The FCA and PRA have confirmed that the next 12 months will be a critical period in transitioning away from the use of LIBOR, advising firms to accelerate their efforts to cease reliance on LIBOR by end-2021. The regulators will step up engagement with firms on LIBOR transition and have contacted senior management responsible for overseeing the transition to set out their expectations for the coming months.

In a suite of documents published last week, the Working Group on Sterling Risk Free Reference Rates (RFRWG), together with both regulators and the Bank of England (BoE), set out the priorities and other actions market participants should take to reduce LIBOR exposure. The documents published include:

- Joint PRA/FCA letter to senior managers of major banks and insurers – Next steps on LIBOR transition

- FCA and BoE statement encouraging switch from LIBOR to SONIA (Sterling Overnight Index Average) for sterling interest rate swaps from 2 March 2020

- RFRWG's priorities and roadmap for 2020

- RFRWG statement on the use cases of benchmark rates: compounded in arrears, term rate and further alternatives

- RFRWG factsheet – Progress on the transition of LIBOR-referencing legacy bonds to SONIA by way of consent solicitation

- RFRWG factsheet – Calling time on LIBOR: Why you need to act now

Milestones for transition

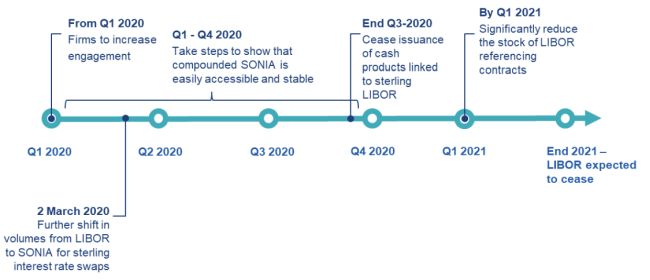

The documents include the RGRWG's key milestones and targets for firms over the coming months (see timeline below).

The UK regulators both fully support the timeframe proposed by the RGRWG. The FCA and BoE have also published a statement encouraging market makers to change the market convention for sterling interest rate swaps from LIBOR to SONIA from 2 March 2020.

Alongside these key milestones, the RGRWG will continue its own education, awareness and communication campaigns.

Key regulatory expectations

The key message from these publications is that sterling LIBOR is expected to cease to exist after the end of 2021, and no firm should plan otherwise. Transition plans should cover firms' stock of legacy LIBOR-linked contracts, as well as new contracts entered into from this year onwards.

Firms should also note several other regulatory expectations highlighted in the documents, including:

Firms should engage proactively with clients and market initiatives

Market participants should be taking appropriate steps to establish that their clients are aware of the risks if new LIBOR transactions are entered into. This expectation to support clients is also brought out in the statement on the use cases of benchmark rates, where the RFRWG suggests within a decision tree that all clients (except large corporates where the transaction size is £25 million or greater) may need to explore with their bank contacts alternatives to compounded SONIA (such as BoE base rates or fixed rates) which are better suited to their needs.

Regulators also expect all firms to play their part in meeting the targets by actively engaging in transition efforts in the market. While progress has been made to date, regulators expect to see clear evidence of engagement from firms from the beginning of Q1 2020.

Senior management should be tracking progress

Senior management should ensure that the management information they receive in respect of LIBOR transition plans tracks performance against targets. This will be relevant to all firms for whom the transition from LIBOR is relevant, but will be particularly important for the senior managers at banks and insurers who have been identified as responsible for overseeing the implementation of the transition plans (in accordance with the FCA and PRA's Dear CEO Letter on firms' preparations for transition from LIBOR to risk-free rates and feedback statement published in September 2018 and June 2019, respectively).

Action is expected in key areas and should feature in firms' planning from Q1 2020

Action in the following areas has been highlighted as being key to delivery and is expected to feature in firms' planning from Q1 2020: product development; reviewing infrastructure (including updating loan system capabilities); client communications and awareness; and updating documentation.

Firms should be mitigating the risks from the transition

The FCA and PRA are aware that firms are transitioning at different rates, but all firms need to be proactive in taking early action to mitigate the risks from transition.

Increased focus on supervisory powers

The publications from the FCA and BoE make clear that they intend to make use of their supervisory powers if firms are seen to be falling short of their expectations.

In the letter to senior management, the regulators reminded firms that the Financial Policy Committee (FPC) will "keep the potential use of supervisory tools under review". Firms will need to show sufficient progress by mid-2020 to avoid the FPC seeking recourse to such supervisory tools.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.