The changing REIT landscape

The UK Real Estate Investment Trust ("REIT") regime launched on 1 January 2007, and immediately saw a number of the UK's largest listed property companies convert to REITs. The following five years have seen further REIT conversions as well as the launch of a number of start-up REITs. As at 1 April 2012 there were 24 UK REITs.

Significant changes to the REIT regime were announced in the 2011 Budget and draft legislation containing the detailed provisions was published on 29 March 2012.

The proposed changes to the REIT regime are farreaching and will significantly increase the attractiveness of the regime to a wider pool of property investors and providers of capital. The changes are aimed at reducing barriers to both entry and investment in REITs.

Although the new rules will not take effect until the Finance Bill becomes law (expected July 2012), those considering REIT conversion in light of the proposed changes will now be able to plan ahead with greater certainty.

The proposed changes to the REIT regime will benefit many

Those expected to benefit most significantly from the proposed changes include:

All existing and future REITs

- The abolition of the 2% entry charge for companies entering the regime will significantly reduce the cost of entering the REIT regime, and may also result in more properties being acquired and sold within corporate

- Allowing cash to be a 'good' asset for the purposes of the balance of business assets test will make it easier for start-up REITs to raise funds to be spent over time. It will also make it easier for existing REITs to raise additional capital from shareholders.

Institutional investors

- The new diverse ownership rule for institutional investors will enable small 'clubs' of diversely-owned institutions to form REITs, where this previously may not have been possible (although the REIT's shares will still need to be either 'listed' or 'traded' on a recognised stock exchange).

Start-up and closely held/family owned property

- The proposed three year grace period for new REITs to meet the non-close company requirement will enable property companies to build sufficient reputation to attract new shareholders without prejudicing their ability to enter the REIT regime at the beginning of the three year period.

AIM and PLUS market (and overseas equivalent) traded companies

- Relaxation of the requirement for a REIT to be listed on a 'recognised stock exchange' will enable AIM and PLUS market (and overseas equivalent) traded companies to obtain REIT status without requiring e.g. a full London listing.

Offshore property companies

- The abolition of the 2% entry charge for companies entering the regime may make the 'on-shoring' of UK properties that are currently held offshore (and already outside the scope of Capital Gains Tax) much more attractive.

Key benefits of REIT status

REIT status affords a number of commercial and tax benefits, including:

Access to the global REIT "brand"

REITs are recognised globally as tax efficient structures for investment in real estate. As at September 2011, there were 35 countries worldwide that have REIT or 'REIT-like' regimes in place. They are known and understood by both investors and analysts worldwide.

Attractors of international capital

REITs have a proven track record of attracting international capital. There are significant investment pools and fund allocations specifically designated for investment in REITs, and conversion to REIT status can often unlock new sources of funding.

A liquid and publicly available source of property

Depending on what exchange a REIT is listed on, the REIT regime provides a method by which investors can tap into a liquid and publicly available source of property investment.

REITs may be attractive to investors for the following reasons:

- Easier access to property investment compared to purchasing a property directly.

- Indirect investment into property through a readily tradable investment asset, as compared to direct investment into property, which is generally illiquid.

- Diversity of investments across a range of property assets.

- Access to parts of the property sector that private investors cannot usually access e.g. shopping centres or industrial property.

- Regular income returns.

- Lower transaction costs, i.e. 0.5% stamp duty on shares compared to 4% SDLT on property.

Key benefits of REIT status

- Access to the global REIT "brand".

- Attractors of international capital.

- A liquid and publicly available source of property investment.

- Improved after-tax returns for shareholders.

- " Effective elimination of latent capital gains.

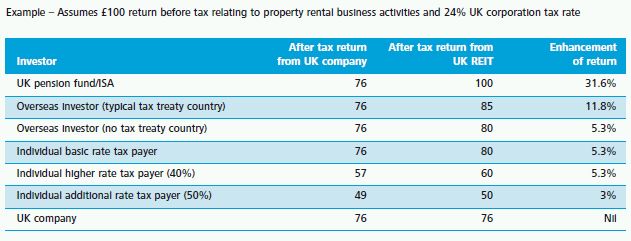

Comparison of after tax returns in investing in a UK taxable company and a UK REIT

To read the remainder of this article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.