FARM INCOMES BOOM

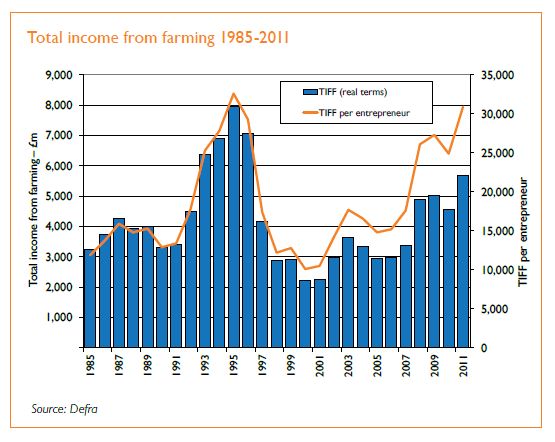

2011 was a very successful year for farm businesses, with profits hitting their highest levels for 15 years. This impressive performance is shown in the latest total income from farming figures released by Defra in May.

Total income from farming

The total income from farming (TIFF) figures show the returns to entrepreneurs (farmers) in UK farming – they are a close reflection of the aggregated profit for the agricultural industry. For 2011, profit is (provisionally) put at £5.69bn. This is a 25% improvement in real terms over the 2010 figure. This profit is also the industry's best performance since 1996, and is £0.5bn higher than the next best year in that 15-year period (which was 2009).

Output rose by 15% between 2010 and 2011 (at current prices), with crops increasing by 21% and livestock by 15%. This increase outpaced the rise in costs with 'intermediate consumption' (basically variable costs) going up by 10%. Other costs rose 14%, with subsidies remaining unchanged.

It is important to highlight that these figures are still only provisional and revised ones will be published in November. There is a history of quite large revisions and this year is expected to be no different. Our view is that, if the figures are going to change, they will come down. Defra's release states that it has collected only 30% of the data on variable costs and 55% of the data on other costs. Given that Defra is therefore likely to find more costs, we could end up with a TIFF closer to £5.25bn.

Returns per entrepreneur

The returns per entrepreneur (per farmer) are even more impressive. As the industry gradually restructures, farm sizes are increasing and the number of farmers is slowly declining. The result is that the returns are being shared by fewer people. This sort of change is normal and is even necessary for the survival of any healthy industry. The TIFF per entrepreneur is almost at the same highpoint as that reached in the mid-1990s.

Looking ahead

Looking to 2012 we would expect incomes to fall back a bit more – possibly to an overall profit for the sector of around £5bn. On the output side, crop prices may be slightly down on 2011 as the market has weakened a little. Milk prices are heading down (however, we are already part way through the year, and prices are higher than the equivalent period in 2011). Beef and lamb prices remain strong, and pig values should pick up towards the end of the year. Poultry is a sector that often gets overlooked, but it contributes a big element to TIFF. Output values seem reasonable there too – especially with egg prices going up.

The reason for our forecast decline in TIFF in 2012 is costs, which climb relentlessly upwards. The single biggest cost item in the UK agricultural accounts is animal feed. Fuel price rises are welldocumented and other costs, such as machinery, will also rise compared to 2011. Taking these factors into account we arrive at our decline in profitability to somewhere in the region of £5bn (possibly a bit below). Before getting too despondent by this outlook, it is worth remembering this would still be considerably better than some of the returns seen between the mid-1990s and early 2000s (double in some cases). However, any predictions on incomes come with a big health warning regarding currency. Any significant realignment of the pound versus the euro could occur quickly, making great impacts on the profitability of the agricultural industry. There have already been substantial movements recently.

MEGA MILK MERGER

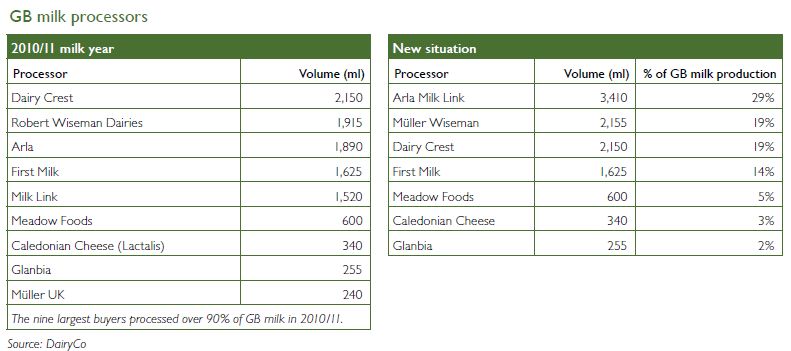

The announcement of a merger between Arla and Milk Link looks set to form the basis of a major reshaping of the UK dairy processing sector.

A merger between Arla and Milk Link would create the UK's largest dairy processing business (see table below). This follows the Müller takeover of Robert Wiseman earlier in the year, and creates a very different processing landscape for UK dairy farmers.

Over 99% of Milk Link's farmer members voted in favour of the merger. The deal must also be agreed by Arla's Danish parent company and both EU and UK regulatory authorities. Arla appears to be on the acquisition trail, also announcing a merger with Milch- Union Hocheifel (MUH), a large German dairy co-operative.

Milk Link members will become full members of the Arla co-op – with exactly the same rights and terms as farmers in Scandinavia and Germany. Members of the existing Arla UK supply group, the Arla Foods Milk Partnership (AFMP) are not part of the merger process and AFMP members will continue to sit outside the main Arla co-op. AFMP producers' milk price will be set separately from the co-op price and from 1 July 2012 Milk Link farmers received a higher milk price than non-aligned AFMP producers.

AFMP are unlikely to be happy to be overtaken by Milk Link farmers in the race to become full members of Arla. The argument is that Milk Link members have invested considerable sums in their co-op to get it to a point where it is an attractive takeover prospect. AFMP farmers have not put the same sums in. However, this merger may well accelerate moves to bring AFMP within the full co-op structure. The terms of the deal are somewhat complicated. Some of the main points are as follows.

- Milk Link members got 1p per litre (ppl) added to their milk price from 1 July, to continue for three months.

- From 1 October, a pricing formula based on either a discount to the Arla co-op price or a premium to a basket of prices from major UK milk buyers will apply.

- Arla Milk Link members will become fully aligned with full Arla co-op members from 1 October 2016. They will then be eligible for the '13th payment' co-op bonus.

- The Arla milk price is set in Danish krone. To remove some of the effects of currency fluctuations a smoothing mechanism based on a rolling two-year average will be used to convert to a sterling price for UK farmers.

- A maximum of 5ppl of Milk Link members' capital will be rolled into Arla, with any excess being paid out.

The merger has been widely welcomed by the industry. It appears to have been a logical move for Arla – adding Milk Links considerable UK cheese business to Arla UK's spreads and liquid milk operations. It also provides Arla with far more clout in the marketplace, and perhaps a better negotiating position with the major retailers. Milk Link farmers who have stuck with the co-op for the last 12 years should end up with a better milk price. It is calculated that Arla members have received a milk price 10% higher on average than Milk Link producers over the past five years.

The UK farmers will get the benefits of being full members of a massive EUwide dairy business that is farmer-owned. The enlarged Arla will have over 12,000 members and process 12 billion litres per year in total – almost equivalent to the entire UK milk output. It appears a good outcome all round, but only time will tell. The next question is 'what happens now?' in terms of rationalisation. Dairy Crest has undertaken some restructuring, but looks to be the next candidate. There is a school of thought that to really reduce the power of the retailers the current 'big three' liquid processors needs to reduce to just two. This would require Dairy Crest's liquid business ending up with either Wiseman Müller or Arla.

Whether the competition authorities would allow this, and what would happen to Dairy Crest's other businesses, especially cheese, is uncertain. Also not at the party so far is the First Milk cooperative, who should not be forgotten. It seems unlikely that this story has played out yet.

BATTLING ON – THE FIGHT AGAINST BOVINE TB CONTINUES

On the back of a continuing battle with bovine TB, a series of measures have been introduced to try and reduce the risks of the disease spreading between cattle.

Changes to the rules on cattle movements were announced last year and included tighter controls around linked holdings. From the 1 July 2012 no new sole occupancy authorities (SOAs) are to be approved or additions to existing SOAs allowed. An SOA is a group of premises under the same management which are linked to overcome the six-day standstill when animals are moved between those premises. Existing SOAs can continue, but the exemption from pre-movement testing for movements from holdings in high risk areas to low risk areas is no longer available. No new cattle tracing system (CTS) links between holdings in high and low TB risk areas will be approved. Existing links (between high and low areas) without an expiry date will be removed on a phased basis.

These changes will not prevent the movement of animals between holdings, but movements will have to be reported. Those producers affected will be contacted by British Cattle Management Service (BCMS). Farmers who would have previously applied for a CTS link (between holdings in high and low TB risk areas) now have the following options.

1. The parties agree to the landlord becoming the keeper of the cattle when they are on the rented land. Movements between the holdings will need to be reported and recorded as normal including pre-movement testing and any standstill provisions.

2. Where keepers cannot or do not take up option 1 above, they will need to secure a temporary county parish holding (CPH) number for that land. This can be undertaken via the Rural Payments Agency.

A CTS link is where a CPH number is linked with another which allows the keeper to move cattle between the linked holdings without having to inform BCMS of the movement. These are often used with grazing licences or where producers have multiple holdings.

It would appear that if option 1 was undertaken, the landlord would then become liable for all the identification and movement cross-compliance responsibilities which, if not adhered to, would involve possible single payment penalties. This is an important consideration to protect single farm payment receipts. In many cases, however, the landlord would not have anything to do with the cattle and could not be considered the 'keeper'.

Some further cattle control measures have also been introduced. These include:

- the removal of the exemption which allows cattle on a farm for under 30 days to be removed without being tested

- the removal of the exemption from pre-movement testing of cattle from higher TB risk herds to agricultural shows where cattle are housed or remain there for more than 24 hours.

- reducing the compensation paid if tests are overdue by more than 60 days.

NEWS UPDATE

Grocery watchdog moves closer

The introduction of a new Groceries Code adjudicator took an important step forward when the Bill was introduced into Parliament in May. The Grocery Supply Code of Practice was brought into force over two years ago now, but without an enforcement mechanism its usefulness has been widely questioned. The introduction of an adjudicator has been welcomed by both suppliers and producers alike. The new body will enforce the Groceries Supply Code of Practice which was put in place after a study of the market by the Competition Commission back in 2008 identified competition issues. The adjudicator will be able to:

- arbitrate disputes between retailers and suppliers

- investigate confidential complaints from direct and indirect suppliers, either from the UK, overseas or third parties

- 'name and shame' offenders

- fine supermarkets if other solutions aren't working (and the Secretary of State grants these powers).

The first reading of the Bill took place on 10 May, a formality that signals the start of the journey through the Lords and the House of Commons. This process will probably not be completed until 2013, although many will be hoping for a swift passage through to Royal Assent.

SINGLE PAYMENT SCHEME ROUND-UP

Just over 103,000 2012 single payment scheme applications were submitted to the Rural Payments Agency this year, slightly down on the 105,000 in 2011. The popularity of online applications continues to grow. This year 42% were submitted online compared to 29% in 2011.

Campaign missing the mark

The Campaign for the Farm Environment (CFE) has been extended to the end of 2012. The objective of CFE is to "retain and exceed the environmental benefits that used to be provided by set-aside". New data on a number of the targets has been released in Defra's third ongoing monitoring survey, Survey of Land Managed Under the CFE. The latest statistics indicate that the campaign is falling short of many of its targets, although it has achieved some. Progress is being measured against a 'baseline' of the 2008/09 cropping year. The survey covered 5,500 farms which are intended to provide a representative sample of the estimated 43,300 farms that fall within the scope of the campaign. The table below summarises progress against some of the main targets.

PUSHING THE ENVELOPE

Susan Shaw discusses HMRC's consultation on an annual charge on 'enveloped' houses owned by companies.

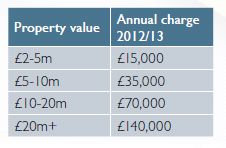

Following the Budget, the Government is consulting on the introduction of an annual charge from 2013. This is to apply to residential property, for example farmhouses, worth more than £2m, where such a property is 'enveloped', to deter stamp duty land tax (SDLT) avoidance. Enveloped is defined as where a property is owned by a company and other bodies corporate, collective vehicles and partnerships including one or more such entities.

The interest to which the charge will apply will be the freehold or leasehold interest owned by the corporate body. Where, for example, we have an Agricultural Holdings Act (AHA) tenancy over a residential property owned by a company, the consultation seems to indicate the charge will apply if the freehold value exceeds £2m.

The charge will be applied to enveloped properties based on the property's value as at 1 April 2012 if held on that date, or its value at acquisition, creation or cessation of a relevant interest if later. This value will be used for the charge during the five-year period from 1 April 2013 to 31 March 2018. A new valuation will be required on 1 April 2017 for all properties within the charge on that date, plus those properties not previously within the charge, but whose value has increased sufficiently to put them within the charge. There will be a requirement to submit an annual charge tax return under self-assessment. It will be the taxpayers' responsibility to obtain a valuation of their property and also to take proper care to establish a correct valuation if they believe their property is below the £2m threshold.

The rate of tax proposed is as follows:

The question has to be whether this charge will come to fruition. The rationale for suggesting this tax is because of the prevalence of enveloping high value residential properties and the potential for SDLT avoidance on subsequent changes of ownership. The annual charge is being introduced to encourage those who own UK residential properties valued over £2m in envelopes to take them out of those envelopes.

However, this has rather missed the point that many long-standing UK businesses have owned properties in these structures and tax avoidance is not the issue. In fact an employee occupying a residential property held in a company suffers tax through the benefit in kind regime and no principle private residence relief is available to the company on a sale. Due to the length of time some of these companies have held such properties there can be significant potential capital gains tax liabilities from a de-enveloping exercise. It is to be hoped that this will become clear to the Treasury during this period of consultation and that the scope of this charge will be reconsidered. However, in the meantime care should be taken to avoid enveloping any residential property, for example by way of a corporate partnership, until the final legislation is known.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.