An EMI scheme is a tax efficient, HMRC approved discretionary share option scheme which has proven popular with private and AIM listed companies. It aligns the interest of shareholders and key employees and provides significant tax savings for both the employer company and the employee. EMI schemes are simple and easy to understand and can be implemented and administered at a very reasonable cost.

Which companies qualify to grant EMI share options?

EMI options can be granted by the employer, the trustees of an EBT or any other shareholder provided the following requirements are met:

- the gross assets of the company/group must not exceed £30 million at the time of grant;

- the company (in which the shares are being issued) must not be controlled by another company;

- the company must only have qualifying subsidiaries (broadly >50% shareholding);

- the company must be a trading company with a qualifying trade (which does not include, amongst others, dealing in land, financial instruments, banking, insurance, other financial activities, legal or accountancy services, farming or market gardening); and

- the company must have fewer than the equivalent of 250 full-time employees. Companies can seek advance clearance from HMRC as to whether or not they meet these requirements.

Option Shares

Shares under EMI options must be non-redeemable, fully paid up, ordinary shares.

However, shares under EMI options can be of a special class, with different rights to existing shares (for example as to voting and dividends) In the case of a group of companies, only the parent's shares can be subject to options.

Employee Eligibility

EMI options can be granted to employees who, broadly, do not hold 30% or more of the company's share capital and:

- they are required to spend at least 25 hours a week working for that company;

- they have no other employment or self-employment; or

- they spend at least 75% of the total time spent on employment and self-employment for the relevant company (or subsidiary).

EMI options cannot be granted to directors who are not employees (i.e. non-executive directors) or consultants.

Limits on issuing EMI options

There is a £3 million overall limit on the value of shares in the company that can be subject to unexercised EMI options.

There is no limit on the number of employees that can hold EMI options.

An employee may not hold EMI options over shares having a value (at the date of grant) of more than £250,000.

An employee may not be granted further EMI options if, in a three-year period, he has already been granted EMI options with a total value of £250,000 but, structured correctly, there is scope for options over shares with a value of £499,999 to be granted within a three year period.

Tax treatment for the company

A corporation tax deduction should be available on the exercise of EMI options in the accounting period when the option is exercised.

The corporation tax relief should be claimed by the optionholder's employing company and not the company whose shares are acquired (if different).

The deduction is broadly equal to the difference between the market value of the option shares on exercise and the amount the employee actually pays for the shares.

Tax treatment for the employee

There are no tax charges when the option is granted.

If the exercise price is at least equal to the actual market value of the shares at the date of grant, there should be no income tax or NIC liability on exercise.

Where the shares are readily convertible assets, any income tax and NICs will be collected under PAYE.

On the sale of the shares, the difference between the proceeds of sale and the price the employee paid for the shares (plus any amount treated as employment income) will be a chargeable gain for capital gains tax purposes, currently charged at the rate of either 18% or 28% (unless entrepreneurs' relief is available to reduce the charge to 10%).

Losing tax benefits

The principle tax benefits (i.e. capital gains tax treatment instead of income tax treatment) is lost, either in whole or in part, if:

- the grant of the EMI option is not notified to HMRC within 92 days after the date of grant;

- HMRC decide that the option does not qualify as an EMI option (subject to appeal); Or

- a "disqualifying event" occurs and the EMI option is not exercised within 40 days of the disqualifying event.

Disqualifying events include the following:

- the company becomes a subsidiary of, or otherwise comes under the control of, another company;

- the company ceases to meet the trading activities requirement;

- the employee ceases to satisfy the working time requirement;

- the employee ceases employment with the EMI company or any subsidiary of it; And

- certain variations are made to the terms of the company's EMI option or the share capital.

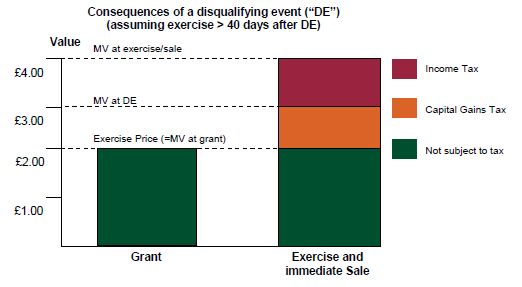

Consequences of a disqualifying event

If a disqualifying event occurs and the option is not exercised within 40 days:

- the option gain attributed to the period after the disqualifying event will be subject to income tax (and, potentially NICs); but

- the option gain attributed to the period before the disqualifying event will retain its income tax-exempt status.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.