Estimates suggest that the Namibian Government could receive close to USD106-billion (NAD2-trillion at the time of writing) from its petroleum royalties alone (calculated at 12.5 % of the market price). This is if "11 billion barrels of oil reserves" are recovered and sold at the current market price of 77 USD per barrel, according to Energy Capital & Power.

Although the oil blocks are yet to be commercially appraised, there is significant potential for petroleum royalties to be a highly lucrative source of income for the Namibian Government. Based on the estimated petroleum royalties cashflow projections, the state revenue of the Namibian Government could be boosted to almost 30 000 more, taking the current state budget of NAD67.7-billion dollars into perspective. The proceeds from petroleum royalties will be a huge source of income for Namibia, and the government must ensure that locals, both present and future, benefit in line with article 95 (l) of the Namibian Constitution, 1990.

CURRENT LOCAL CONTENT INITIATIVES FOR NAMIBIA'S PETROLEUM SECTOR

The Welwitschia Sovereign Wealth Fund

The Namibian Government has created the Welwitschia Sovereign Wealth Fund, which will have two sub-accounts: a stabilisation account to cater for inflation, and an intergenerational account to invest with various asset managers globally which will earn a return on investment for future Namibians. The Namibian Government is yet to decide what percentage of the petroleum royalties will be channelled to the Welwitschia Sovereign Wealth Fund.

Upstream Petroleum Local Content Policy

Apart from the creation of the Welwitschia Sovereign Wealth Fund, the Namibian Government, through the Ministry of Mines and Energy has prepared a Upstream Petroleum Local Content Policy based on the Norwegian local content model, which mainly aimed at:

- local participation in the value chain of goods and services;

- employment creation;

- training and development of Namibia citizens; and

- equity participation for Namibians.

The Upstream Petroleum Local Content Policy encourages the minister to impose a condition on petroleum licences, for such licencees, to submit local content plans to give effect to the aims enlisted above.

To date, there have been no other local content initiatives put forward by the Namibian Government yet, hence, this article explores further a further local content initiative that the Namibian Government can employ to ensure that locals, both present and future benefit optimally.

PERSONAL INCOME TAX BREAKS FOR NAMIBIAN RESIDENTS

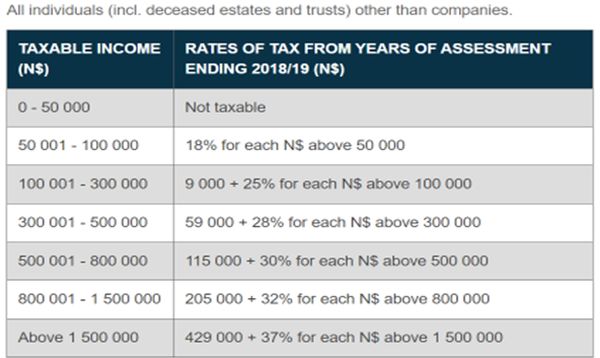

Currently, Namibian personal income tax is calculated at the following scale:

(retrieved from the NamRa website in 25 July 2023)

The income tax, although at a sliding scale, is one of the largest costs to company for many Namibian companies. Employees are paid much less than the gross income that the company pays them and in turn it ultimately affects the external employability and reduces the multiplier effect of each employee. Put differently, the affordability of daily goods and services is affected. If the Namibian Government considers subsidising the personal income tax – encouraged by the lucrative cashflow projections from petroleum royalties, it will directly benefit the current working class Namibians and directly put money in the pockets of employees, who will, in turn, have more buying power to afford goods and services. Namibians will directly feel the impact of petroleum production and economic growth and empowerment will be almost instant. Additionally, employers will employ more employees as the cost to company is subsidised. The Namibian Government will also attract skilled labour as foreigners will seek to enjoy the enjoy personal income tax benefit.

According to an IMF Working Paper titled "Personal Income Taxes in the Middle East and North Africa: Prospects and Possibilities" by Mario Mansour and Eric M. Zoltp Personal income taxes play little or no role in the Middle East and North Africa, more particularly, Bahrain, Saudi Arabia, UAE, and Oman. The income tax breaks should be stand-alone and not be shifted and recouped towards other forms of taxes such as higher corporate taxes or value-added taxes. The paper also highlights that employers should not see it as an opportunity to exploit the personal income tax breaks meant to benefit the working class.

Personal Income Tax Breaks is one of the simplest local content initiatives to ensure that all current Namibians benefit from the lucrative cashflow projections from Petroleum Royalties. There are further local content initiatives such as giving basic income grants for the unemployed, reducing corporate taxes or increasing SME funding opportunities that can further be explored by the Namibian Government.

Reviewed by Wolf Wohlers, an Executive at ENSafrica Namibia.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.