BOTSWANA: 2020 Budget presented to parliament

The Botswana Minister of Finance presented the 2020 Budget to parliament on 3 February 2020. No tax legislation amendments were proposed.

CAMEROON: Finance Law 2020 promulgated

The Finance Law 2020 was promulgated on 24 December 2019. Significant amendments, which generally became effective from 1 January 2020, include:

Corporate taxation

- limiting head office overhead expenses and other deductions for remuneration of services rendered to Cameroonian businesses (including technical assistance and related fees for factory assembly) by non-resident companies to 2.5% of taxable profits before deduction of such cost. The deduction of head office overhead expenses is limited to 1% of the turnover for public works companies and 5% for consultancy firms (bureau d'étude) operating in conformity with the regulations relating to consultancy firms and consulting engineers;

- the introduction of additional conditions for claiming provisions for doubtful debt as deduction, including a requirement that such claims must be unsecured debts, regularly registered as part of the assets of the company's balance sheet and the claim having been subject to conciliatory (extra-judicial) or forceful recovery procedures under the OHADA Uniform Act on Simplified Recovery Procedures;

- a requirement for related companies managed under the Large Taxpayers' Department to electronically file an annual transfer pricing declaration;

- confirmation that, for purposes of the arm's length principle, a relation between parties is deemed to exist when one company holds at least 25% of the shares of the other, either directly or through third parties, or exercises power of decision making in the other. Furthermore, a relationship between parties is presumed if the companies are under the control of the same enterprise or person;

- clarification of the validity period for incentives for companies to encourage the recruitment of young graduates to be three years effective from the date of recruitment;

- extending incentives to promote Authorised Management Centres, previously limited to a pre-established list of "large enterprises" issued by the Minister of Finance, to all producers and wholesale distributors;

- expanding incentives to encourage companies to invest in economic disaster areas to include an exemption from value-added tax ("VAT") on the purchase of inputs for production and a 75% reduction of tax debts;

VAT

- extending the scope of VAT from taxable operations within Cameroon to e-commerce (sale of goods and services online), performed on local and foreign platforms, as well as commissions on sales of goods and services encashed by e-commerce platforms operators;

- reinstating the exemption from VAT on life insurance (repealed by Finance Law 2019), provided the life insurance contract (and commissions paid) has a savings component;

Tax administration

- extending the requirement for a tax identification number to the opening of a bank account, subscribing for insurance contracts, signing a utility contract for the supply or water and/or electricity, applying for land title and accreditation for a government-regulated profession; and

- requiring businesses with an annual turnover of FCFA1-billion and above, that are controlled by other enterprises, to submit to tax auditors all documents enabling them to justify their transfer pricing policies applied to transactions carried out with related companies.

DEMOCRATIC REPUBLIC OF CONGO: 2020 Finance Bill enacted

On 31 December 2019, the 2020 Finance Bill was promulgated by the president and published in the Official Gazette of 3 January 2020. It has been effective since 1 January 2020.

Significant amendments include:

Corporate taxation

- the introduction of domestic advance pricing agreements ("APAs") with the tax authority for purposes of transfer pricing. Companies will be able to request an APA effective for a maximum period of four financial years;

- a requirement for medium and large taxpayers to pay the company's income tax in advance in four instalments (previously, two) by no later than 1 June, 1 August, 1 October and 1 December, respectively. These instalments represent 20% of the company's income tax paid in the prior financial year, including any additional related payments established by the tax administration;

Personal taxation

- an increase in the rate of the first bracket of employment income tax from 0% to 3%;

- increasing the threshold of employment income tax calculated (after deduction of the family tax credit) from CDF1 500 to CDF2 000; and

VAT

- postponing the implementation date of the provision for VAT digital tax records from 1 January 2020 to a date to be announced by a ministerial decree.

ETHIOPIA: Directive on export tax of raw and semi-processed hides and skins issued

On 6 January 2020, the Ministry of Finance issued Directive No. 61/2020, introducing 150% export tax on raw and semi-processed hides and skins.

GHANA: Income Tax (Amendment) Act 2019 gazetted

The Income Tax (Amendment) Act, 2019 was assented to by the president on 28 December 2019 and was gazetted and became effective on 30 December 2019. Significant amendments include:

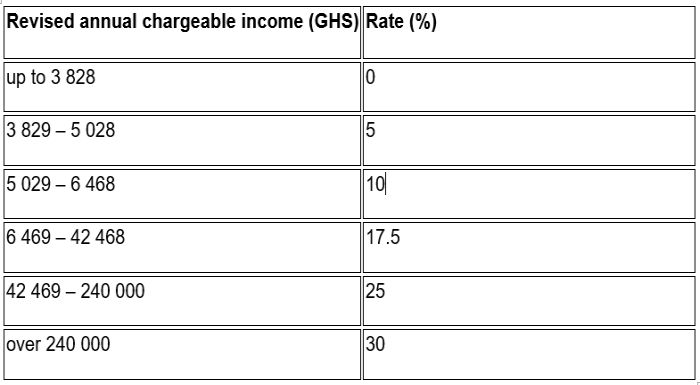

- the following changes to the personal income tax bands:

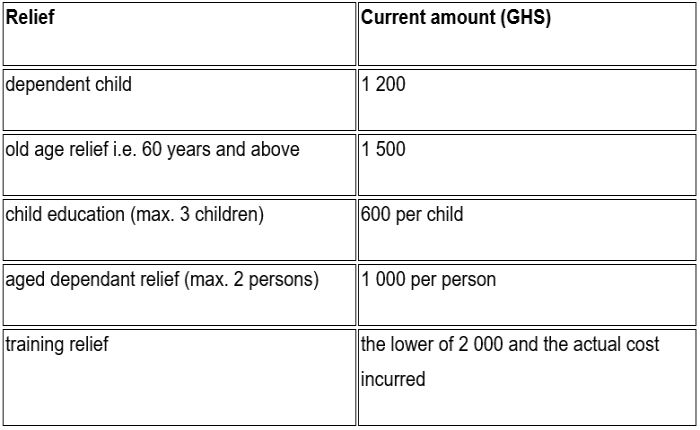

- the following increases to personal reliefs:

- exempting the income of a registered manufacturer or assembler of semi-knocked down automobiles for three years from the date of commencement of manufacturing or assembling and for 10 years for the manufacture or assembly of completely knocked-down vehicles.

KENYA: Finance Act 2019 published

On 7 November 2019, the Finance Act, 2019 was published. Significant amendments include:

Corporate taxation

- including income accruing through a "digital market place" as income chargeable to tax. A "digital marketplace" is defined as a platform that enables the direct interaction between buyers and sellers of goods and services through electronic means;

- exempting dividends paid out of exempt income from tax;

- including income of a non-resident shipping line, including income from the delay in taking delivery of goods or returning any of the equipment used for transportation of those goods, in taxable income;

- the introduction of withholding tax on reinsurance premiums paid to non-residents;

- re-introducing turnover tax at a rate of 3% of gross monthly receipts of business income payable by any resident individual whose turnover does not exceed KES5-million;

- extending the exemption of income of Real Estate Investment Trusts ("REITS") to include the investee companies of the REITS;

- a reduction of the corporate tax rate for plastic recycling companies to 15% for the first five years from the year of commencement of its operations;

- exempting group restructuring or reorganisation transactions from capital gains tax, subject to specified conditions;

VAT

- expanding the scope of VAT on taxable imported services to be charged not only on VAT-registered persons, but also on non-registered persons;

- levying VAT on supplies made through a "digital market place" as defined;

Other taxes

- increasing the import declaration fee ("IDF") from 2% to 3.5% and the railway development levy from 1.5% to 2%; and

- retaining the 1.5% IDF for raw materials and intermediate products imported by approved manufacturers, raw materials and intermediate products imported by manufacturers and input for the construction of houses under an affordable housing scheme.

MAURITIUS: Multilateral Convention enters into force

On 1 February 2020, the Multilateral Convention (2016) ("MLI") entered into force in respect of Mauritius. Mauritius signed the convention on 5 July 2017 and deposited its final MLI position on 18 October 2019, including the 44 tax treaties that it wishes to be covered by the MLI.

NIGERIA: 2019 Finance Bill signed into law

The President of the Federal Republic of Nigeria, Muhammadu Buhari, signed the Finance Bill, 2019 into law on 13 January 2020.

The amendments announced by the Finance Act, 2019 intend to increase revenue collection to fund public expenditure; ensure that tax laws are consistent with national tax policy objectives; and incentivise investment in infrastructure and capital markets.

Significant amendments introduced by the Act include:

Corporate taxation

- taxing foreign companies involved in the digital economy, including those transmitting or receiving signals in respect of, inter alia, electronic commerce, high frequency trading, electronic data storage, online adverts, participative network platform and online payments, to the extent that the company has significant economic presence in Nigeria and profit can be attributable to such activity;

- levying a final withholding tax on income earned by foreign companies from technical, management, consultancy or professional services that are remotely provided to a person resident in Nigeria;

- reducing the withholding tax rate on certain construction contracts from 5% to 2.5%;

- exempting unit trust dividends from withholding tax;

- exempting franked investment income, after-tax profits, tax-exempt income and distributions made by real estate investment companies from excess dividend tax;

- exempting profits arising from the transfer of assets pursuant to a related party business reorganisation from capital gains tax, subject to certain conditions;

- removing the requirement that every company liable to companies income tax is required to make an advance payment of its companies income tax prior to paying interim dividends;

- scrapping the withholding tax exemption for dividends in specie;

- modifying the rules applicable to determining the deductibility of expenses to limit deductions to expenses incurred in the production of taxable income;

- removing the requirement that the deductibility of management fees and other related party costs be subject to regulatory approval;

- restricting deductible interest to 30% of earnings before interest, tax, depreciation and amortisation, with any excess deduction to be carried forward for five years;

- simplifying the base for minimum tax to 0.5% of a company's turnover less franked investment income and removing the exemption for companies with at least 25% imported capital;

- introducing specialised tax rules for real estate investment companies;

- allowing insurance companies to carry forward tax losses indefinitely, deduct the reserve for unexpired risks on a time apportionment basis and abolishing special minimum tax for insurance companies;

- levying 10% withholding tax on dividends distributed from petroleum profits;

VAT

- an increase in the VAT rate from 5% to 7.5%, effective from 1 February 2020;

- introducing an annual VAT registration threshold of NGN25-million turnover;

- introducing VAT "place of supply" rules for services, and deeming any service supplied to a Nigerian-based customer and enjoyed in Nigeria to be VATable in Nigeria;

- defining zero-rated "exported services" for VAT purposes as a service rendered within or outside Nigeria by a person resident in Nigeria to a non-resident person outside of Nigeria, in line with the destination principle;

- introducing a requirement for a customer to self-account for VAT where the supplier or VATable goods or services failed to charge VAT;

Tax administration

- requiring companies filing self-assessment returns to pay their taxes in full on or before the due date for filing, but offering a 1% tax credit (2% for medium-sized companies) to those paying 90 days before their due date for filing; and

- requiring every company to provide a tax identification number as a prerequisite to opening or continuing to operate a bank account.

NIGERIA: Circular on eligibility claim of tax treaty benefits issued

On 4 December 2019, the Federal Inland Revenue Service ("FIRS") issued Information Circular No. 2019/03, providing guidance on the requirements and process of accessing and computing various tax treaty benefits available to residents and non-residents deriving income from Nigeria and its treaty partners.

In summary:

- a taxpayer can only be entitled to

benefits under the tax treaty between Nigeria and its treaty

partners if the taxpayer is a resident of either Nigeria, the other

treaty country or both countries. In addition,

- the taxpayer must be liable to tax in the treaty partner country of which he or she is a resident;

- the income in question should not be exempted from tax in Nigeria;

- the tax for which the individual is seeking a benefit should be covered by the treaty;

- the benefit should not specifically be excluded under the treaty; and

- the benefit should be claimed within the time stipulated by the treaty or domestic laws;

- a taxpayer who qualifies for treaty benefits may be denied such if it is discovered that its residency in one of the treaty countries was principally for the purpose of accessing treaty benefits; and

- a taxpayer seeking treaty benefits is required to complete a certificate of residence for Nigerian or non-Nigerian residents (as applicable) and obtain its tax authority's endorsement of the certificate before submitting a formal application (together with the endorsed certificate, evidence of foreign tax paid, etc) to the tax authority of the other country for approval. The forms are available on the FIRS's website.

Seychelles: Immovable Property Tax Act gazetted

On 27 December 2019, the Immovable Property Tax Act, 2019 was assented to by the president and gazetted.

The Act provides for the imposition and collection of tax on immovable property owned by non-Seychellois at a rate of 0.25% of the market value of chargeable immovable property with effect from 1 January 2020.

Properties used for residential purposes and owned by one taxpayer, married to a Seychellois and whose marriage is still subsisting or whose spouse has died after owning the property, are exempt from the tax. Commercial or industrial property as defined is also exempt.

South Sudan: Financial Act 2019-20 comes into effect

On 27 January 2020, the National Revenue Authority published a circular announcing that the Finance Act 2019-2020 came into effect on 1 January 2020. Click here for more details regarding the 2020 Budget.

UGANDA: Court of Appeal rules on interest charged on outstanding tax during appeal before Tax Appeals Tribunal

On 12 November 2019, The Court of Appeal gave its decision in the case of Airtel Uganda Limited v. Uganda Revenue Authority.

In the case at hand, Airtel Uganda Limited ("Airtel"), a telecommunications company, lodged an objection to an assessment raised by Uganda Revenue Authority ("URA") on 25 February 2004 with the Tax Appeals Tribunal ("TAT") and paid 30% of the disputed tax in accordance with the legal requirement when lodging an objection under section 15 of the Tax Appeals Tribunal Act. The TAT and the High Court subsequently ruled in favour of the URA and Airtel paid the outstanding 70% tax at that stage. However, the URA also demanded interest on the 70% that was outstanding and had remained unpaid during the litigation process.

The Court of Appeal held that the requirement to pay 30% of objected tax suspends the requirement to pay the whole sum which is objected to and which may be paid after the objection is dismissed and that the law protects the taxpayer from penalties during the period of dispute resolution. The court declared that the interest imposed on Airtel by the URA had no legal basis and ordered that any interest or penal tax that may have been paid to URA in respect of the period in which the dispute was pending before the TAT and the High Court be refunded to Airtel with interest at 15% per annum from the date the payment was made.

ZAMBIA: 2020 budget tax measures take effect

On 1 January 2020 Zambia commenced the implementation of the following new tax measures under the 2020 Budget, as approved by parliament:

Corporate taxation

- reducing capital allowance for mining companies from 25% to 20%;

- exempting interest payable to banks and other financial institutions by customers;

VAT

- discontinuing the transition to sales

tax and implementing the following amendments to the VAT Act:

- zero-rating copper cathodes sold within Zambia as well as capital equipment and machinery purchased by mining companies and gas stoves, other gas cookers and gas boilers;

- limiting input VAT claims on diesel by mining companies from 90% to 70%;

- limiting input VAT claims on electricity by mining companies from 100% to 80%;

- disallowing input VAT claims on stationery, lubricants and spare parts; and

- making the use of electronic fiscal devices compulsory.

Zimbabwe: Budget for fiscal year 2020 presented to parliament

On 14 November 2019, the budget for the fiscal year 2020 was presented to the parliament by the Minister of Finance. Significant proposed amendments include:

Corporate taxation

- reducing the corporate tax rate from 25% to 24%;

- restricting the deduction of interest on foreign loans to the highest inter-bank rate;

- granting a monthly credit of ZWL500 for each additional employee under the age of 30 years up to a maximum of ZWL60 000 per year, provided that that the employee is employed for a continuous period of 12 months, his or her salary is at least ZWL2 000 and the employer is a registered compliant taxpayer with an annual turnover not exceeding the equivalent of USD1-million;

- excluding non-residents from tender withholding tax;

- introducing new conditions for the exemption from tax of venture capital companies;

Personal tax

- increasing the monthly non-taxable threshold for ZWL remuneration from employment to ZWL2 000;

- amending the existing 20% withholding tax for directors' fees to be a final tax;

- increasing the amount of tax free bonuses from ZWL1 000 to ZWL5 000 with effect from 1 November 2019;

VAT

- increasing the VAT registration threshold from ZWL60 000 to ZWL1-million with effect from 1 January 2020;

- reducing the standard VAT rate from 15% to 14.5% with effect from 1 January 2020; and

Other taxes

- increasing the amount exempt from intermediated money transfer tax from ZWL10 000 to ZWL50 000 and increasing the cap rate for a single transaction from ZWL750 000 to ZWL1 250 000 with a corresponding increase in tax from ZWL15 000 to ZWL25 000.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.