continue into 2024, helped by lending conditions easing.❞

Laura Ackroyd, London'

"Newcrest's A$26 billion sale to Newmont demonstrates that a scrip (all-share) merger in commodities (in this instance, gold) can survive choppy markets and commodity price volatility.

Rodd Levy

Melbourne

"We have seen some very close shareholder votes in the UK, with meetings being adjourned at the last minute to give time to drum up more shareholder support. And even then the deal may still get voted down.

Robert Moore

London

Outlook for 2024

We are optimistic that 2024 will be a busy year for public M&A, with the return of more stable economic conditions. PE buyers have money to spend and strategics are still looking for deals to expand or transform their businesses. Target boards will have to consider carefully which is the right deal and what is the right price.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.