INTRODUCTION

Global businesses are increasingly migrating their finance functions to regional hubs or shared service centres, either through in-house or outsourced operations. This is driven by the need to cut cost, streamline processes and maintain central control. For many with established service centres, the question is 'What functions can we centralise next?'

In a centralised business model, global companies still need to comply with a multiplicity of local regulations, for example in the areas of tax returns, local accounts filing, company secretarial and payroll. Challenges of scale and the need for local knowledge in these areas are often the most significant barriers to delivering a truly centralised finance function.As one of our clients has said to us – 'It's hard to find Peruvian GAAP knowledge in Bangalore'.

BDO has conducted a study to examine the different models that companies have adopted as they centralise, to ensure compliance with local regulatory requirements. The study combined face to face interviews with desk research and culminated in a discussion and debate among the participants.

This report contains a summary of the key findings and a description of the four models identified. A full presentation of the results is available from Richard Cantor or David Lewis at BDO whose contact details can be found on the back page. This presentation includes additional material such as the participants' vision of the future, challenges to overcome and an analysis of their opinions on escalation issues.

COMPANIES IN OUR STUDY

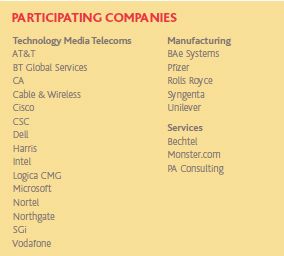

This report is based on a study conducted via interviews with senior

finance executives from major global companies, including AT&T, BT and Vodafone; Dell, Logica and Microsoft; BAe, Rolls Royce and Unilever. The interviews were held during the first half of 2008 and a full list of participating companies is included.

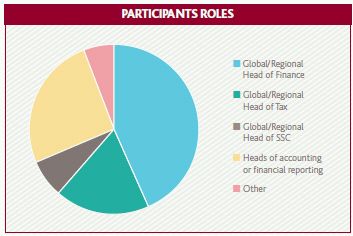

Participants included:

- CFOs and global or regional finance leaders

- Heads of global or regional shared service centres (SSC)

- Global and regional heads of tax

- Company secretaries and heads of legal compliance and governance functions.

Two thirds of our participating companies are from the technology and telecoms sectors. Others are drawn from the manufacturing and service sectors.

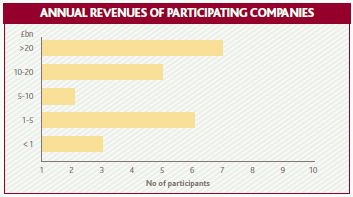

Participant companies in the study collectively have global sales of US$550bn with an average of $24bn

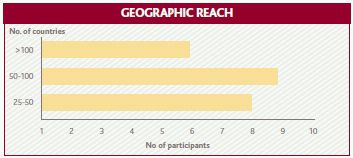

The various corporate activities of our participants span the globe and this is one of the key reasons that this study is relevant to all finance functions aiming to meet the commercial demands of the 21st century.

With more and more business activities becoming globalised, this study looks at the transition of finance functions as they adapt to meet their strategic objectives. It highlights the challenges they face on the way as they seek to optimise their operations globally yet maintain compliance with local regulations.

SUMMARY OF KEY FINDINGS

- Without exception, participants have embarked on a 'journey' to transform their finance functions.

- There is no clear 'one size fits all' roadmap as to how to get there.

- Ten years ago, as their corporate responsibilities grew and broadened globally, most of our participants would have followed the traditional finance model of essentially replicating the same functions in each country under a local FD. None of the companies in our study still follow this model.

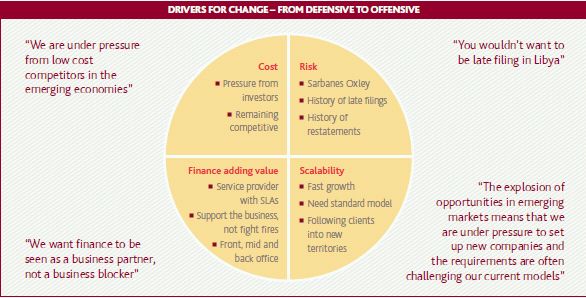

- The starting points of their transformational journies may be very different, but the drivers for change are common and there are similarities in the paths being taken and in the destination.

- Most companies are at some stage of development of a shared service centre strategy. This takes the bulk of the finance function out of the local countries and into a central location (which can be in-house or outsourced, and often in low cost areas). However, this streamlining of operations creates issues with compliance.

- Compliance is never a driver for change and is rarely a primary consideration. However, if compliance is not addressed, it can present significant risks and prevent the maximisation of transformational gains.

- Ambitious, rapidly expanding companies tend to use outsourced support to gain localised efficiency and expertise.

- We identified four models that companies are using for local compliance. Of these, centrally coordinated outsourcing with local service delivery was seen to be the most attractive model but not the model most in use.

- Future convergence of accounting and taxation standards is unlikely to remove the need for local expertise.

- Technology will play an increasing role in improving the efficiency of local compliance.

We found a clear direction in the journey from fragmented and localised towards standard and global. Companies with 'multinational' characteristics such as local products, geographic reporting lines and local autonomy, or those with a history of growth through major acquisition, have a different starting point from more 'global' companies – those with standard global products, central control and functional reporting lines – and those with a history of mainly organic growth. Companies with more of the latter characteristics are likely to be further along the path to globalising financial processes.

DRIVERS AND ENABLERS OF CHANGE

Advances in IT and telecommunications technology have turned the business world into a competitive global village, driven by the need to reduce costs, streamline processes and maintain strong control.

Efficient standardised processing is seen as a way to achieve cost reductions and, centralisation of accounting process is seen as a way of improving control and minimising corporate risk.

However, the key driver for the reshaping of finance functions appears to create a better overall service provider, internally and externally, and add more value to the business.

Whether finance functions are insourced or outsourced they are now aiming to serve their businesses better – reducing running costs, meeting service level agreements, maintaining compliance and freeing the decision support functions from routine activities.

Is the journey really necessary?

No-one is forcing anyone to transform their finance function but participants have found there are compelling commercial reasons for doing so.

Globalisation is here to stay: Now that the opportunities of international telecommunications and worldwide web connectivity have been released there is no going back to geographical national markets and parochial corporate bodies. Markets today are led by global brands and the companies operating within those markets are highly complex international entities.

Lean business is good business – Controlling costs and efficiency are keys to the bottom line success of 21st century business. Administrative 'back office' activities within finance functions are under the spotlight just as much as revenue generating areas.

Regulation and Litigation – The world in general has become more litigious and the business world more accountable, wherever it operates. The experiences of Enron,WorldCom and others stand as a trenchant reminder and the Sarbanes Oxley Act demonstrates a fresh will to instil regulation into corporate processes worldwide with the need for well documented and controlled processes.

It's expected of you! – Corporate image is not just external and focussed on consumers. Professional efficiency is expected at all times, in all areas. Not only are there 'internal customers' to satisfy but alliance partners will expect assurance, if not demand verification, of trouble free finance functions.

The Role of IT

The emergence of global ERP systems, enabled by high bandwidth telecommunications has made the transformation journey possible. At the same time, the cost of ERP implementation in smaller countries can create a barrier to complete global roll-out.

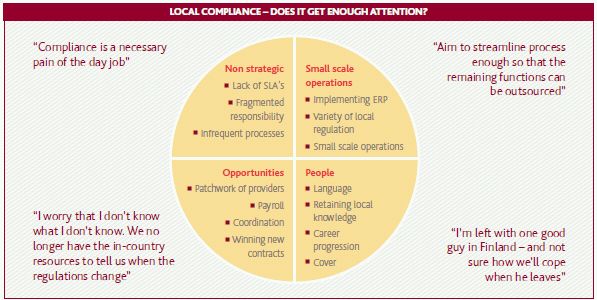

LOCAL COMPLIANCE – ISSUES AND CHALLENGES

Local compliance isn't a strategic issue, but it can be an irritating operational problem – the sore toe that can cause a giant to stumble.

In some countries, errors or lateness in compliance can go beyond mere penalties and lead to the closure of commercial operations.

Local compliance is necessary but was not ranked a priority by our study group, and accordingly performance levels can vary dramatically, affecting corporate cost-effectiveness and process efficiency.

Our study highlighted four areas of concern:

Poor process performance

- Lack of service level agreements (SLAs)

- Fragmented responsibility (i.e. separate reporting lines for tax, finance and legal)

- Infrequent compliance processes leading to a patchwork of providers and little coordination.

Problems with operational scale

- A great variety of local regulation

- Language issues

- Low transaction volumes render the use of a large outsourcer or shared service centre (SSC) uneconomic

- Standardisation through Enterprise Resource Planning (ERP) systems may not be feasible.

People issues

- Limited local career progression opportunities for staff

- Lack of holiday or sickness cover

- Safeguarding local knowledge when key staff leave/retire

- Staff retention – beware of 'poachers'!

Market challenges

- Finding suitable single providers eg payroll

- New contract wins in new countries require rapid response from finance function

- Continuity and co-ordination with existing structures and systems to help maintain overall corporate performance.

OPERATING MODELS FOR LOCAL COMPLIANCE

The clear directional trend shown by our study participants is away from the traditional finance model reporting vertically in a hierarchical manner towards a flatter globalised structure. There is a move away from fragmented regional and local functions towards standardized processes and/or outsourced processes to specialists.

We have identified four models that companies are using to meet their local compliance obligations.

Model 1 In-house, in-country

This is a typical model in a traditional business that does not have shared service centres. It is also often the starting point of a company's transformational journey.

A common first move is to introduce a shared service centre for basic accounting activities such as transaction processing, but harder activities such as compliance and payroll are still undertaken locally in each country.

A variant of this model is country clusters where one country will also look after the finance functions for the neighbouring country, for example in Eastern Europe or in Africa or Middle East.

ADVANTAGES

- Suits organisations with large operations in each country eg manufacturing

- Local knowledge under control of local entity

DISADVANTAGES

- Difficult to maintain in combination with a shared service centre

- Limited career progression

- Cover for staff absences

OPERATING MODELS FOR LOCAL COMPLIANCE

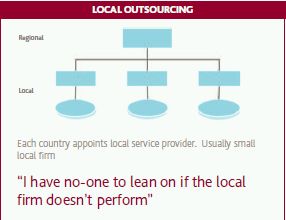

Model 2 Local outsourcing

In this model, the parent headquarters requires each country or regional operation to employ a suitable local accounting firm to undertake the bookkeeping and/or local compliance work.

This model is often used when companies are first moving into new territories and is currently used by some of our participants, particularly in their smaller countries.

The advantages are that it assists continuity, and provides time to consider 'the bigger picture' and any improvements that might be introduced.

ADVANTAGES

- Low cost outsourcing solution

- Reduces dependency on a single individual

DISADVANTAGES

- No central coordination

- Multiple points of contact

- No escalation if service is poor

- Lower visibility and control

- High time demand on company management

OPERATING MODELS FOR LOCAL COMPLIANCE

Model 3 Centralised outsourcing, central delivery

This model depends upon personal expertise and/or specialist software.

The first option is to employ a foreign national expert within the shared service centre, which works with the larger countries, while the expert handles the specific requirements of their country.

One of our study respondents with a tax service centre in London employs French, Scandinavian, German and Italian experts in London for their local country knowledge and language skills.

The weakness lies in human preference.Will the professional expert want to uproot to live and work where the SSC operates?

The second approach is to try and develop local software that automates the local compliance processes and creates filings automatically from data in the system.

Advances have been made in this software technology, particularly for VAT processing, but the weakness is that if there are input mistakes with the raw data, then there will be mistakes in the filing.

An expert professional eye will still be required to oversee the process in order to get satisfactory local sign-off. And local professionals are still needed to deal with audits and queries from the authorities.

Move the people – employ foreign specialists located at SSC

ADVANTAGES

- Can be cost effective for larger countries

DISADVANTAGES

- Less suitable for smaller countries with one or less full-time role

- Must be desirable SSC location

- Risk of disruption through staff turnover

Automate – develop software for local processes to run from SSC or processing centre

ADVANTAGES

- Technology provides cost efficiency where scalable

DISADVANTAGES

- Rubbish in, rubbish out – lose sense checks by local experts

- No local presence for local authority audits

- Changes in local regulation

OPERATING MODELS FOR LOCAL COMPLIANCE

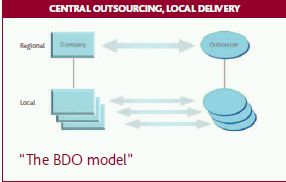

Model 4 Central outsourcing, local delivery

The best of both worlds – and a model recommended and delivered by BDO International.

Services in each country are delivered by outsourced local accounting and tax professionals who know the local regulations and speak the language.

Operations are centrally managed between the designated point of contact at the parent headquarters and the agreed central point of contact at the global accounting firm.

ADVANTAGES

- Local service delivery and local presence

- Global visibility for local compliance issues when needed

- Central coordination reduces management time

- Defined escalation path

DISADVANTAGES

- Few firms offer full service and global cover

- complaints about extra fees from some big-4 service providers

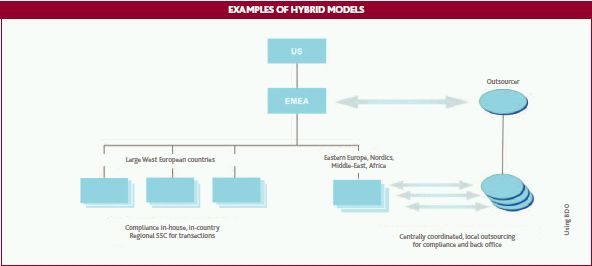

HYBRID MODELS 'A journey through a changing landscape'

Our study plainly indicated the direction in which most companies are heading – towards greater centralisation and streamlining of operations – but it also revealed that there is no clear 'one size fits all' roadmap as to how to get there.

The truth is, this journey to transform the finance function has no set destination and may never end. To remain competitive, as the world changes and new markets evolve, companies must modernise and adapt, and with them their finance functions. It is a continuing journey of professional necessity.

By nature the journey will involve transition between models and the tailoring of models to suit individual corporate needs and parameters. Hybrid models merely reflect the continually changing nature of our business world, and many companies operate different models for different parts of their business.

Typically, in the largest countries, transaction processing functions will be in a shared service centre or outsourced, and the compliance functions will tend to be carried out in-house.

In smaller countries, too small to have the ERP system installed, the transactional functions are likely to be either 'in-house in-country' or 'locally outsourced'. Compliance functions may be done in 'country clusters' or again 'locally outsourced'.

On the right is an example of a US company that uses two different models in Europe. The European shared service centre handles transactions which cover all of the larger countries, while the smaller countries have moved from a 'local outsourcing'model to a 'central outsourcing, local delivery'model, using the BDO offices in each country.

THE FUTURE FOR COMPLIANCE –VIEWPOINTS

Addressing the problems

- Compliance issues tend not to be on the strategic roadmap but perhaps they should be.

- The division of responsibility between finance, tax and legal functions means that local compliance is rarely addressed as a single issue.

- As more and more is standardised and fewer finance staff are located in-country, local regulatory requirements will act as an increasing barrier to change if the issues are not addressed sooner rather than later.

- Managed service providers are increasingly entering multiple new countries through the award of a single contract.

Possible solutions

- Consider developing clear processes for regulatory compliance. Use the same rigour applied to 'in scope' activities for SOX.

- Use web based tools to track compliance and progress with the processes needed to ensure compliance.

- Introduce clear service level agreements between finance, tax and legal functions.

- If you outsource your compliance functions apply the same rigour that you apply to other aspects of your business: look for suppliers with global reach, adopt a common framework and reduce your number of suppliers.

- Managed service providers should have a compliance roadmap, possibly in alliance with an outside provider, which they can build into their proposals and be ready to execute on contract closure.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.