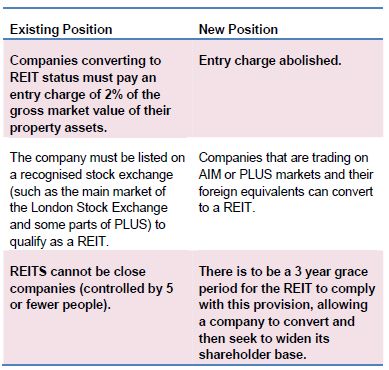

The REIT regime was launched in 2007, with the aim of creating a tax efficient vehicle in which to encourage investment into Real Estate. However, with only a limited number of companies making the conversion to REIT status, the Government has sought to improve the regime by reducing barriers to entry, encouraging investment into REITs and reducing the costs of complying with the regime. The Finance Bill 2012, which received Royal Asset on 17 July 2012 has brought in a number of changes which are designed to meet these aims, the most pertinent of which are listed below:

Comment

The barriers to entry have been significantly reduced with the abolishment of the entry charge and the relaxation of listing rules. With these barriers addressed, there are a variety of other companies who may now wish to convert to REIT status: AIM and foreign listed companies who do not wish to incur the cost of main market listing; family property companies considering succession planning; and property companies seeking equity investment.

Furthermore, with the relaxation of the close company requirements, companies that do convert have time to seek investors, whilst also enjoying the tax benefits of their REIT status. And due to the change in the diverse shareholders requirement, once they do find investors, they do not need to be concerned if only a small pool of institutional investors become their shareholder base. These changes could also encourage fund managers to incorporate new fund ventures as a REIT rather than a traditional fund structure and certain types of institutional investors could establish wholly-owned REITs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.