This month MJ Hudson celebrated it's 10-year anniversary. So, for this View from the Bridge newsletter, we wanted to capitalise on it by shining a light on ten key facts of the Venture Capital industry that illustrate its state of play, scope, and successes.

We have seen in past financial crises that Venture Capital has had a significant hand in helping economies recover. It is a key player for job creation, driving Environmental, Social and Governance (ESG) objectives ("build back better") and stimulating economic growth. Venture Capital, like many industries, has suffered in the current Covid-19 climate and it is still too early to understand what the rest of the year looks like for the industry. However, we should assume that there is an ever-increasing role for Venture Capital to create both positive change and financial returns.

We selected these facts to ensure that we not only look back to see how far Venture Capital has come in the last ten years, but also to highlight some of the important trends and changes needed for the next decade.

1. Market Size

As of Q2 2020, data shows that current total global venture investments for this year are at $129 billion, which is only down 7 percent from the first half of 20191. It is still very unclear how much Covid-19 will impact the VC market, both in terms of fundraising and investments. The market has shown a decline, with many start-ups laying off staff, reduced revenues, and down rounds etc. Naturally some sectors have been hit worse and some like Medtech, Edtech and Biotech are seeing a massive increase in investment.

2. Unicorns

As of June 2020, the total number of global Unicorn companies is 476, with a total cumulative valuation, of c. $1,421 billion2. Today, 82% of unicorns are VC-backed, compared with only 20% a decade ago. In the last ten years, we have seen an increase in Unicorns in Europe, but the majority are still US based, with Spotify, in 2018, still being the largest EU unicorn with an exit valuation at IPO of $29.5 billion.

3. Impact Investing

The estimated global market size for impact investments is currently at £715 billion, which is a ~30% increase from last year3. There are numerous surveys and research, both in the US and Europe, which highlight that impact and responsible investing are key drivers in LP investment decisions. They are looking for both strong ESG credentials, alongside market return.

4. Deal Size

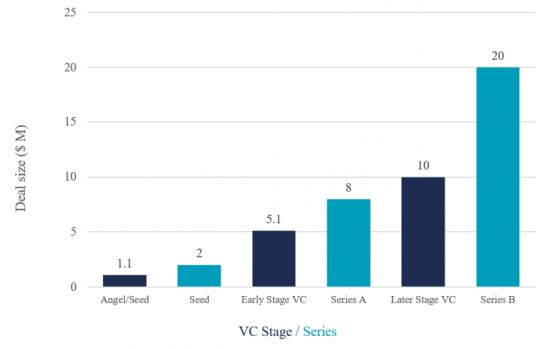

See below global median deal size in 2020 (based on Q1 figures) as broken down by funding series or VC stage4.

Both have experienced a steady increasing trend over the last ten years, with later stage VC funding rounds seeing the biggest yearly increase, these trends are expected to continue.

5. Exits

As of 2019, European VC-backed exits have generated a cumulative return of ?223 billion since 2013, with some of the largest exits being Skype at 317x, Yandex at 1496x and Playtika at 2933x. We do need to contextualise these exit successes, highlighting that only circa. 25% of VC firms will give investors their targeted fund return (typically 3x), with the majority being closer to 1x5, but that is always the risk with VC.

6. Diversity

When considering diversity issues in VC, they are many aspects to consider, whether it is in terms of gender, education and/or ethnicity etc. Whilst over the last few years we have seen some improvements and greater acknowledgement of the issues, it continues to be a problem, prevalent at all levels of VC from founders, investors, to the VC firm themselves. For example, for every £1 of investment in the UK, all-female founder teams get less than 1p, all-male founder teams get 89p, and mixed-gender teams 10p6. In Europe just 0.9% of founders are black.

7. First Time Exits

In 2019, in the US, $4.3bn of capital was raised for first-time VC across 49 funds, but currently in 2020, only $1.1bn has been raised across 9 funds7. Last year, there were a total of 470 first-time venture capital financing deals in Europe. Many groups have experienced an impact on their fundraising due to Covid-19 and as a result, expect to extend time periods before they can successfully launch.

8. EU v US

The 2019 figures show that 38% of all global seed stage capital is raised by European start-ups, but the USA is slowly catching up. An increasing number of US firms are now coming to Europe to look for Seed and Series A investments, as it is believed that there are better valuations and deals to be had, thus increasing the competition.

9. Future Fund

The UK Government's Future Fund published its diversity statistics in June. Currently it has made £236.2m loans into 252 companies. Of these, 45% of funding has been to companies outside of London, whilst almost 80% of management teams have been of mixed gender and 50% of management teams have been of mixed ethnicity . With the rapid demand on the Future Fund, they have expanded the amount of capital available from the original £250m, but the limit to that funding is still under review.

10. ESG

The UN has declared that we are currently not on track to achieve the United Nations Sustainable Goals by the 2030 agreed deadline. In the latest SDG Report 2020, it remarked that progress had been made in some areas (e.g. child health, electricity accessibility and increasing women's governmental representations), but this does not negate the fact that many areas, such as food insecurity, climate change and pervasive inequalities, have worsened. It also highlighted the Covid-19 disruption to progress, with the world's poorest and most vulnerable being the most affected by the pandemic.

After reading these statistics, you might find yourself either feeling quite daunted or invigorated about the industry. Venture Capital is an amazing ecosystem that offers a great tight-knit community. It keeps expanding and exploring new geographies, demographics, and sectors. However, none of us know what the next ten years will hold for Venture Capital. In particular, Europe appears to be experiencing a fly wheel of successes. There is ever-increasing scale-up capital and the industry is embracing ESG integration, particularly in terms of governance factors surrounding diversity and inclusion. It will be interesting to see what impact the industry can have in helping the world recover from the pandemic, and whether VC capital can be a driving force for long-term, sustainable change.

Footnotes

1 https://news.crunchbase.com/news/q2-2020-global-venture-report-funding-through-the-pandemic/

2 https://www.cbinsights.com/research-unicorn-companies

3 https://thegiin.org/research/publication/impinv-survey-2020#charts

4 https://assets.kpmg/content/dam/kpmg/xx/pdf/2020/04/venture-pulse-q1-2020-global.pdf

5 https://blog.dealroom.co/wp-content/uploads/2016/12/Exits.pdf

7 https://nvca.org/research/pitchbook-nvca-venture-monitor/

Originally published July 23, 2020 .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.