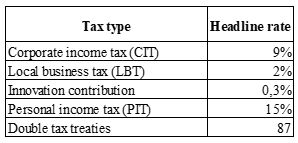

During tax planning, Hungary stands out as an attractive jurisdiction due to its favorable tax environment. This is attributed to the country's main tax types, which boast some of the lowest tax rates.

The main types of taxes create a very favorable environment for businesses operating in Hungary:

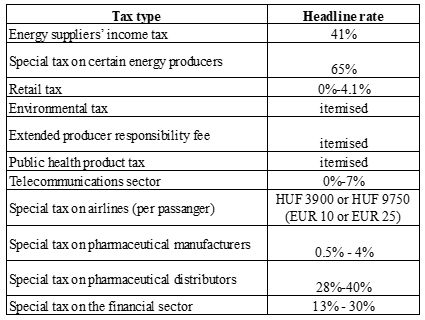

However, in addition to the main types of taxes, the Hungarian tax system recognizes several other types of taxes, sectoral and special taxes that are related to a particular activity.

The amount of these special taxes and the related administrative requirements are not negligible factors in tax planning. Moreover, one of the biggest tax risks in the case of a company operating in Hungary or newly established is the special taxes. It is therefore recommended to analyze the additional tax burden that certain economic activities may incur, in addition to income taxes and sales tax. This prevents the company from subsequently revealing, for example, that a given economic event or activity has made the company subject to a specific tax type and has incurred a payment obligation.

In this article we deal with taxes on the retail, energy supply and energy generation sectors, the environmental tax, the public health product tax, the innovation contribution on medium-sized and large enterprises, the special tax on telecommunications and airlines and the financial sector tax. To illustrate these special taxes, here is the following table:

Below is an overview of the above specific taxes that may affect a wider range of businesses.

Local business tax (LBT)

All municipalities are entitled to levy local business tax, i.e. LBT. LBT is deductible for Hungarian corporate income tax (CIT) purposes and is not treated as 'income tax' in the application of the tax treaties.

The LBT base is the total net sales revenue reduced by the cost of goods sold (COGS), subcontractors' work, material costs, mediated services, and research and development (R&D) costs. These items are deductible under a decreasing scale at taxpayers with larger turnover (with the effect that lower margin businesses may have higher effective LBT rates). The LBT rate may differ from municipality to municipality but is capped at 2% by law (but there are also municipalities with zero rates).

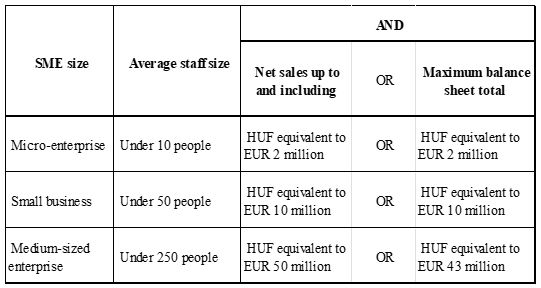

Innovation contribution

The innovation contribution must be paid by domestic companies and enterprises based in Hungary. The innovation contribution is 0.3% of net turnover (the tax base is the same as Local Business Tax base).

Companies qualifying as micro or small enterprises are exempt from the innovation contribution. The classification shall be carried out in respect of the first day of the financial year.

The indicators are summarized in the table below.

In principle, two of the three indicators must be met: headcount in any case, and at least one of the other two indicators (turnover and balance sheet total).

The innovation contribution, as assessed by the OECD Peer Review from the perspective of the global minimum tax, is categorized as a so-called covered tax. Therefore, it is eligible for consideration in the context of global minimum tax burden.

Energy suppliers' income tax

Questions about this tax type most often arise in connection with the taxpayer itself. Energy suppliers, public service providers are considered taxable persons, which include:

- Hydrocarbon extraction operators, mining contractors,

- Producers of petroleum products and certain traders in petroleum products,

- Certain entities with natural gas trading license, universal service provider and distribution license,

- Certain entities with electricity trading license, producer license, universal service provider and distribution license,

- Water utility provider,

- Public service provider authorized to collect domestic wastewater not collected by public utilities,

- Public service operator providing public waste management.

The regulation temporarily extended the scope of income tax: for the 2022-2024 tax years, the following manufacturers are also subject to the tax.

- Bioethanol producer,

- Manufacturer of starch and starch products, and

- Sunflower oil manufacturer.

The income tax of energy suppliers must be calculated partly in a way already known from the corporate tax system: the starting point for the tax base is the profit before tax shown in the tax year's accounts. The profit before tax should be adjusted by certain increasing and/or decreasing items and the tax base should be proportional so that only income from activities subject to income tax becomes taxable.

Non-resident organizations are only taxed on activities carried out through their permanent establishment in Hungary.

The income tax rate is 31% of the positive tax base. However, this temporarily increased by 10 percent to 41% for two years.

The energy suppliers' income tax is considered a covered tax from the perspective of the global minimum tax, according to the OECD Peer Review. Therefore, it is a factor that can be taken into account in assessing the global minimum tax burden.

Special tax on certain energy producers

A new obligation has also been introduced for certain energy producers for the 2022-2024 tax years.

Electricity produced from renewable energy sources or waste is subject to this tax, and also certain producers eligible for green-type aids.

Producers of power plants with an installed capacity not exceeding 0.5 MW shall be exempt from this special tax. Furthermore, electricity produced from solid biomass should not be subject to the special tax obligation.

The special tax shall be based on the positive sum of the turnover of the quantity of electricity fed into the electricity grid by the producer, less the feed-in tariff, established by the authority.

On the basis of the above, it can be said that the special tax is charged on the extra profits made by electricity producers with regard to the sale of electricity on the free market.

The special tax rate is 65%.

Retail tax

Retail activities, including the sale of goods handed over domestically by a non-resident person or organization to their customer in the framework of retail activities, are taxable, other than through a branch.

The regulation prescribes two common criteria: the defined activity and the potential customer base.

Taxpayers who carry out other activities(s) in addition to retail activities are liable to tax only on retail activities.

Another important condition for tax liability is that an individual may also be in the customer position. This basically means that the sales channel used by the taxpayer is potentially accessible to the public. However, the actual buyer no longer necessarily must be an individual.

In practice, the assessment of this condition is the most frequently raised, especially if the taxpayer's customer base is mixed and it has to be decided whether its individual sales channels (e.g., sales to resellers and sales to individuals) can be considered sufficiently separate.

Furthermore, a person or entity making the supply does not necessarily have to be a Hungarian resident taxpayer to become subject to tax. If the goods are delivered to Hungary, the tax becomes chargeable; a typical example of this is distance sales ordered via the Internet.

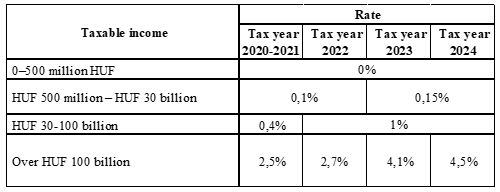

In practice, however, the actual tax liability only affects taxpayers with a higher turnover, considering that the tax rate is progressive in bands, in the lowest band of which – below HUF 500 million turnover – the tax rate is 0 percent, and in the absence of tax payable, no tax return obligation arises.

The taxable amount is the net turnover attributable to taxable retail activities.

The evolution of tax rates is summarized below:

Environmental tax

The most important objective of the environmental tax is to create financial resources for the prevention and reduction of environmental hazards and damages caused during the production, distribution, and use of products.

Environmental tax is payable on the import, sale or own use of certain petroleum products, tyres, refrigerants, packaging, batteries, advertising paper and electrical and electronic equipment.

Contract manufacturing can also be considered a special case, which is defined separately by law: from the materials provided by its customer a resident person produces a product subject to environmental tax.

There are also cases that result in exemption from the obligation.

For example, there is no tax obligation

- upon certified delivery abroad of the product subject to tax,

- when using residual material returned to the process or scrap

- in the case of packaging imported from abroad, when using the reusable packaging product for own purposes.

Extended producer responsibility fee

As of 1 July 2023, the extended producer responsibility fee has been introduced, with the environmental tax remaining in effect, despite the large overlap in the range of products covered. Double taxation should be avoided, and the amount of the extended producer responsibility fee will be deductible from the amount of the environmental tax. Therefore, calculating the environmental tax and/or extended producer responsibility fee for each product is very important.

Public health product tax

The aim of the regulation is to promote a health-conscious diet for people by taxing foods that are unhealthy from the point of view of public health due to certain components and have a long-term negative impact on individuals and thus also at social level, as well as to finance health services and public health programs.

Taxable products: soft drink, energy drink, snacks, flavored beer, alcoholic refreshments, fruit flavors, alcoholic beverages, delicacy, prepacked sweet, savory pasta.

The taxpayer is the person who sells the taxable product for the first time domestically (typically domestic manufacturers) or the person who purchases taxable goods from abroad (the importer) and sells and/or uses them to produce their own products and sells the products manufactured in this way domestically.

The taxable amount shall be the quantity of taxable goods supplied, expressed in kilograms or liters.

The taxable person supplying taxable goods shall be exempt from payment of the tax if he supplies less than 50 liters or 50 kilograms of taxable goods in the calendar year, or if the goods are supplied to another Member State of the European Union or to a third country, i.e. abroad.

Telecommunications sector

Telco companies operating in Hungary are liable to pay surcharge on their net turnover; the rate of the telecommunications surcharge

- 0% for the part not exceeding HUF 1 billion,

- 1% for the part exceeding HUF 1 billion but not exceeding HUF 50 billion,

- 3% for the part exceeding HUF 50 billion but not exceeding HUF 100 billion,

- 7% for the part exceeding HUF 100 billion.

Special tax on airlines

The tax is based on the number of passengers departing with the aircraft, excluding transit passengers. Rate of contribution:

- HUF 3900 (EUR 10) per passenger, if the passenger's final destination is Albania, Andorra, Bosnia and Herzegovina, North Macedonia, Iceland, Kosovo, Liechtenstein, Moldova, Monaco, Montenegro, the United Kingdom, Norway, San Marino, Switzerland, Serbia, Ukraine and the European Union,

- HUF 9750 (EUR 25) per passenger flying to countries other than those specified above.

Special tax on pharmaceutical manufacturers and distributors

In the case of special taxes on pharmaceutical manufacturers, the tax rates will be halved next year in all bands, so that from 1 January 2024 the tax base will be reduced to

- 0.5% for the part not exceeding HUF 50 billion,

- 1.5% for the part exceeding HUF 50 billion but not exceeding HUF 150 billion,

- 4% for the part exceeding HUF 150 billion.

However, the special tax rate on pharmaceutical distributors will increase from 28% to 40% for medicines with producer prices exceeding HUF 10,000.

Special tax on the financial sector

The tax base should be determined based on adjusted profit before tax, i.e., the special bank tax payable in 2024 tax year will also be profit-based, and the tax base will be the adjusted profit before tax determined based on the annual accounts of the 2022 tax year. The tax base is reduced by dividend income for the 2022 tax year and profits from sales of goods and services not generated in the ordinary course of activities. The special tax on financial organizations deducted from profit before tax for the 2022 tax year, the financial transaction tax and the bank extra-profit tax itself will have to be taken into account as increasing items.

The rate is: 13% will be paid on the part of the tax base not exceeding HUF 20 billion, and 30% on the part above that.

As a novelty, the 2024 tax liability can be reduced if the daily average stock of Hungarian government securities owned by banks or financial institutions for the period between 1 January 2024 and 30 November 2024 increases compared to the daily average stock between 1 January 2023 and 30 April 2023. By purchasing government bonds, the special tax liability may be reduced up to a maximum of 50 percent of the amount payable for the tax year.

There is also an insurance surcharge for insurance companies, that will remain in place in 2024, with surcharge rates being the same as for the 2023 tax year.

Note: the tax-related information provided here is not comprehensive and is intended for general informational purposes only. It is advisable to consult with a tax advisor in every case for a thorough examination and advice.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.