2023 has been a record-breaking year for the bulk annuity market and reinsurers have been busy providing longevity reinsurance to back these bulk annuities, as well as writing longevity swaps with pension schemes. Matt Wiberg and Rhys Mellens share views on current trends in the longevity swap market and pricing developments.

During the year the BT Pension Scheme (£5bn) and the Marsh & McLennan Companies (MMC) UK Pension Fund (£2bn) completed their second longevity swaps. The Yorkshire and Clydesdale Bank Pension Scheme (£1.6bn) and the Nationwide Pension Fund (£1.7bn) also completed their first longevity swaps.

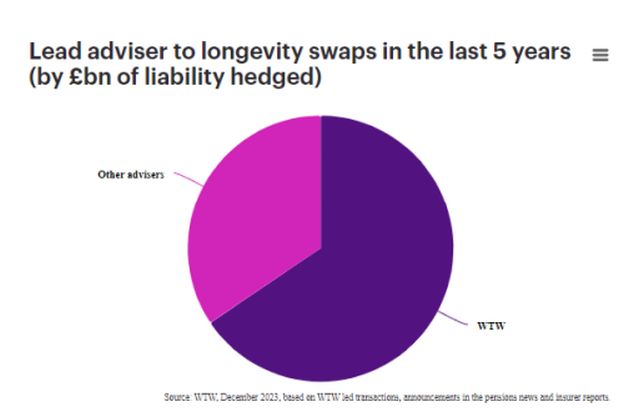

This was the fifth year in a row that at least four UK pension schemes completed longevity swaps and volumes exceeded £10bn. Over that period from 2019, 24 longevity swaps have been written totaling nearly £80bn of liabilities and WTW has been lead adviser on 12 of these covering over £50bn of this total.

Much of the activity in the market was repeat deals or cases that were well advanced prior to the September 2022 Mini Budget. Since then others have pivoted towards full scheme buy-in or a long term buyout target, perhaps initially suggesting a tailing off of activity in the longevity swap market. However, as noted earlier in the report, in light of the Mansion House proposals and the proposed flexibility of use of surpluses/encouragement to invest in productive assets some schemes are now looking to run on for an extended period - this we expect to result in action to hedge unrewarded risks such as longevity.

Current trends in the longevity swap market

Non-pensioner longevity swaps

In 2021 we led a ground-breaking non-pensioner longevity swap for the AXA UK Group Pension Scheme, opening up the longevity market for pension schemes to reinsure non-pensioners. 2023 saw the second largest longevity swap to include non-pensioners, the MMC UK Pension Fund's transaction with Munich Re, demonstrating the increased demand for non-pensioner longevity swaps and the growing ability of reinsurers to cover these members.

Competition for swaps of all sizes

Whilst larger swaps, like those completed by the BT Pension Scheme, often attract the headlines, there are currently several longevity swaps in the market which are sub-£1bn. Whilst the dynamics may be slightly different to the larger swaps, there continues to be strong competition for cases of all sizes from reinsurers. In many cases these smaller swaps are for schemes who, pre-LDI crisis, would have pursued pensioner buy-ins, but now prefer longevity swaps given their reduced impact on liquidity.

Longevity swaps being used to hedge bulk annuity pricing

We often hear that longevity swaps are only suitable for schemes that have no intention of buying out in the foreseeable future. In our view this is not the case and clients are increasingly considering longevity swaps as an effective tool to reduce the risk of bulk annuity pricing moving against the scheme. This is supported by the fact that multiple pension schemes have now 'novated' longevity swaps to bulk annuities.

Hedging longevity risk, or hedging bulk annuity pricing risk?

Longevity reinsurance is one of the key building blocks of bulk annuity pricing – the majority of bulk annuity insurers put in place longevity reinsurance when they take on the liabilities, so if the cost of this goes up then buyout pricing will follow. Reinsurer pricing is currently at its lowest in recent memory relative to pension scheme reserves (more on this later) and locking into this now will reduce the risk that reinsurance pricing is more expensive when the time comes to fully buy-in or buyout (e.g. due to supply / demand dynamics in the market, higher life expectancy or market conditions).

The reduction of one of the key risks to the affordability of a future bulk annuity needs to be weighed up against the cost of putting in place and maintaining the hedge, and we wouldn't typically recommend a scheme that's only a few years away from buying out considering a longevity swap for this reason. However, pension schemes targeting full buy-in / buyout over a slightly longer timeframe wouldn't typically be comfortable with leaving other pricing risks unhedged, such as interest rate and inflation, so it is not surprising that more schemes are considering whether they should be hedging longevity risk as such a significant risk to the journey plan.

And whilst longevity expectations may not be as volatile as financial markets, recent experience has shown that longevity expectations can change significantly over the period of just a few years. Projections of future life expectancy have fallen over the last 10 years, but could this trend reverse in future and make buyout unaffordable for some schemes that haven't hedged this risk?

Longevity reinsurance pricing

In last year's report, we outlined three key reasons why the cost of longevity reinsurance reduced materially over 2022:

- Increased market capacity and competition

- Rise in global yields

- Recent mortality experience

These trends have continued in 2023, which means pricing has improved further. Reinsurer fees for longevity reinsurance are at an all time low, leading to reductions in pricing for longevity swaps and attractive bulk annuity pricing.

However, when considering pricing for longevity risk it is important to look at the underlying longevity assumptions as well as the reinsurer's fees. Reinsurers have their own views on longevity expectations which may differ from the scheme's view, and any difference in views will influence the attractiveness and may make the cost of a longevity hedge appear more or less expensive to the scheme.

Let's consider two key assumptions where views may differ between reinsurers and a scheme:

Base mortality

'Base mortality' is the mortality rate for members at the current date with no allowance for future longevity improvements. Reinsurers typically set assumptions for this through a combination of the scheme's own recent mortality experience, characteristics of the scheme's membership such as pension amount or postcode, and mortality experience in the general population. This is not dissimilar from the approach typically taken by pension schemes, although reinsurers may place different credibility weightings on the scheme's own mortality experience and use different postcode models.

Initially following the outbreak of the COVID-19 pandemic, much like the approach adopted by pension schemes, reinsurers generally chose not to factor in mortality experience over the COVID period when setting base mortality assumptions. However, more recently reinsurers have increased their allowance for 'COVID experience' in their assumptions, using sophisticated methods to remove any distortion from COVID in their analysis.

Future improvements

Pension schemes often set assumptions for future improvements in mortality based on publicly available models, such as those produced by the Continuous Mortality Investigation (CMI). As a result, there can be a step change in longevity expectations for pension schemes when a new iteration of the model is released, such as the CMI 2022 model which was released in 2023 and led to a reduction in life expectancy (versus the previous CMI 2021 model).

This 'step change' is not typically observed in reinsurance pricing, as reinsurers typically review their future improvement assumptions on a continuous basis and set their own bespoke future improvement assumptions allowing them greater flexibility in the assumptions they adopt. This also means they may have already reflected more recent data in their pricing by the time the latest CMI model is released.

Reinsurers have made significant advances in their approach to allowing for COVID in their pricing and these changes have broadly mirrored the reduction in life expectancy typically allowed for by pension schemes over the last few years.

In addition, the impact of high levels of competition in the market and rising yields has reduced reinsurance fees. In combination this means that the cost of a longevity swap has improved, relative to best estimate assumptions, for most pension schemes. This presents a significant opportunity both for schemes to lock in a key element underlying bulk annuity pricing, and for those looking to run-on. We expect a busy and buoyant longevity swap market in 2024 as a result.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.