Joint Share Ownership Scheme ("JSOS")

A JSOS can provide a tax efficient alternative to an unapproved share option scheme. Under a JSOS:

- the employee is invited to acquire shares ("jointly owned shares") jointly with a coowner (typically an employee benefit trust));

- the co-owner will normally be the registered holder of the jointly owned shares.

The employee's interest in the jointly owned share entitles him to:

- the growth in value of the shares above a prescribed threshold (see further below);

- the proportion of any dividend equal to the value of his respective interest in the jointly owned shares; and

- the right to direct the co-owner to exercise the voting rights in respect of such number of jointly owned shares that have a value equal to the employee's interest,

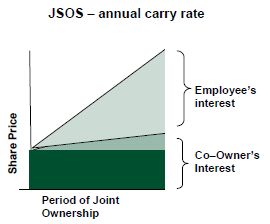

The prescribed threshold is normally the market value of the jointly owned shares on the date the employee becomes a joint owner, plus a "carry rate". The relevant carry rate will differ from plan to plan; some plans are implemented with a flat hurdle rate, some with an annual compounded rate.

The market value of the employee's interest in the jointly owned shares is a fraction of the value of the jointly owned shares on the date the jointly owned shares are acquired.

If the employee does not pay or agree to pay the initial unrestricted market value (assuming a restricted securities election is made) for his interest in the jointly owned shares he will be subject to an income tax charge (and if the shares are readily convertible assets, national insurance contributions).

Future gains on a sale should be subject to capital gains tax, currently at the rate of either 18% or 28% (or 10% if entrepreneurs' relief is available).

Growth Share Ownership Plan ("GSOP")

The GSOP is a flexible share ownership plan that can be implemented by companies whose shares do not all need to be of the same class (i.e. non listed companies).

Employees are offered the opportunity to acquire a new class of ordinary share with limited rights ("Growth Shares"). The Growth Shares will entitle the employees to participate in a proportion of any future growth in value of the Company above a threshold value.

The aggregate entitlement of the Growth Shares to participate in the excess value can be decided on a case by case basis for each sponsoring company.

As with a JSOS, if the employee does not pay or agree to pay the initial unrestricted market value (again, assuming a restricted securities election is made) for his growth shares he will be subject to an income tax charge (and if the shares are readily convertible assets, national insurance contributions).

Future gains on a disposal of the growth shares should be subject to capital gains tax, at the current rate of 28%.

Nil Paid Shares

Nil paid shares were previously attractive because they required no upfront payment from the employee, but they offer the tax advantages of immediate share ownership; increases in value of the shares are subject to capital gains tax rather than income tax.

The "disguised remuneration" legislation which was introduced in 2011 now makes some of the planning around nil paid shares ineffective, unless the shares in question are newly issued. However, it is possible to replicate the planning through purchase at market value funded by a loan from the employer (or perhaps from another group company).

JSOSs, GSOPs and nil paid share schemes can be technically complex, but they can also provide a healthy return to participants in the right circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.