Rules and principles governing foreign investments in Turkey are regulated by Direct Foreign Investment Act no. 4875 (Act). The Act designates the manner in which foreign investment shall be treated. It echoes the fundamental principle of equal treatment. As per article 3, foreign investors and Turkish investors shall be subject to equal treatment unless otherwise stipulated by international conventions or special laws. The aforementioned principle provides that incentives offered for Turkish investors shall be offered equally to foreign investors. Therefore, the below explanations on the Turkish Incentive System (System) shall be considered concerning foreign investments.

1. Objectives of the Incentive System

Incentives have long been utilized in boosting internal initiatives as well as attracting direct foreign investment. Turkey had been offering incentives for a while, when an incentive system was adopted in 2012 with Decree no. 2012/3305 aiming to boost development in line with economic and social components of the country.1 In this regard, the main objectives of the incentive system are to:

- increase production and employment

- steer investments to large scale, high tech, R&D projects that will establish international competing power

- minimize regional development discrepancies

- reduce dependency on import of intermediate goods that are vital for certain strategic sectors.

The incentive system was organized with a sector specific approach and special attention to export-oriented investments. Ministry of Economy (Ministry) is responsible for the execution of the System.

2. Available incentives

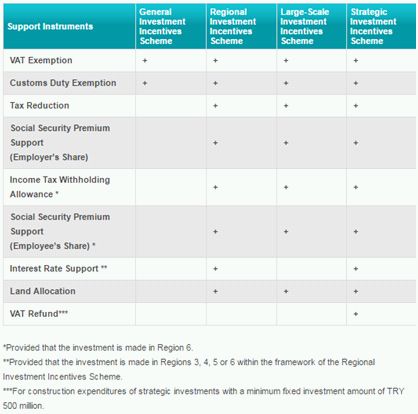

The following incentives are available within the context of the System; VAT exemption, customs duty exemption, tax reduction, social security premium support (for employer's share and employee's share), interest support, land allocation, VAT refund and income tax withholding support. Incentives granted to investors are designated in the Investment Incentive Certificate (IIC), holder of IIC benefits from incentives defined below.

Investors holding the IIC are exempt from VAT for imported or domestically supplied machinery and equipment. Imported machinery and equipment are also exempt from any customs duties. Investments made within the scope of IIC are subject to deducted corporate income tax. Income tax is reduced up to the point where reduced tax amount reaches the amount of contribution to the investment.2 IIC holders are also provided with social security premium support for both the employer's and employee's share. Employer's share of the social security premium corresponding to legal minimum wage is covered by the Ministry for additional employment created by the employer. Similarly, for additional employment created by the employer, employee's share of social security premium corresponding to legal minimum wage is covered by the Ministry.

Another incentive granted within the scope of the System is interest support. It is a financial support provided for loans with a term of at least one year obtained within the scope of IIC. This support can also be reimbursed for a maximum of five years if justified by the Ministry. Investors holding IIC may also be allocated land for the execution of investments. Such allocation, depending on the availability of the land, is made by the Ministry of Finance. Within the context of the System, VAT collected on building and construction for strategic investments with fixed investment amount of TRY 500 million (approximately US$140 million) is refunded. Completion of the entire investment is not a requisite for the refund. Lastly, income tax for additional employment created by the investment will not be subject to withholding taxes under IIC.

At this point it should be reminded that under each system only certain incentives are offered. The table shows incentives that are available under each incentive system.3

3. Incentive systems

The System stipulates four different systems to which it offers different incentives. Investors can apply for one of the systems provided within the System:

- General Investment Incentives System

- Large-Scale Investment Incentives System

- Regional Investment Incentives System

- Strategic Investment Incentives System.

Turkey is divided into six regions in order to determine region specific incentives.4 The minimum investment amount required for benefiting a certain system is also different in each region.

General Investment Incentives System: All projects meeting the capacity conditions and minimum fixed investment amount requirement, regardless of execution region of the investment, benefit from incentives provided under this system.

Large-Scale Investment Incentives System: 12 specific investment categories determined by the Decree benefit from incentives provided under this system. The objective of designating these categories is to define large-scale investments which will ultimately boost technology and R&D capacity as well as the international competing force of the country. Below are some of the investment categories benefiting from this system:

- Production of refined petroleum and chemical products

- Production of railway and tram locomotives and/or tram cars

- Transit pipeline transportation services.

Incentives provided for these categories are designated to be more advantageous compared to the Regional Investment Incentives System given the scale of these projects.

Regional Investment Incentives System: System is established with a sector specific approach. In doing so, sectors to be supported in each region are determined considering regional potential and economic conditions. Under this system projects according to their region, are required to meet a different amount of minimum investment and benefit from different incentives.

System defines certain investment areas as "priority" and grants these projects incentives provided for Region 5 - regardless of the region of the investment. Investments made for the manufacture of products or parts developed by an R&D project, pharmaceutical investments and defense industry investments with a certain minimum investment amount, and investments made for production of items in high-tech industry segment are some of the priority areas benefiting Region 5 incentives.

Strategic Investment Incentives System: Incentives under this system aims at encouraging production of intermediate goods for which dependency on import is high. Incentives offered under this system are more advantageous compared to those offered under Large-Scale and Regional Investment Incentive Systems in order to stimulate domestic manufacture. Although goods of this nature are not listed, all investments meeting conditions such as minimum investment amount and import dependency rate are supported under this system.

Project Based State Aids in Investments: Apart from the systems mentioned above, project based incentives were introduced in 2016 with Decree no. 2016/9495.5 The decree aims at supporting investments on a project basis. Incentives provided hereunder are broader than incentives offered by the System. Some of the additional incentives offered on a project basis are as follows:

- personnel

- capital and energy contribution

- purchase guarantee

- infrastructure support.

4. Eligibility and application

Investors should apply for the IIC in order to benefit incentives under a certain system. Application should be made to the Ministry (Directorate General of Implementation of Incentive and Foreign Capital) or local authorities (Chambers of Industry or Development Agents).

Real persons, partnerships, capital stock companies, cooperatives, unions, joint ventures, public institutions and organizations, professional organizations with public institution status, associations and foundations and branches of foreign companies meeting conditions stipulated under each system are eligible for applying. As provided by the Act, foreigners and legal entities established per foreign laws also benefit from incentives granted by the System under the principle of equal treatment.

Footnotes

1. Decree on State Aid in Investments, Official Gazette No. 28328, 19.06.2012.

2. Contribution amount to investment is the amount of tax which is not collected by the Tax Authority from the investor holding IIC.

3. The table can be found on the website of the Investment Support and Promotion Agency of Turkey.

4. The map can be found on the website of Investment Support and Promotion Agency of Turkey.

5. Decree on Granting Project Based State Aids, Official Gazette No.29900, 26.11.2016.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.